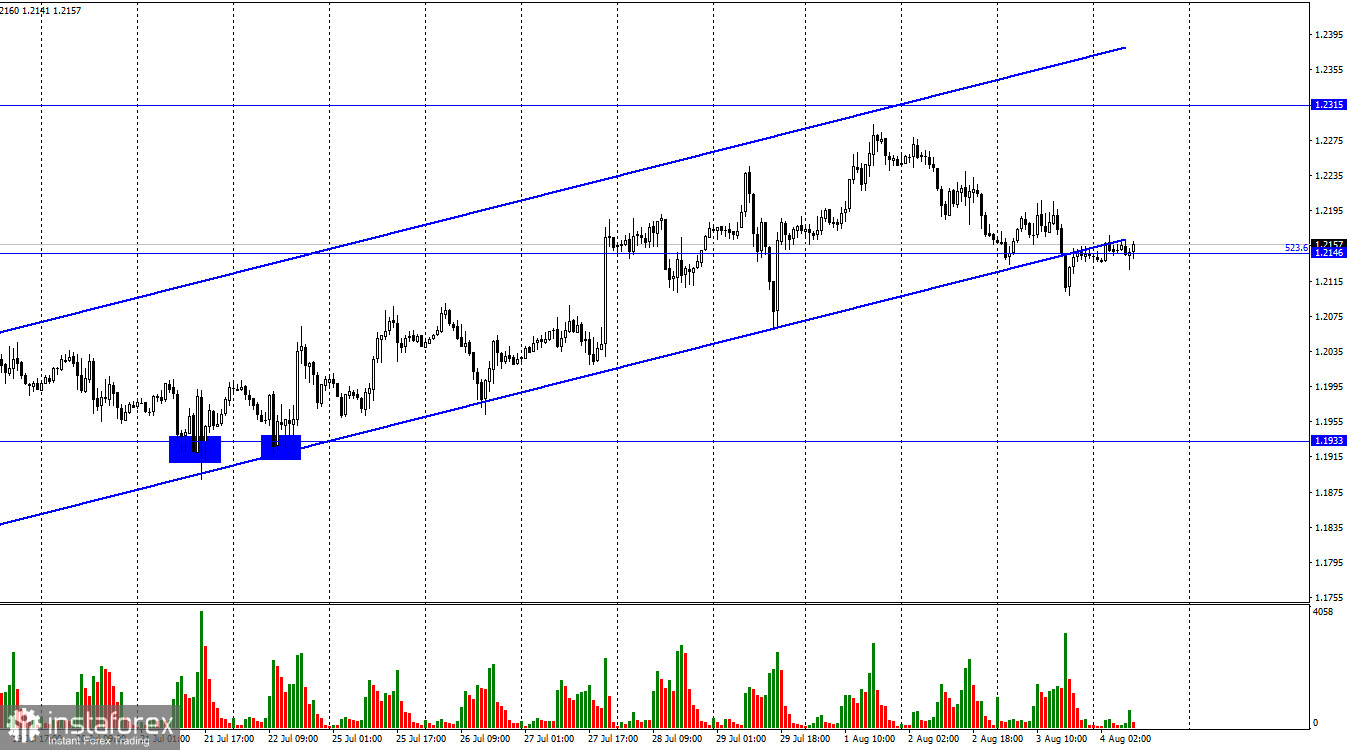

According to the hourly chart, the GBP/USD pair closed under an upward trend corridor on Wednesday, which characterized the mood of traders as "bullish" for almost a month. However, the fall after this close did not last long, and at the moment, the quotes have already made a return to the corrective level of 523.6% - 1.2146. Consolidation above this level may mean new growth for the British, but I think it is more important to consolidate under the ascending corridor. The pair may return to its location for a while, but it may start falling again. The week's key event for the British pound will occur in a few hours. The Bank of England will announce the results of the meeting, which traders have been waiting for more than a week – since the Fed meeting last week. I want to note that all this time, the British dollar has been actively bought by traders. However, today its strong fall may begin since all possible tightening of the monetary policy of the British regulator can already be taken into account by traders.

Thus, the pound may be tossed from side to side today, but it is important where it will go after the passions in the market subside. The Bank of England will raise the interest rate by 0.50%, and almost all analytical sources write about it today. There will be a speech by Governor Andrew Bailey, on whose words the further dynamics of the Briton will largely depend. His vision of the problem of high inflation, the likelihood of a recession, and his willingness to raise the rate further will be important. As we could see the week before last, the ECB is not ready to follow the ambitions of the Fed and the Bank of England and is not ready to raise the rate at the same pace. But the British regulator also has a margin of safety. It is unlikely that he wants the economy to enter a recession, so it is important to understand how far the regulator is ready to go in raising the rate. In any case, traders are waiting for a very volatile day.

