Investors have got it into their heads that the Fed will begin to slow down the rate of monetary restriction, and are rushing to buy US stocks. A leapfrogging global risk appetite is hitting safe-haven positions. The US dollar is weakening, the EURUSD pair is going up. All this creates a feeling of some kind of illusion. But as long as people enjoy being scammed, why not continue?

The 13% rally of the S&P 500 from the June bottom levels has generated a huge amount of bullish recommendations for the S&P 500. Citigroup notes that concerns about the recession have almost faded, and although analysts tend to advise buying stocks more often than selling them, they now look particularly interested. There are more bulls in the USA and developing countries than in Europe and Japan. When the number of optimists goes through the roof, it becomes a wake-up call. It is curious that such a bright "bull" on stock indices as JP Morgan recommends reducing the share of shares in investment portfolios, and increasing the share of raw assets. The sales of the latter look excessive.

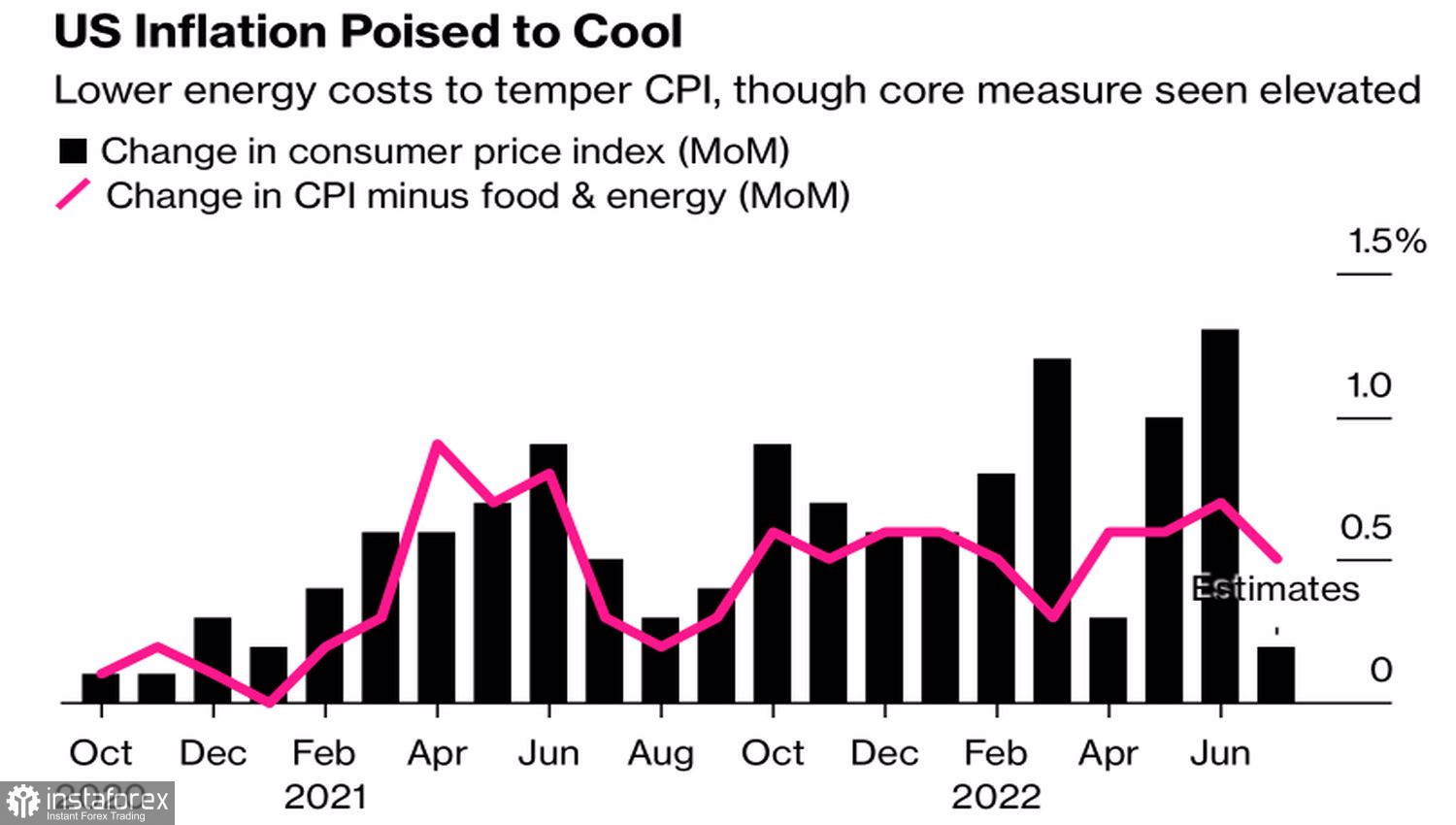

The US inflation report could change the balance of power by influencing risk appetite. Bloomberg experts expect consumer prices to slow down in July from 9.1% to 8.7% YoY and to 0.2% MoM, which is the lowest rate since January 2021. Core inflation is also losing steam: +0.5 % MoM is a very modest figure. Indicators are slowing down, and this reinforces the belief that the Fed will put on the brakes. No matter how many FOMC officials say otherwise. And no matter how strong the labor market looks. In the 1970s, it was also initially like this, but subsequent adjustments in employment growth made it possible to say that a recession had already begun.

