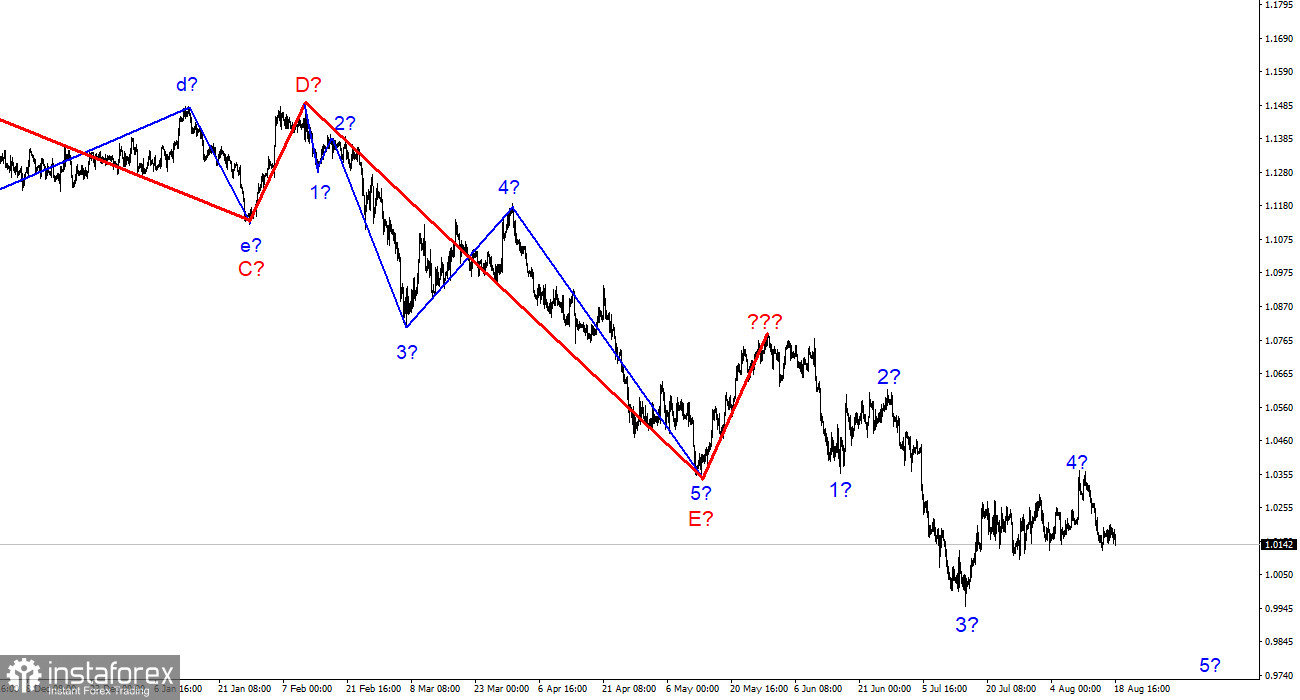

Currently, the wave pattern of the 4H chart for the EUR/USD pair still does not require any adjustments despite the fact that the rise in quotes within the anticipated wave 4 was stronger than expected. The new wave chart does not yet take into account the ascending wave marked with a bold red line. The whole wave structure may become more complex again. Therefore, that is the downside of wave analysis as any structure may have a more complex and extended form. Now the formation of the ascending wave, which is interpreted as wave 4 of the descending section of the trend, is presumably completed. If this assumption is correct, the instrument has started to form wave 5. The presumed wave 4 has taken a five wave corrective form. However, it can still be considered wave 4. A failed attempt to break through the level of 1.0356, which equates to 261.8% Fibonacci, indicates that market makers are not ready to continue buying the euro. Therefore, I expect the decline of the pair's quotes to continue with the targets below 1.0000 within wave 5.

The Fed minutes did not attract considerable interest either

The EUR/USD pair was down 50 basis points on Thursday. The demand for the US dollar increased some hours ago, that is, when the American trading session started. At that time, there were no significant events in the US. The news background was weak today. Nevertheless, quotes fell by 50 basis points in just one hour. I believe this movement could be determined by two reasons. The wave pattern has been pointing to the downward wave formation for a long time. Consequently, the fall of the instrument could be caused by the general bearish sentiment. Moreover, the news and reports were not significant today to increase the demand for the US dollar. The demand for any currency grows not only under conditions of a strong news background!

If waves are of no importance, then the major focus is the reaction of market makers to yesterday's FOMC minutes. Many analysts consider it hawkish. In fact, hawkish or dovish minutes as well as the results of the FOMC meeting are subjective. Moreover, the market does not always follow these rules when reflecting these events. The minutes stated that the regulator intended to further pursue its policy of high rates and price stability. This means that interest rates will continue to rise, though possibly at a lower rate. I believe that even a lower rate hike cannot be considered a dovish factor. Nevertheless, a rate hike is obvious when this aspect is not discussed in the EU. The ECB raised the interest rate once and promised to do it again at the next meeting in September. Moreover, it did not pledge to tighten monetary policy more significantly. Therefore, the Fed may raise the interest rate by 25 basis points at each meeting. This stance is still more hawkish than the ECB one. It should be enough for at least one more downward wave.

General conclusions

Based on the conducted analysis, I conclude that the formation of the downward trend section continues. It is advisable to sell the instrument now with the targets located near the calculated level of 0.9397, which equates to 423.6% Fibonacci, on each MACD downward signal in the expectation of wave 5 formation. A failed attempt to break through the 261.8% Fibonacci level indicates that market makers are ready for new sales of the instrument.

The wave pattern of the downtrend section is noticeably more complicated and lengthened on a senior wave scale. It can take almost any form. Therefore, I think that now it is better to select three- and five-wave standard structures from the overall picture and use them.