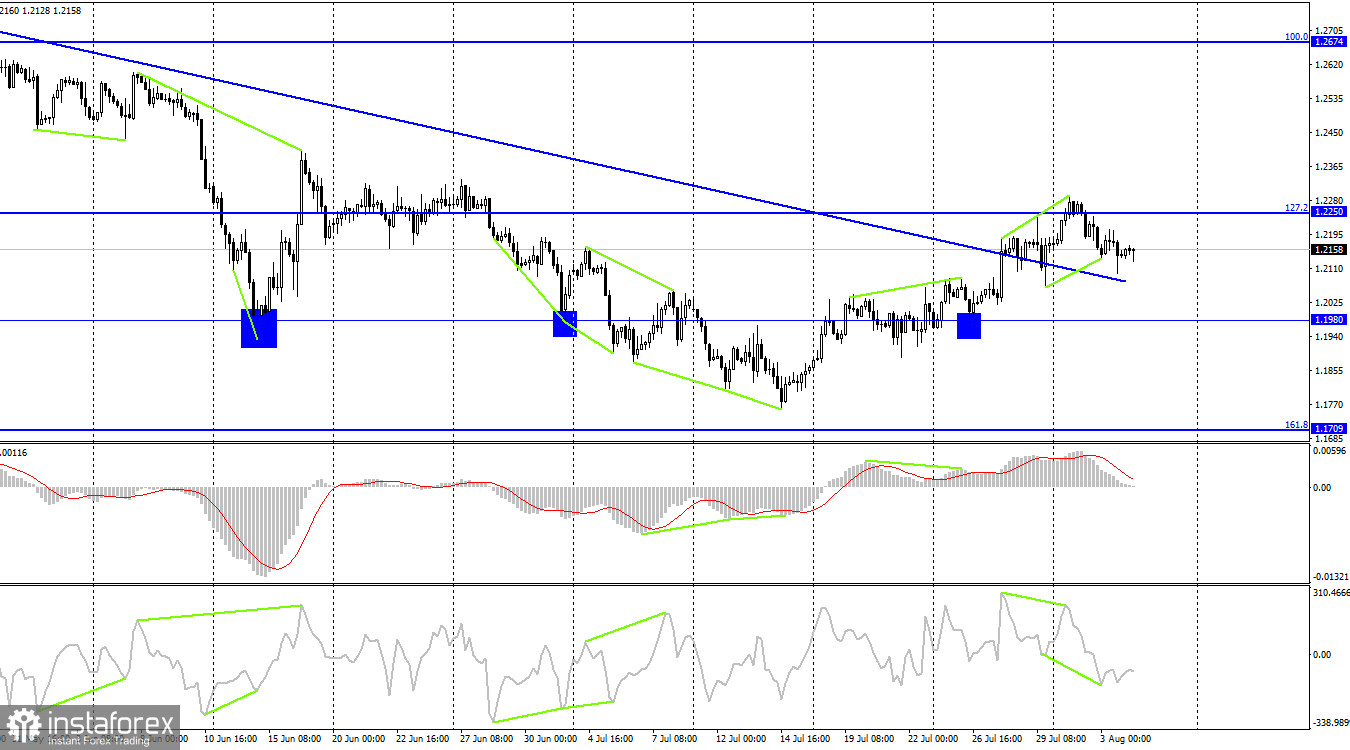

On the 4-hour chart, the pair performed a rebound from the corrective level of 127.2% (1.2250) and a reversal in favor of the US currency. The "bullish" divergence of the CCI indicator has already been canceled since its low was broken. Thus, the process of falling quotes can be continued in the direction of the level of 1.1980. Fixing the pair's rate above the Fibo level of 127.2% will increase the chances of further growth of the British dollar in the direction of the next corrective level of 100.0% (1.2674).

