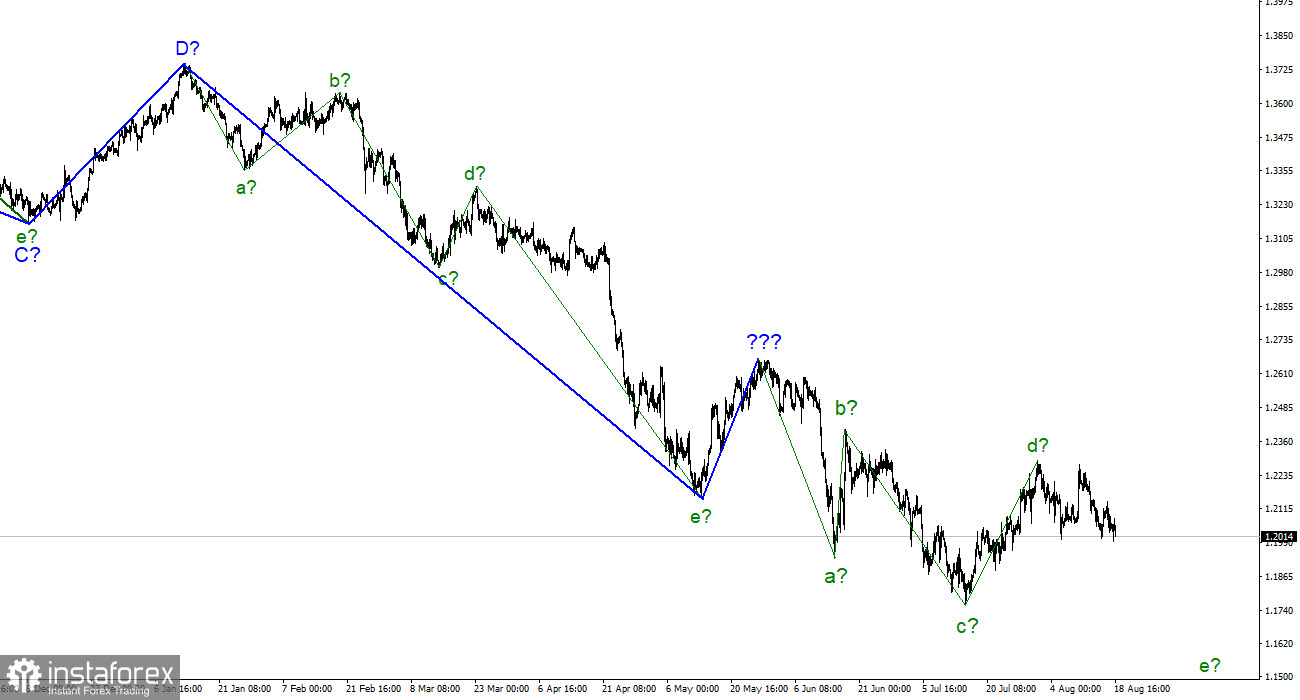

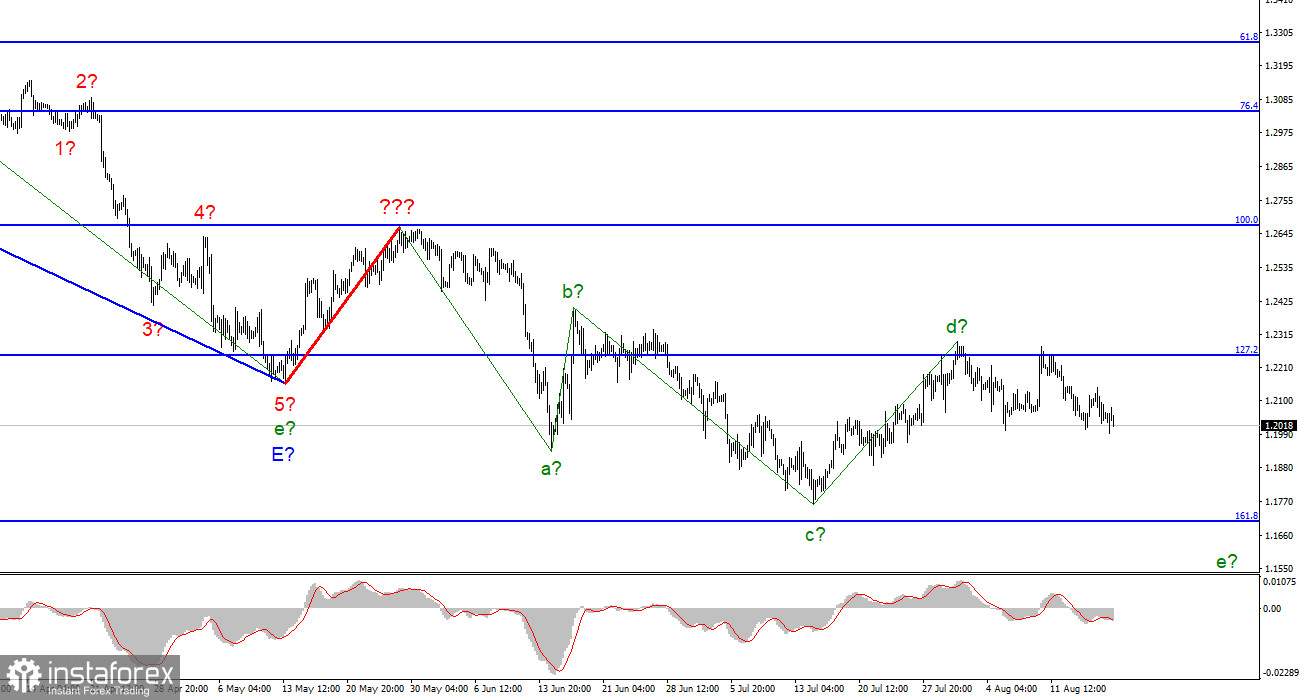

For the pound/dollar instrument, the wave marking looks quite complicated at the moment but does not require any clarifications yet. The upward wave, built between May 13 and May 27, does not fit into the overall wave picture, but it can still be considered corrective as part of the downward trend section. Thus, it can now be concluded that the downward section of the trend takes a longer and more complex form. I am not a big supporter of constantly complicating the wave marking when dealing with a strongly lengthening trend area. And the current trend has already taken a very extended form. I think it is much more practical to identify rare corrective waves, after which new clear structures will be built. At the moment, we have completed waves a, b, c, and d, so we can assume that the instrument has moved on to constructing wave e. If this assumption is correct, the quotes' decline should continue in the coming weeks. The wave markings of the euro and the pound differ slightly in that the downward section of the trend for the euro has an impulse form. Still, the ascending and descending waves alternate almost the same way, and both instruments presumably completed the construction of their fourth waves simultaneously.

We do not notice the positive, and we work out the negative.

The exchange rate of the pound/dollar instrument decreased by 40 basis points on August 18. Today, the news background did not give the market any important information, and the British traded during the day accordingly. Today, we observed both segments of increase and segments of decrease. In general, the decline of the instrument continues, which fully corresponds to the current wave pattern, which assumes the construction of the fifth wave of the last downward trend segment. What happens after its completion will largely depend on the same news background. However, the market has recently started to pay attention only to negative news for the pound.

