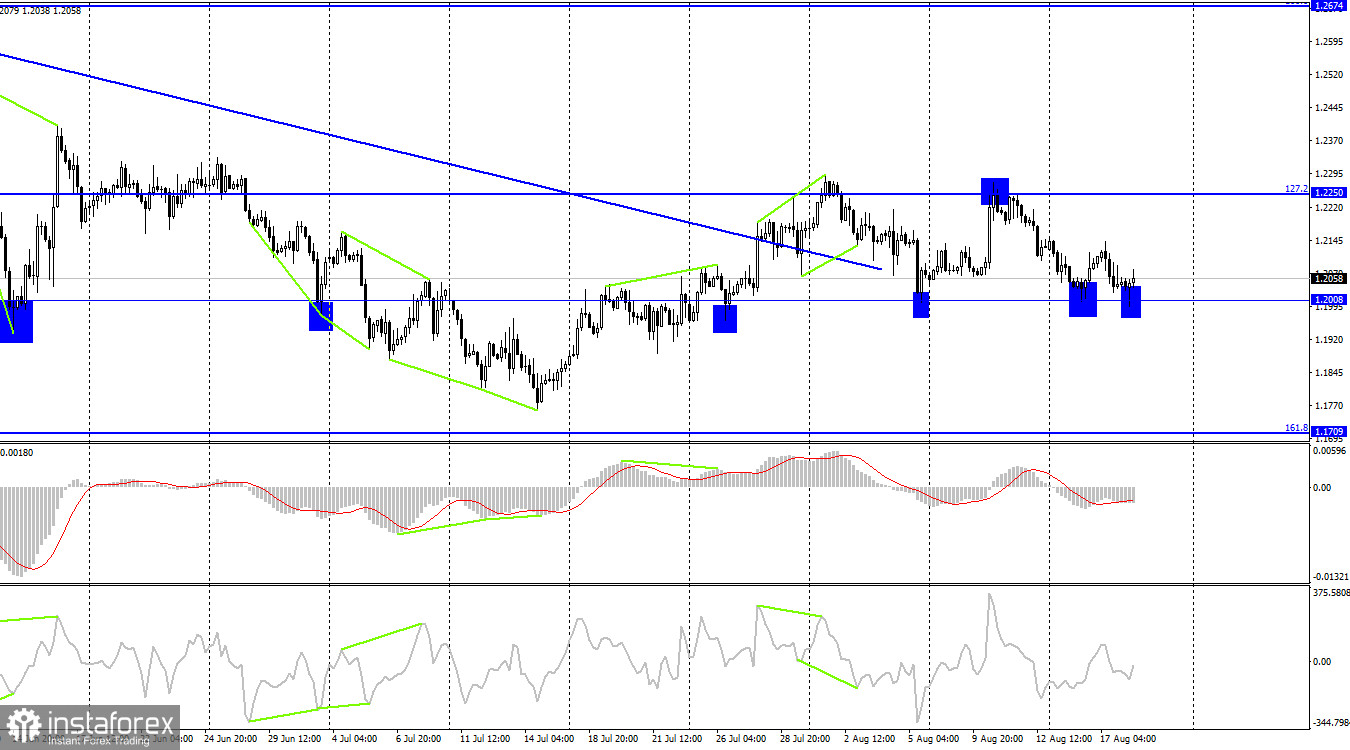

According to the hourly chart, the GBP/USD pair on Wednesday returned to the corrective level of 523.6% (1.2146), a reversal in favor of the US currency, and resumed falling towards the level of 1.1933. The decline in the British dollar's quotes has been going on for six days in a row, so I formed a downward trend corridor, which characterizes the mood of traders as "bearish." However, I cannot assume how much longer the fall of the British will continue, and that's why. The first reason is the very likely departure of a European into a side corridor. We know that the pound likes to follow the example of the euro, so I do not exclude that it will move horizontally for some time. The second reason is the Fed protocol. From my point of view, the results of the last meeting are "hawkish." Traders continue to treat it differently and do not have a common opinion. Some believe the Fed is not tough enough in its actions and statements. Some believe that the period of aggressive rate hikes ended at the moment when the latest inflation report was released.

Some continue to believe that the Fed will continue to raise interest rates. However, if most traders are confident in further rate growth, the dollar should continue to grow. But the question is, do most traders now want to continue buying the dollar, even if the FOMC rate hike continues? There are already a lot of conversations and topics for discussion around yesterday's protocol. In part, this protocol has already ceased to be relevant since after the Fed meeting, an inflation report has already been released, which showed the first decline in a long time. The minutes also say that the Fed will consider macroeconomic data before raising the rate. That is, the regulator intends to "act on the situation." I think things are like this: the Fed will continue to raise the rate slowly. First by 0.50%, then by 0.25%. Are traders ready to buy the dollar on such terms?