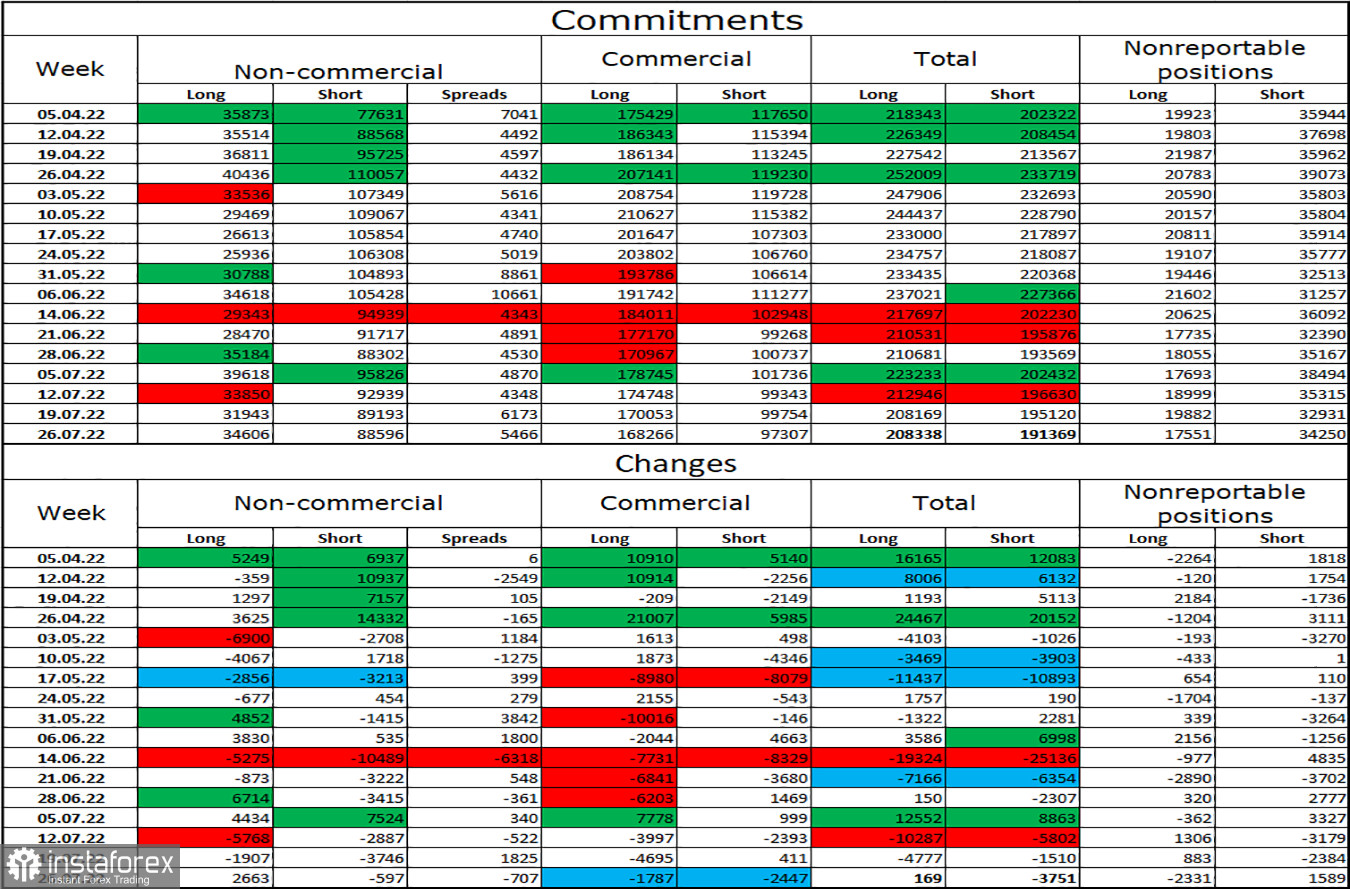

Commitments of Traders (COT) Report:

The mood of the "Non-commercial" category of traders has become a little less "bearish" over the past week. The number of long contracts in the hands of speculators increased by 2,663 units, and the number of short contracts decreased by 597. Thus, the general mood of the major players remained the same – "bearish," and the number of short contracts still exceeded the number of long contracts by several times. Major players continue to get rid of the pound for the most part, and their mood has not changed much lately. The pound itself has been showing growth in recent weeks, but COT reports make it clear that the Briton may resume its decline over the next few weeks, as the positions of bull traders are in no hurry to improve enough to count on an upward trend.

News calendar for the USA and the UK:

UK – index of business activity in the construction sector (08:30 UTC).

UK - interest rate decision (11:00 UTC).

UK - speech by the head of the Bank of England Bailey (11:30 UTC).

US - number of initial applications for unemployment benefits (12:30 UTC).

On Thursday, the calendars of economic events in the UK and the US contain interesting entries, but all the attention of traders will be directed to the results of the Bank of England meeting and Andrew Bailey's speech. Thus, the influence of the information background on the mood of traders today can be strong.

GBP/USD forecast and recommendations to traders:

I recommended new sales of the British when anchoring under the ascending corridor on the hourly chart with a target of 1.1933. It was also possible to sell at the rebound from the level of 1.2250 on the 4-hour chart. I recommend buying the British when fixing above the level of 1.2250 on the 4-hour chart.