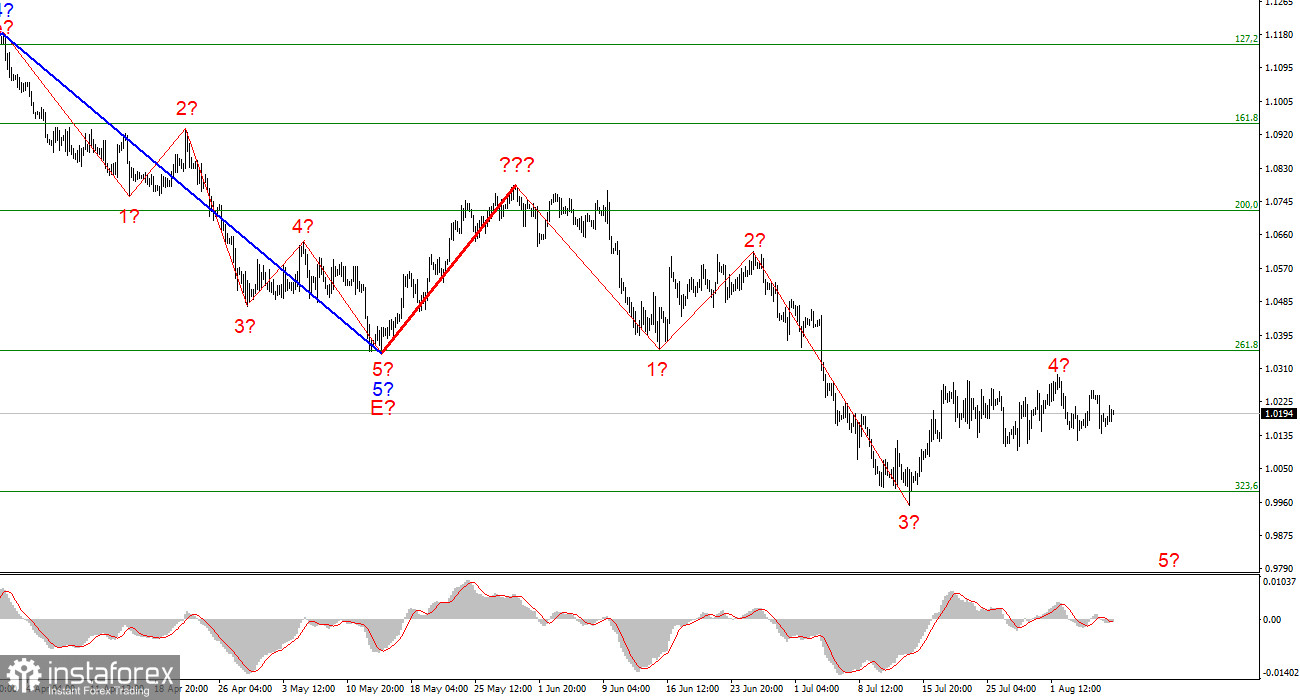

The wave marking of the 4-hour chart for the euro/dollar instrument does not require adjustments at the moment. I recently built a new wave markup that does not yet consider the rising wave marked with a bold red line. The whole wave structure can be complicated an unlimited number of times. This is the disadvantage of wave analysis since any structure can always take a more complex and extended form. Therefore, now I propose to work on wave structures of a lower scale.

As you can see, the construction of a descending wave has presumably begun, which may be wave 5 of a new downward trend section. If this assumption is correct, the instrument will continue to decline with targets below 1.0000. The supposed wave 4 took a three-wave form and surprisingly coincided with the peak of the supposed wave 4 according to the British. Thus, it is possible that the market was waiting for this moment to start selling both currencies from Europe at the same time. The euro and the pound are now coinciding in their wave markings, which suggests a new decline. The wave pattern may take a more complex form, which we would like to avoid, but the wave pattern looks very convincing at the moment.

Payrolls and unemployment have not increased the demand for the dollar.

The euro/dollar instrument fell by 70 basis points on Friday. The proposed wave 4 already looks fully equipped, so the demand for the US currency must grow to maintain the integrity of the current wave markup. American reports on Friday did everything in their power to make the market buy the dollar again. The market did it, but wave five does not look too convincing so far. As if everything would not end with a new complication of wave marking. The market continues to be half-asleep, and it is unclear to me what can bring it out of a state of suspended animation. The reports on Friday were very important. They, in particular, open up excellent prospects for the Fed, which can now raise the interest rate, fearing much less of a possible recession. In general, everything now speaks in favor of the fact that the US currency should grow, and the euro/dollar instrument should build at least one more downward wave.

