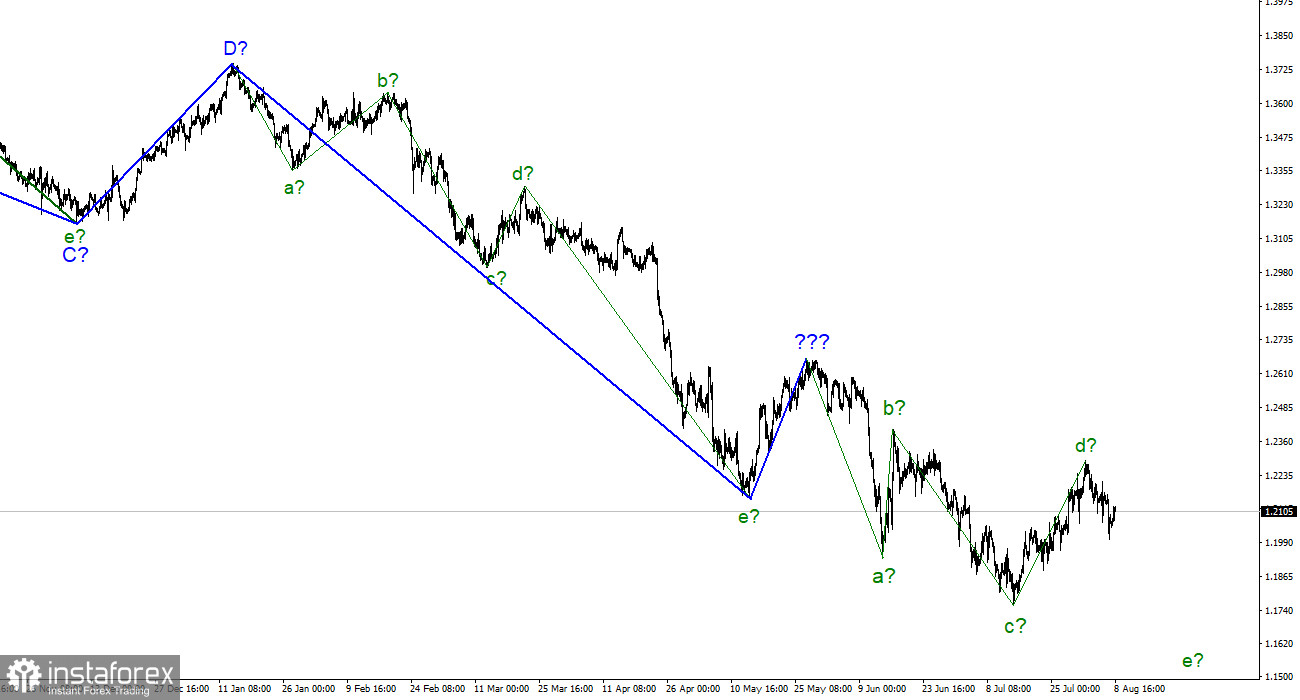

For the pound/dollar instrument, the wave marking at the moment looks quite complicated but does not require any clarification. The upward wave, which was built between May 13 and May 27, does not fit into the overall wave picture, but it can still be considered corrective as part of the downward trend section. Thus, it can now be concluded that the construction of the upward correction section of the trend is canceled, and the downward section takes a more extended and complex form. I am not a big supporter of constantly complicating the wave marking when dealing with a strongly lengthening trend area. It would be much more appropriate to identify rare corrective waves, after which new clear structures would be built. At this time, we have completed waves a, b, c, and d, so we can assume that the instrument has moved on to constructing wave e. If this assumption is correct, the quotes decline should continue in the coming days and weeks. The wave markings of the euro and the pound differ slightly in that for the euro, the downward section of the trend has an impulse form (for now), but the ascending and descending waves alternate almost identically, and at this time, both instruments presumably completed the construction of their fourth waves at the same time. I still expect a new decline in the British dollar in the coming days.

In the USA – an inflation report. In Britain – a GDP report.

The exchange rate of the pound/dollar instrument increased by 65 basis points on August 8. Let me explain my thoughts: on Friday, the Briton was losing demand due to strong statistics in the US. On Thursday, it was losing demand due to the predictable decision of the Bank of England and Andrew Bailey's pessimistic forecasts. But why was the Briton in demand on Monday when the news background was just zero? Out of the blue, the British pound rose in price by 65 points with an empty calendar, and on Friday, it fell by 90 points with the most important reports in favor of the dollar. I repeat, the movement is very strange, and it does not look like the market will build another downward wave. However, I have no concrete reasons to expect a violation of the wave marking.

I believe that Andrew Bailey's words on Thursday will strongly impact the market mood, making it more "bearish." Since the current downward trend is not impulsive, it may be normal for the pound to move down slowly. However, the report on US inflation this Wednesday may cause an increase in demand for the dollar, as it is unlikely that this report will indicate a strong slowdown in prices. And on Friday, an important report will be released in the UK, which is likely to confirm the words of the governor of the Bank of England about the impending recession in the British economy. GDP in the second quarter of this year may decrease by 0.2%, although growth of 0.8% was recorded in the previous quarter. However, the market is waiting for a negative value, and for the next 5-6 quarters, the economy may be below zero growth every quarter. Of course, the British can react with a new decline, but now the market is in a double position since the US GDP also declined in the first and second quarters.

General conclusions.

The wave pattern of the pound/dollar instrument suggests a further decline. I advise now to sell the instrument with targets near the estimated mark of 1.1708, which equates to 161.8% by Fibonacci, for each MACD signal "down." An unsuccessful attempt to break through the 1.2250 mark indicates that the market is not ready to continue buying the British pound.

The picture is similar to the euro/Ddllar instrument at the larger wave scale. The same ascending wave does not fit the current wave pattern, the same three waves down after it. Thus, one thing is unambiguous – the downward section of the trend continues its construction and can turn out to be almost any length.