The pound encountered support after the release of better-than-expected data. The fact that the British economy is not in its best state ahead of the winter season is clear. There are great risks of a recession in the country as monetary tightening along with high energy prices are posing a threat to the economy.

Meanwhile, Pantheon Macroeconomics sees Q4 GDP rising by 0.3% from the previous period.

"A winter recession can't be ruled out, given that the rise in Ofgem's energy price cap in October will boost CPI inflation—and hence reduce real incomes—by nearly four percentage points. But with fiscal support likely to be scaled up considerably by the next PM and high income households still possessing substantial savings, we think that GDP will flatline through the winter, rather than fall," economists at Pantheon Macroeconomics said.

In the second quarter, the British economy contracted by 0.1%, below the expected 0.2%. Overall, the economy expanded by 2.9% year-on-year, above the market forecast of 2.8%.

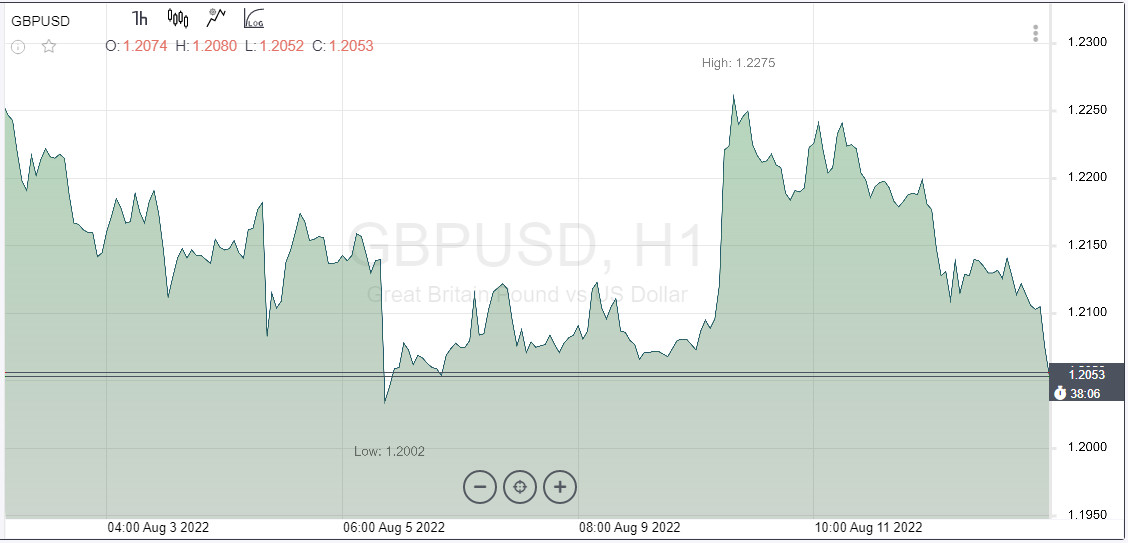

The pound saw an increase in volatility, but traders made no attempts to trade in any direction. In light of a rise in the dollar, however, a sell-off occurred. At the beginning of the trading week, the pair is trying to consolidate. Demand for the pound is decreasing and the currency is edging down amid gloomy forecasts made by the Bank of England.

On Monday, bearish pressure on the pound increased, and the price fell below 1.2100. So, GBP/USD was unable to rise on better-than-expected macro data.

At the same time, the dollar does not show steady growth either. Traders are now uncertain about the Federal Reserve's further monetary stance. The hawkish comments of some policymakers hint that the regulator will remain aggressive. Yet, there are still questions. The situation will get clearer when the FOMC Minutes are released this week. Should the Federal Reserve stay aggressive, the greenback's rally will extend.

Therefore, the dollar is unlikely to be bearish at the beginning of the trading week although its growth potential will be limited. So, GBP/USD may recover eventually.

Weekly outlook for GBP

This week, the focus will be on the retail sales report scheduled for Wednesday as well as US weekly jobless claims and the FOMC Minutes.

"Next week's FOMC minutes will contain some discussion of the FOMC's apparent desire to slow the pace of hikes soon. But we do not expect it to be a lasting relief," Goldman Sachs said.

Analysts now see a 50 basis-point hike as the unlikely outcome at the September meeting.

US macro data will surely be of great importance to the GBP/USD quotes. Still, macro results in the United Kingdom could affect the Bank of England's interest rate forecast.

On Tuesday, traders will see the release of data on the UK labor market report, which will influence the Bank of England's monetary policy stance.

Meanwhile, the inflation report published on Wednesday will be of primary importance as it will affect both the BoE's monetary policy and the pound's short-term potential. At this point, it is unclear how the market could react to a possible increase or decrease in rate hikes.

Therefore, in light of a busy trading week, the pound is likely to trade in a trend in the coming days after consolidation.On Monday, bullish demand for the pound is falling. In the short-term, the pair is expected to be bearish, with targets at 1.2050 and 1.2000 (psychological level).

Resistance is seen at 1.2200, 1.2265, and 1.2315. Support stands at 1.2080, 1.2030, and 1.1965.