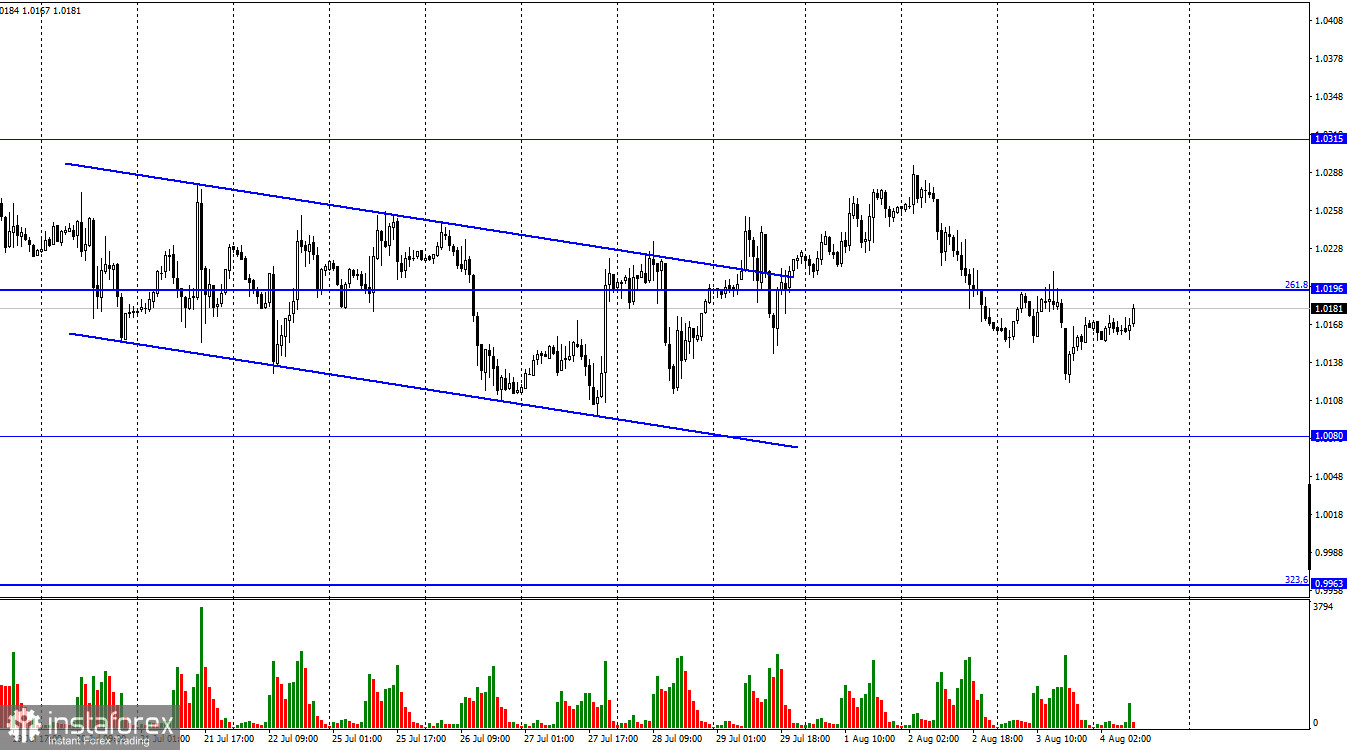

On Wednesday, the EUR/USD pair rebounded from the corrective level of 261.8% (1.0196), which allowed it to continue falling towards 1.0080. The ISM non-manufacturing business activity index also helped the US dollar, which unexpectedly turned out to be better than traders' expectations. At the same time, the S&P business activity index in the same area reached 47.3 points, but the ISM index is considered more important, so traders worked it out. However, the growth of the US currency did not last long. It is not visible on the hourly chart, but the euro/dollar pair has been trading mostly horizontally for a long time. Because of the larger scale of the movements, one might think there is a trend now. But switching to a 4-hour chart shows that the pair has not been able to restore the trend for almost a month. Thus, all the movements of yesterday do not affect the general mood of traders and do not mean that now the movement in the side corridor will be completed.

I did not plot a side corridor on the chart since it would have turned out to be too wide on the hourly chart. Accordingly, I conclude that at this time, traders are waiting. But what they are waiting for is quite difficult to say. The ECB and Fed meetings have already passed, and the next ones are scheduled only for September. Important reports on unemployment, wages, and the labor market will be released in America tomorrow. Perhaps they will fix the situation. But from my experience, I can say that when the instrument moves to a side corridor, the exit from it can occur regardless of the presence or absence of statistics and important events. Tomorrow, the euro currency may grow by 100 points on weak data from America, but it will remain in the same side corridor. Thus, I consider the American data important, but I do not think these reports will lead to restoring the trend. There is no information background on the European Union and the USA today. Taking into account the recent geopolitical events, I would like there to be no news on this topic.