On the 4-hour chart, the pair returned to the level of 1.2008, a new rebound from it, and began a new growth in the direction of the corrective level of 127.2% (1.2250). Fixing the pair's exchange rate below the 1.2008 level will work in favor of the US currency and resume falling towards the next corrective level of 161.8% (1.1709). No indicator has any brewing divergences today.

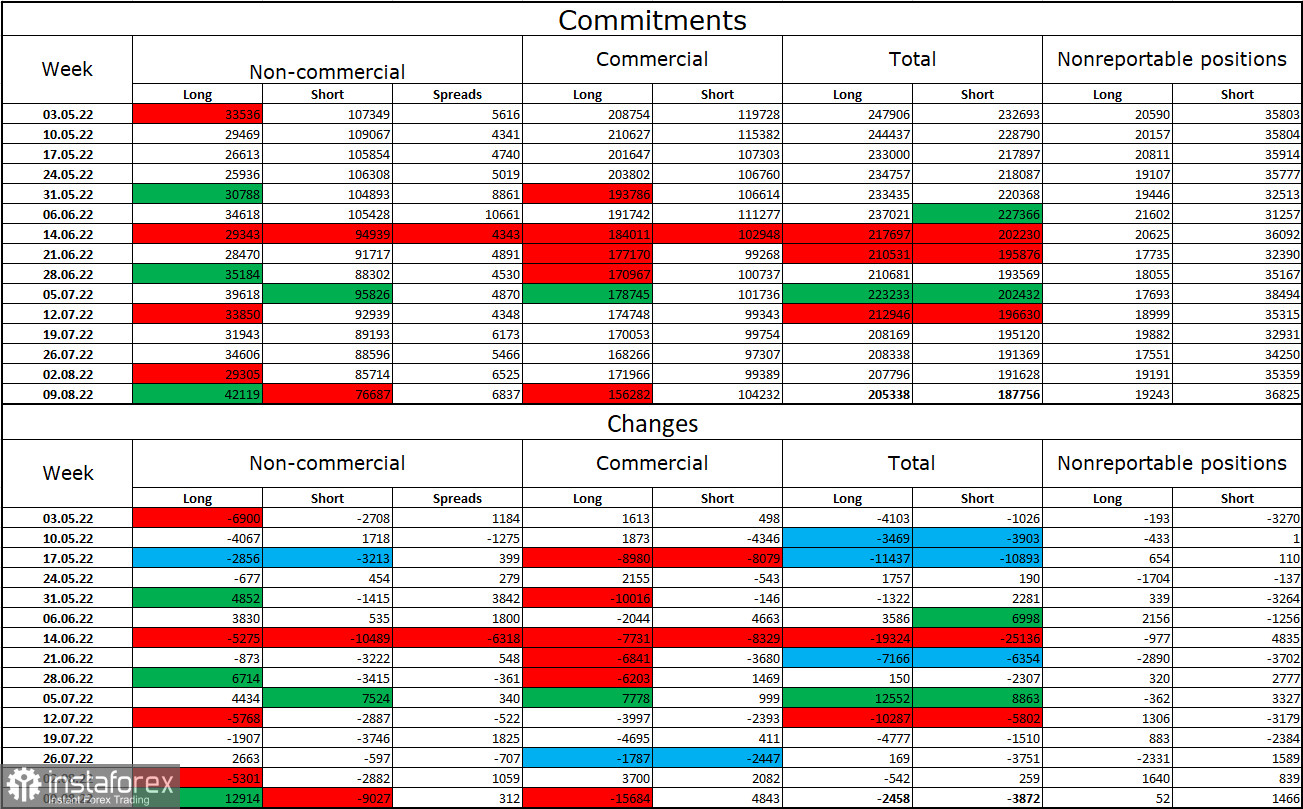

Commitments of Traders (COT) Report:

The mood of the "Non-commercial" category of traders has become much less "bearish" over the past week. The number of long contracts in the hands of speculators increased by 12,914 units, and the number of short contracts decreased by 9027. Thus, the general mood of the major players remained the same – "bearish," and the number of short contracts still exceeds the number of long contracts, but much less than before. The big players stay in the pound sales for the most part, and their mood is gradually changing towards "bullish," but it is still a very long time before this process is completed. The pound has shown weak growth in recent weeks, and COT reports so far make it clear that the British pound will resume its decline rather than start a long upward trend.

News calendar for the USA and the UK:

US - number of initial applications for unemployment benefits (12:30 UTC).

On Thursday, the calendar of economic events in the UK is empty, and in the US, there is one report that rarely arouses the interest of traders. Thus, I believe that the influence of the information background on the mood of traders today will be absent.

GBP/USD forecast and recommendations to traders:

I recommended selling the British when anchoring under the level of 1.2208 on the hourly chart with a target of 1.1709. I recommend buying the British when the pair's rate is fixed above the descending trend corridor on the hourly chart with a target of 1.2250.