Dynamics of American inflation

The markets continue to give wishful thinking, although CME derivatives have increased the chances of a 75 bps increase in the federal funds rate in September to 70%, and FOMC officials openly talk about a higher ceiling on borrowing costs and keeping them at a high level for a long time. Citigroup does not rule out the option of raising the rate by 100 bps at the next committee meeting.

Everyone is fixated on the markets fighting the Fed, but outside of this pageant, nothing has changed. The armed conflict in Ukraine continues, energy prices are rising, and, most likely, will continue to do so as dark and frosty evenings approach. The political drama in Italy is far from over. On the contrary, everything is just beginning.

Dynamics of European gas prices

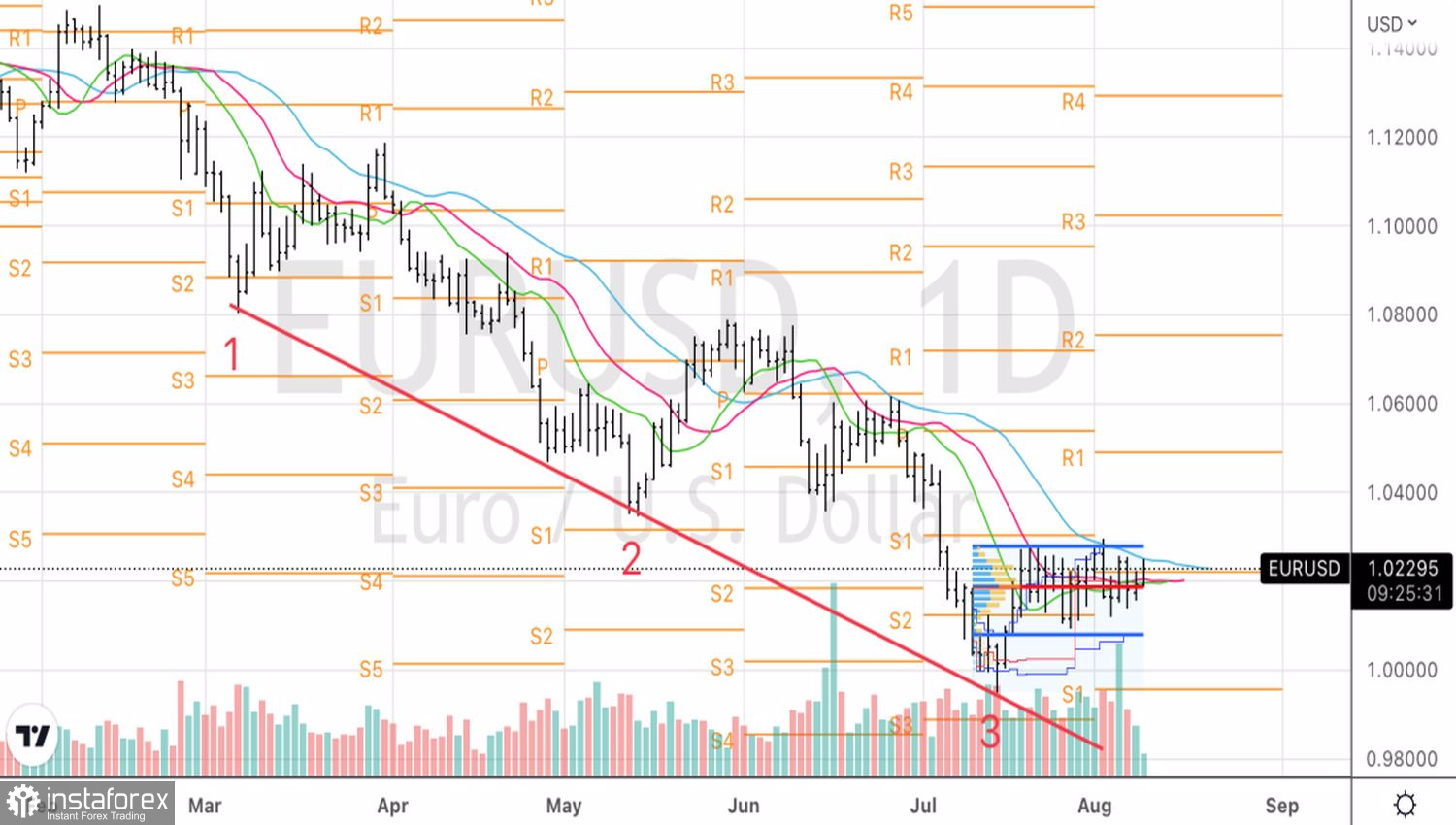

The eurozone economy is weak, the ECB's hands are tied, but the euro is rising against the US dollar. More precisely, the dollar is weakening against everyone amid an improvement in global risk appetite. I hope the release of inflation data will dot the i's.

Technically, the movement of EURUSD above 1.02 on the daily chart does not change anything. To continue the rally, the pair needs to leave the boundaries of the 1.01–1.03 trading range. In the meantime, we will sell it if it falls below 1.018.