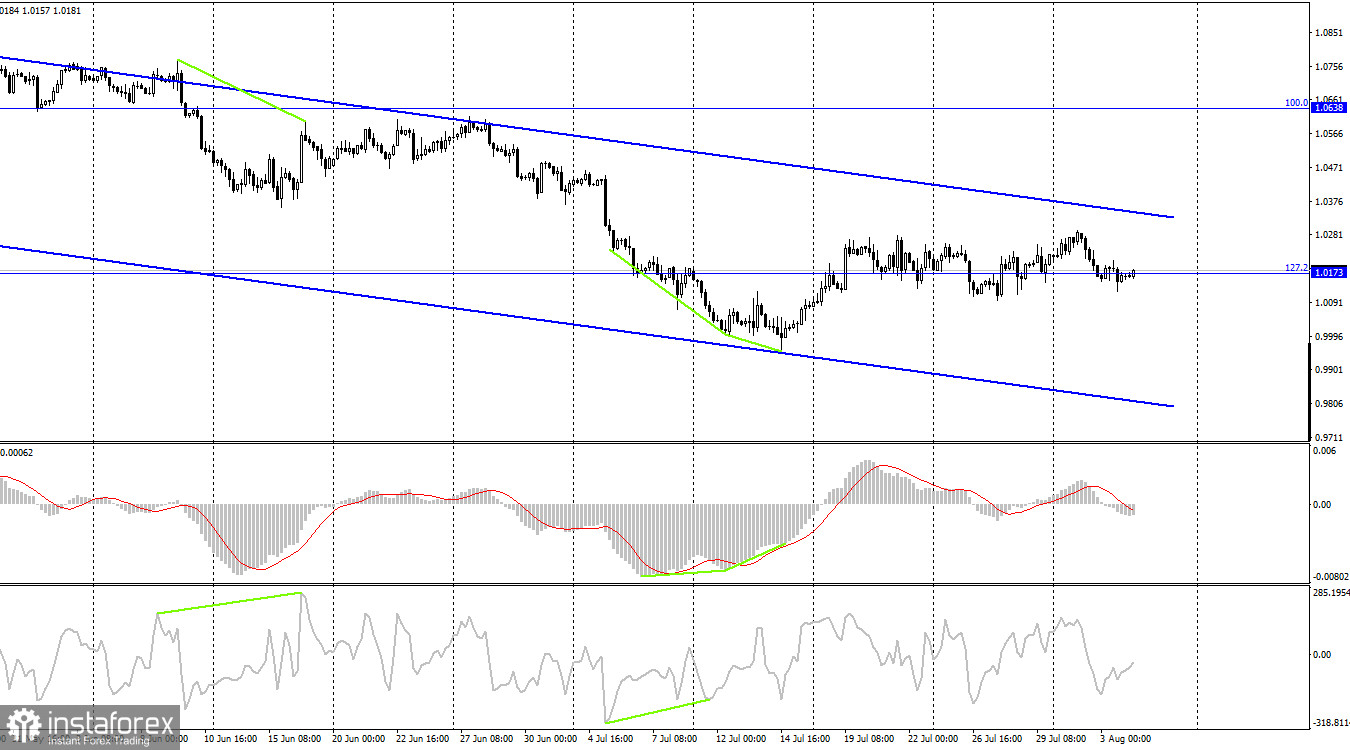

On the 4-hour chart, the pair continues to remain above the level of 127.2% (1.0173). Thus, the growth process can be resumed in the direction of the upper line of the descending trend corridor. However, I want to note that the level of 1.0173 is weak, and the pair regularly breaks it in both directions. I would focus now on the very nature of the movement – horizontal. Consolidation above the corridor will increase the probability of a resumption of growth in the direction of the next corrective level of 100.0% (1.0638).