On the first two trading days of the week, the market can deservedly rest. The news background these days will be so meager that when viewing the news calendar, the eye has nothing to cling to. Thus, the closest interesting event will be the US inflation report, which will be released on Wednesday. I want to note right away that the Fed has been raising the rate for quite a long time, and during this time, it has managed to grow to 2.5%, which should be enough at least for the consumer price index to start slowing down. And if it starts to slow down, then the pace of tightening of the Fed's monetary policy may slow down in September, which is not very good for the dollar. However, I would not draw such radical conclusions. The Fed may raise the rate at least 3–4 more times, and how much it will raise will depend on the inflation reports. If, on Wednesday, it turns out that the consumer price index has slowed down minimally or has not slowed down at all, then the demand for the US currency may grow, which is what we need now.

General conclusions.

Based on the analysis, I conclude that the construction of the downward trend section continues. If so, it is now possible to sell the instrument with targets located near the estimated 0.9397 mark, which is equivalent to 423.6% Fibonacci, for each MACD signal "down" in the calculation of the construction of wave 5. Wave 4 can be completed.

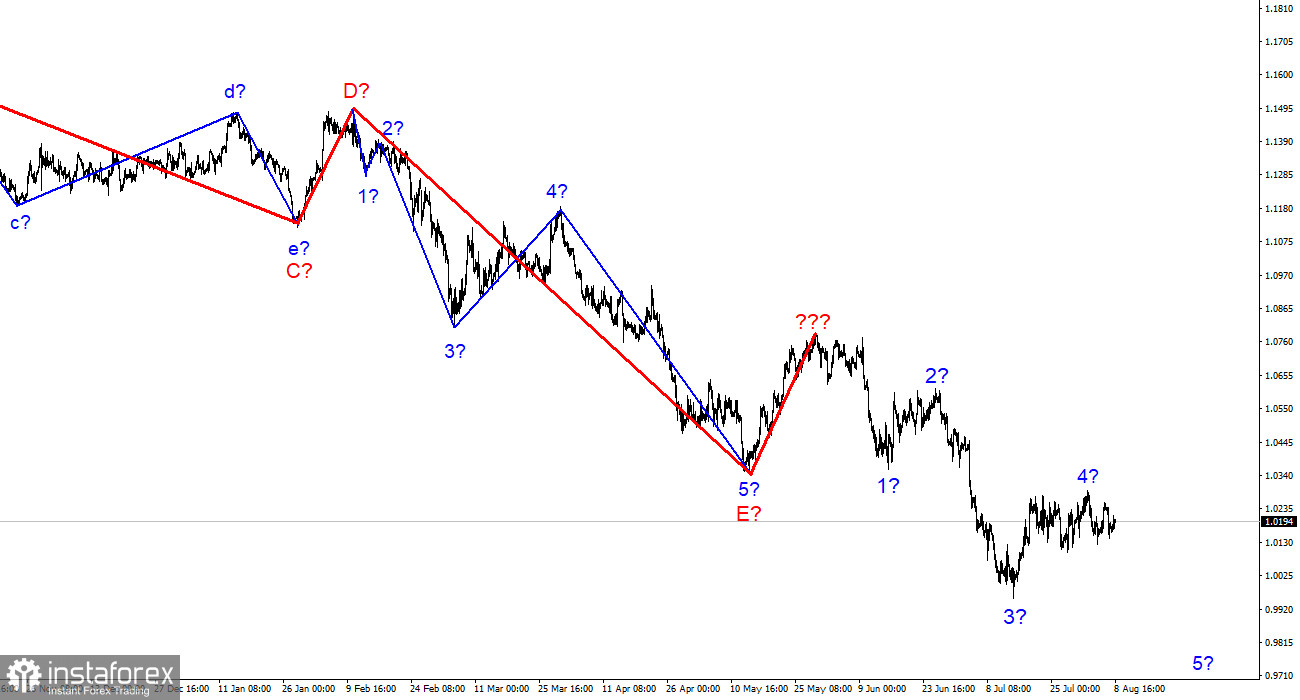

At the higher wave scale, the wave marking of the descending trend segment becomes noticeably more complicated and lengthens. It can take on almost any length, so I think it's best to isolate three and five-wave standard wave structures and work on them.