Quite a lot of reports have been released in Britain this week. There was an unemployment report, a report on wages, applications for unemployment benefits, and an inflation report. And all the data, except for inflation, is quite easy to call and consider positive. Wages are rising; unemployment remains low, GDP decreased minimally in the second quarter (and its value may still be revised), and the number of applications for benefits decreased by several tens of thousands. Only the consumer price index rose by 10.1%, and, from the point of view of UK residents, this is certainly a negative. However, from a general economic point of view, is this so? I believe the Bank of England has no other way but to raise the interest rate further. It can do this much more slowly than the Fed, so an increase in inflation does not mean that the rate will rise by 75 basis points in September. It may not even grow by 50 points. But if the Bank of England refuses to tighten the PEPP further, why did it undertake to raise it? Thus, there will be no tightening of the pace of rate increases, but the rate will continue to rise at each meeting. Only here will the Fed rate rise at each meeting and, most likely, faster.

General conclusions

The wave pattern of the pound/dollar instrument suggests a continued decline in demand for the pound. I now advise selling the instrument with targets near the estimated mark of 1.1708, which equates to 161.8% Fibonacci, for each MACD signal "down." An unsuccessful attempt to break through the 1.2250 mark indicates that the market is not ready for new purchases by the British.

The picture is similar to the euro/dollar instrument at the higher wave scale. The same ascending wave does not fit the current wave pattern, the same three waves down after it. Thus, one thing is unambiguous – the downward section of the trend continues its construction and can turn out to be almost any length.