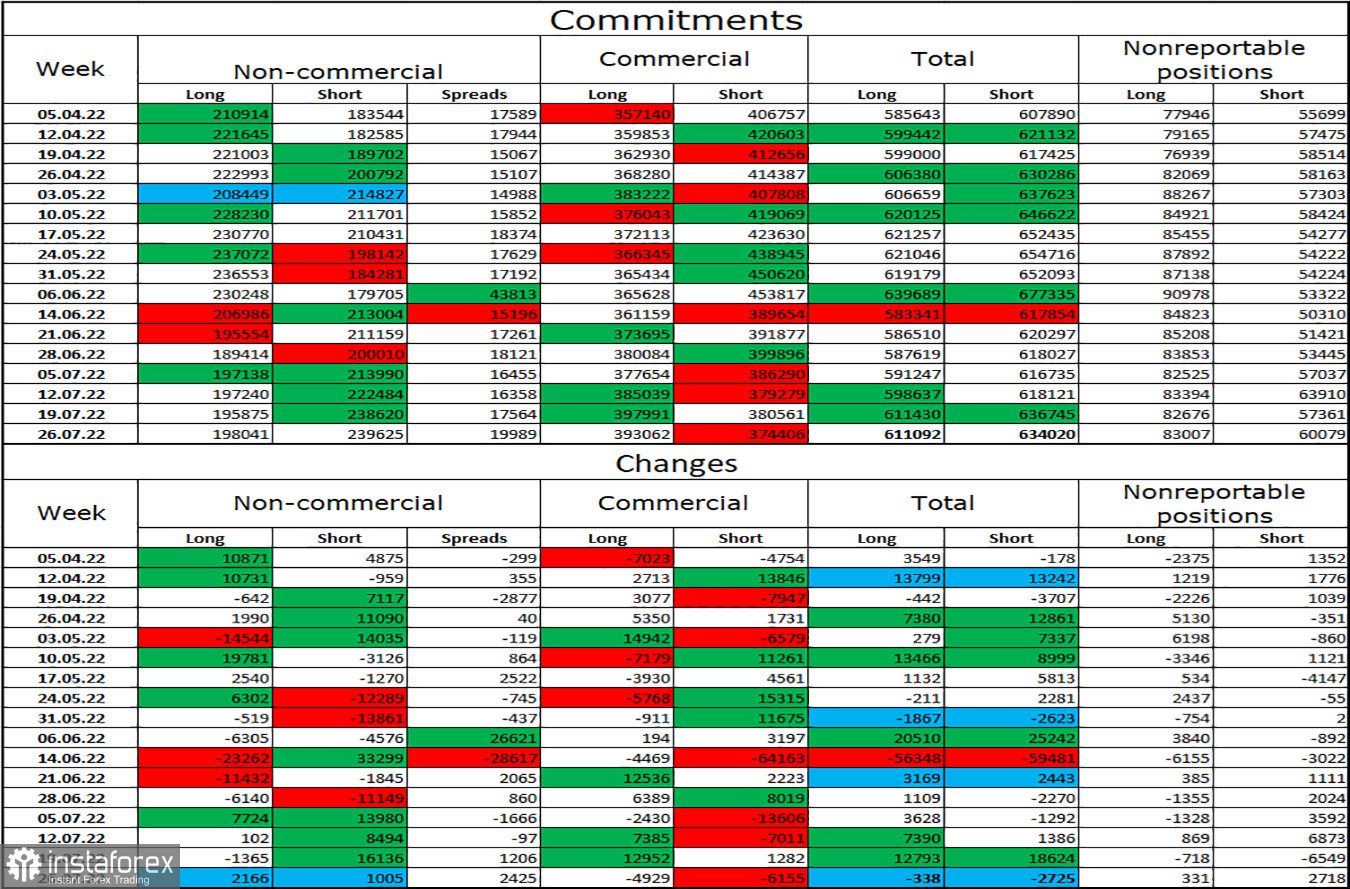

Commitments of Traders (COT) Report:

Last reporting week, speculators opened 2,166 long contracts and 1,005 short contracts. It means that the "bearish" mood of the major players has become a little weaker, but it has remained. The total number of long contracts concentrated in the hands of speculators is now 198 thousand, and short contracts – 240 thousand. The difference between these figures is still not too big, but it remains not in favor of the bulls. In the last few weeks, the chances of the euro currency's growth have been gradually growing, but recent COT reports have shown no strong strengthening of the bulls' positions. Thus, it is still difficult for me to count on the strong growth of the euro currency.

News calendar for the USA and the European Union:

US – number of initial applications for unemployment benefits (12:30 UTC).

On August 4, the calendars of economic events of the European Union and the United States contain one more or less important entry for two. Traders ignored all the latest reports on applications for unemployment benefits. Thus, the influence of the information background on their mood today may be absent.

EUR/USD forecast and recommendations to traders:

I recommend new sales of the pair when rebounding from the upper line of the corridor on the 4-hour chart with a target of 1.0173. I recommend buying the euro currency when fixing quotes above the descending corridor on the 4-hour chart with a target of 1.0638.