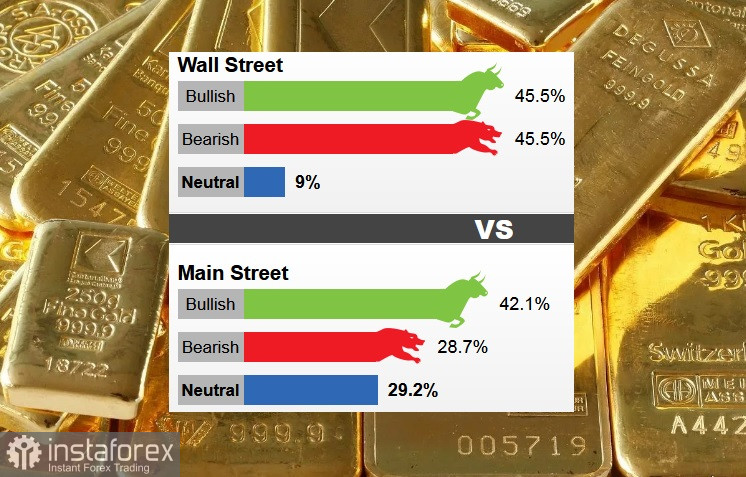

The results of the weekly gold survey showed that analysts on Wall Street are now evenly divided as to which direction gold prices will go this week. Of the 11 analysts who participated in the survey, only 9% were neutral, 45.5% predicted a rise in prices, and the remaining 45.5% voted for a reduction.

The Main Street side remained bullish. The survey showed that out of 216 retailers, 42.1% expected price increases, 28.7% called for a decline, and 29.2% remained neutral.

According to analysts, the US dollar is likely to put pressure on gold this week.

Fed officials are playing a central role in containing gold's momentum, Forexlive.com chief currency strategist Adam Button said.

The slowdown in inflation was the main signal of last week's macroeconomic data. Nevertheless, Federal Reserve speakers continued to oppose the idea of a potential Fed reversal.

The US Consumer Price Index (CPI) stood at 8.5% in July, below market expectations of 8.7% after a 9.1% YoY increase in June. Core inflation, excluding food and energy price volatility, accelerated 5.9% year-on-year.

In addition, the US Producer Price Index (PPI) rose more slowly in July, at an annualized rate of 9.8% against the expected 10.4%.

However, despite signs of a slowdown in inflation, the Fed remains firmly on the course of tightening.

According to Adrian Day Asset Management President Adrian Day, the market is gradually realizing that the Fed cannot significantly reduce inflation without triggering a recession. This is positive for gold.

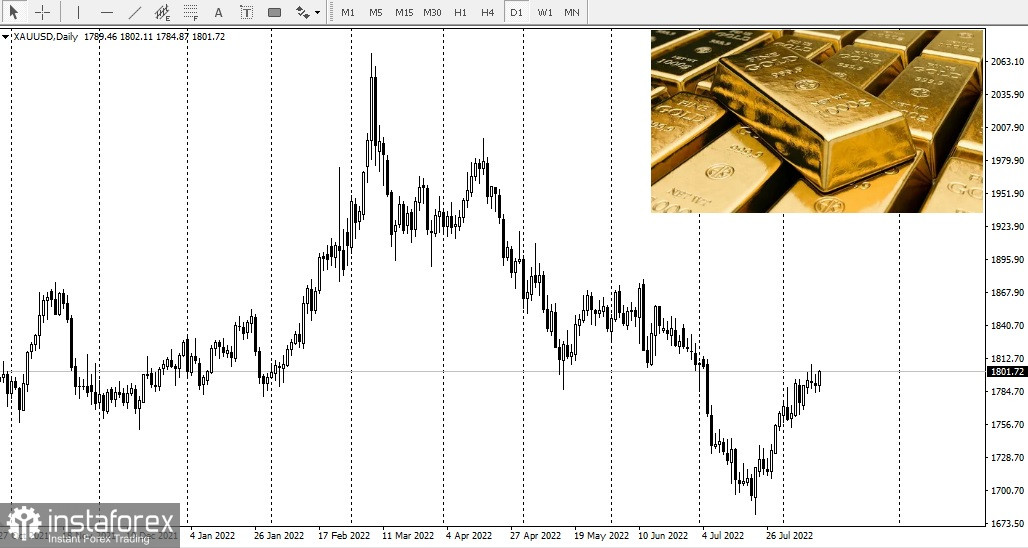

The price of gold shows the fourth weekly increase.