If the Fed has one plan and it's good for the US dollar, then the ECB has two, and both are bad for the euro. No matter how much US inflation slows down, the Fed will continue to raise rates to bring it back to the 2% target. In the eurozone, the structure of consumer prices is dominated by elements beyond the control of the Central Bank, for example, energy prices. An increase in borrowing costs will lead to only one thing—a recession and a fall in the EURUSD. The pause in the process of monetary restriction is also bad news for the bulls.

The different rate of gas price growth is a key driver of exchange rate formation on Forex. If in the USA prices have jumped 1.5 times over the past 12 months, in Europe, it's almost six times. They are ten times higher than usual at this time of year. Despite the slowdown in the global economy and the improvement of supplies outside the euro area. These "bearish" factors for blue fuel do not work when Russia turns off the taps, and the water level in the Rhine falls below the critical 40 cm mark. It is unsuitable for shipping and cargo transportation. Europe has lost half of its zinc and aluminum production capacity over the past year due to high energy costs.

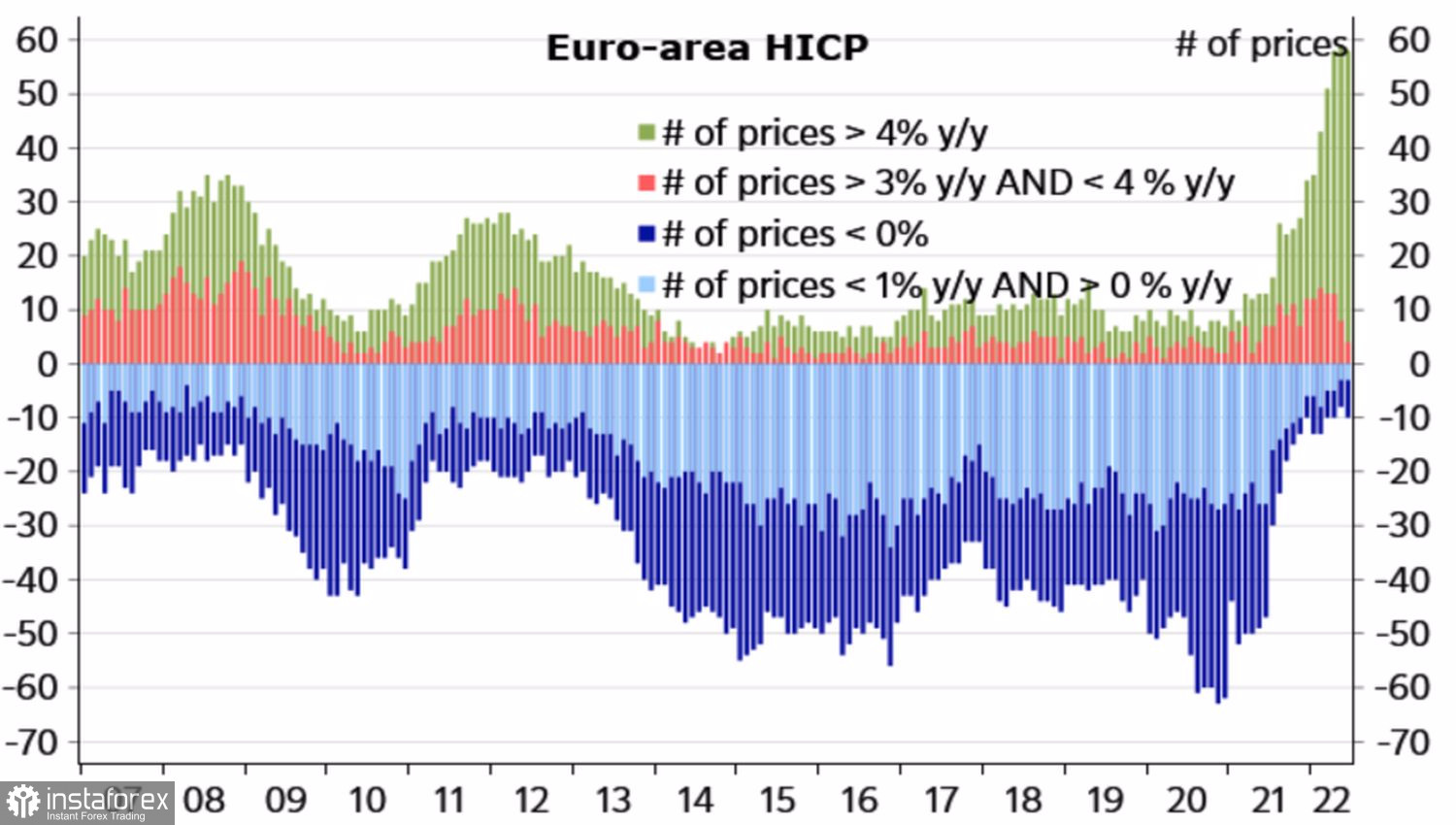

As gas prices rise, so does inflation. In July, consumer prices in the euro area jumped to a record high of 8.9%. In Latvia, they even exceed 20%, which makes the head of the local Central Bank, Martins Kazaks, argue that the ECB will continue to raise rates. But when many elements of the CPI are out of your control, to say that this is the right way is extremely reckless.

