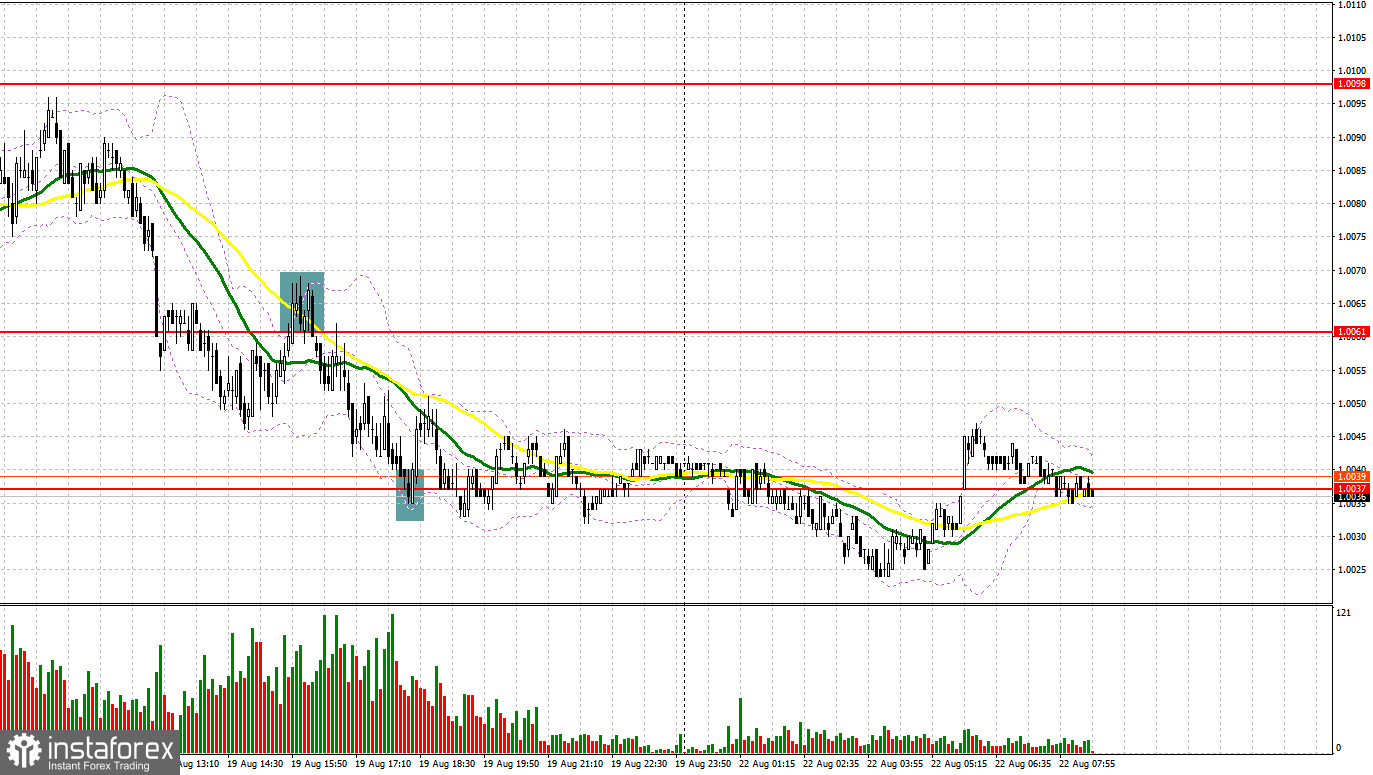

On Friday, traders received several signals to enter the market. Let us take a look at the 5-minute chart to clear up the market situation. Earlier, I asked you to pay attention to the level of 1.0098 to decide when to enter the market. In the first part of the day, the euro's upward potential was capped by Germany's PPI data. According to the report, the indicator showed a sharp rise. Unfortunately, the pair failed to hit 1.0098, depriving traders of a sell signal. Only a false breakout of 1.0061 gave a sell signal closer to the middle of the US trade. As a result, the euro dropped by 25 pips. Trying to protect the support level of 1.0037, bulls formed a long signal, but the pair did not show a jump.

Conditions for opening long positions on EUR/USD:

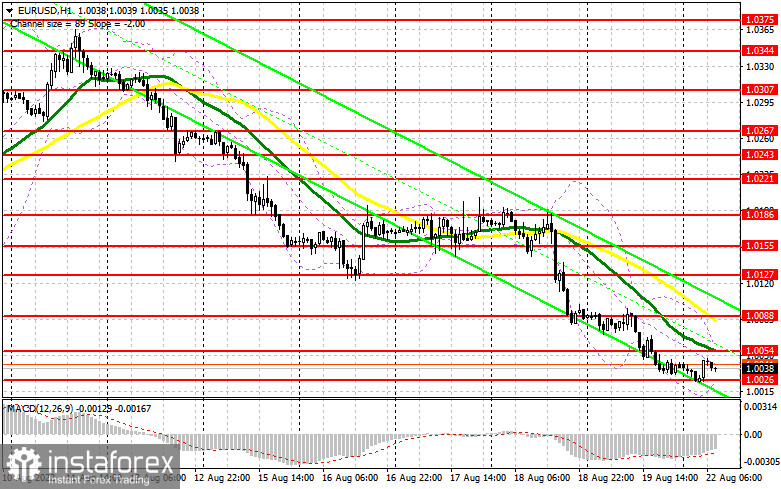

Today, in the macroeconomic calendar, there is no statistical data that may support buyers of the euro. From the technical point of view, the euro has every chance to launch an upward correction. That is why traders should pay attention to the nearest support level to find a signal. The pair may either break 1.000 or form a double bottom and a signal of a mid-term market reversal, which will boost risk assets. Notably, the likelihood of the second scenario is quite small. If the pair continues falling, only a false breakout of 1.0026 will give a long signal with the target at the nearest resistance level of 1.0054. Slightly above this level, there are bullish moving averages. A breakout and a downward test of this level will affect bears' stop orders, forming a new long signal with the target at 1.0088. The next target is located at the resistance level of 1.0127, where it is recommended to lock in profits. If the pair declines and buyers fail to protect 1.0026 amid the publication of the Bundesbank report, pressure on the pair will increase. In this case, the bullish trend will hardly be supported by the beginning of the week and oversold signals provided by the MACD indicator. It will be better to go long after a false breakout of 1.0000. Buy orders could also be initiated after a bounce off 0.0058 or lower – from 0.9915, with the expectation of a rise of 30-35 pips within the day.

Conditions for opening short positions on EUR/USD:

Bears should primarily protect the nearest resistance level of 1.0054. It will be wise to go short after a false breakout of this level in the first part of the day before Bundesbank publishes its report. In this case, the euro may decline to 1.0026. A breakout and settlement below this level may happen soon. Thus, the pair will hardly avoid parity. An upward test of 1.0026 will give an additional sell signal that will affect buyers' stop orders. As a result, the pair may slump to 1.000, which is too close to 0.9958, where it is recommended to lock in profits. The next target is located at 0.9915. If the price climbs during the European session and bears fail to protect 1.0054, traders will have a chance to lock-in profits at the beginning of the week. In this case, the market situation will become bullish. That is why I recommend that traders avoid short orders until the price hits 1.0088 only in case of a false breakout. It is also possible to sell from the high of 1.0127 or higher – from 1.0155, expecting a downward correction of 30-35 pips.

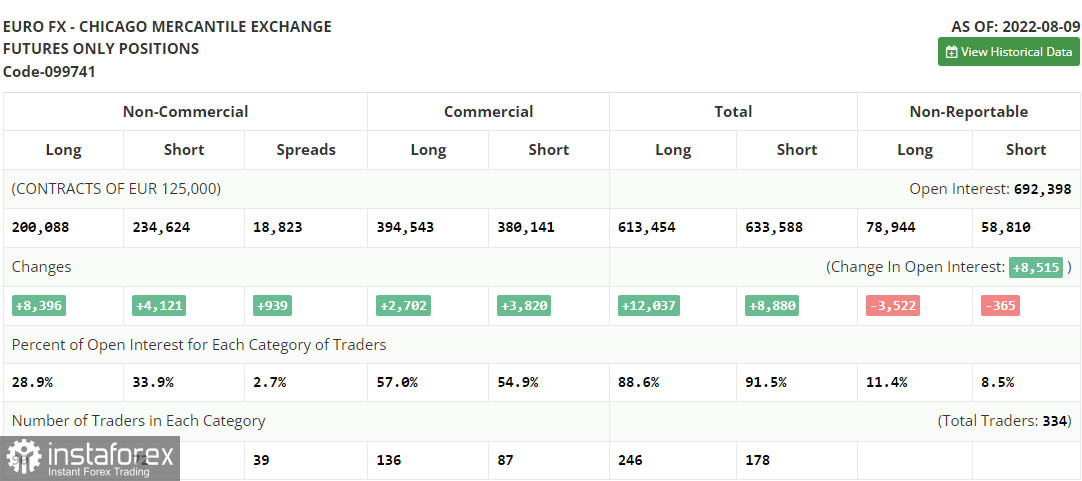

COT report

According to the COT report from August 9, the number of both short and long positions increased. The rise in the number of short positions was more significant. It means that the bullish trend is losing its momentum and the price may reach the bottom after it hits parity against the US dollar. The US inflation report published last week considerably affected the market situation. Demand for risk assets increased amid the first decline in the US inflation after it reached the peak of 10.0%. Investors prefer not to enlarge long positions due to the risk of the global economic recession. This week, traders will hardly receive any important macroeconomic report that will allow the euro to recoup losses. That is why traders should bet on the trading within the sideways channel. Until autumn, the market situation is unlikely to change. The COT report unveiled that the number of long non-commercial positions rose by 8,396 to 200,088, while the number of short non-commercial positions jumped by 4,121 to 234,624. At the end of the week, the total non-commercial net position, although it remained negative, rose slightly from -39,811 to -34,536, which indicates that the market is becoming bullish. The weekly closing price rose to 1.0233 against 1.0206.

Signals of indicators:

Moving Averages

Trading is performed below 30- and 50-day moving averages, thus pointing to the bearish market.

Note: The period and prices of moving averages are considered by the author on the one-hour chart that differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

In case of a rise, the upper limit of the indicator located at 1.0054 will act as resistance.If the pair declines, the support level will be located at the lower limit of the indicator - at 1.0026.

Description of indicators- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 30. It is marked in green on the graph.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). A fast EMA period is 12. A slow EMA period is 26. The SMA period is 9.

- Bollinger Bands. The period is 20.

- Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are a total number of long positions opened by non-commercial traders.

- Short non-commercial positions are a total number of short positions opened by non-commercial traders.

- The total non-commercial net position is a difference in the number of short and long positions opened by non-commercial traders.