Structure and dynamics of European inflation

The Fed's mission does not look simple either, but compared to the ECB, it is heaven and earth. Jerome Powell and his team must convince the financial markets that they are wrong. CME derivatives expect the federal funds rate to peak at 3.7%, but it may take 4.5–5% for inflation to return to the target. The Fed should continue the cycle of monetary restriction, including ramping up the process of selling bonds from the balance sheet. As a result, financial conditions will tighten, and inflation will continue to slow down.

Thus, the downward movement of EURUSD is based on the energy crisis in Europe, which is pushing the economy of the currency bloc into recession and tying the hands of the ECB. The situation is unlikely to improve in the near future. Rains are expected in Germany, which will raise the water level in the Rhine, but after a week, the heat will return to the country. As winter and cold weather approaches, gas prices will continue to rise.

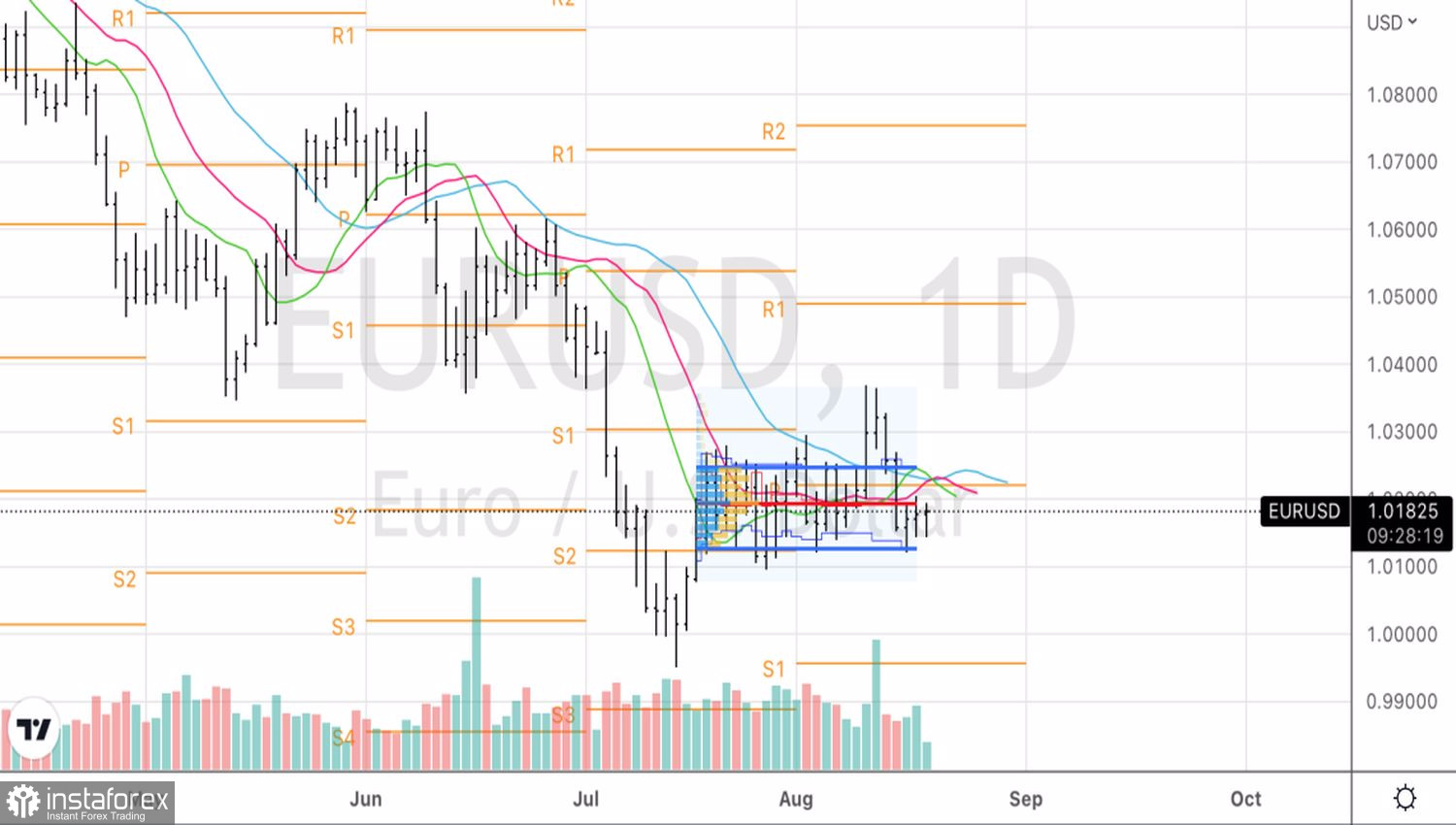

Technically, an inside bar has formed on the EURUSD daily chart. A break of its lower border near 1.014 will allow to build up short positions, while a successful assault on the upper one at 1.021 may become a reason for a pullback. However, it is unlikely that a deep correction should be expected in the current conditions. Rebound from resistances at 1.0225, 1.0250 and 1.0300 should be used to form euro shorts against the US dollar.