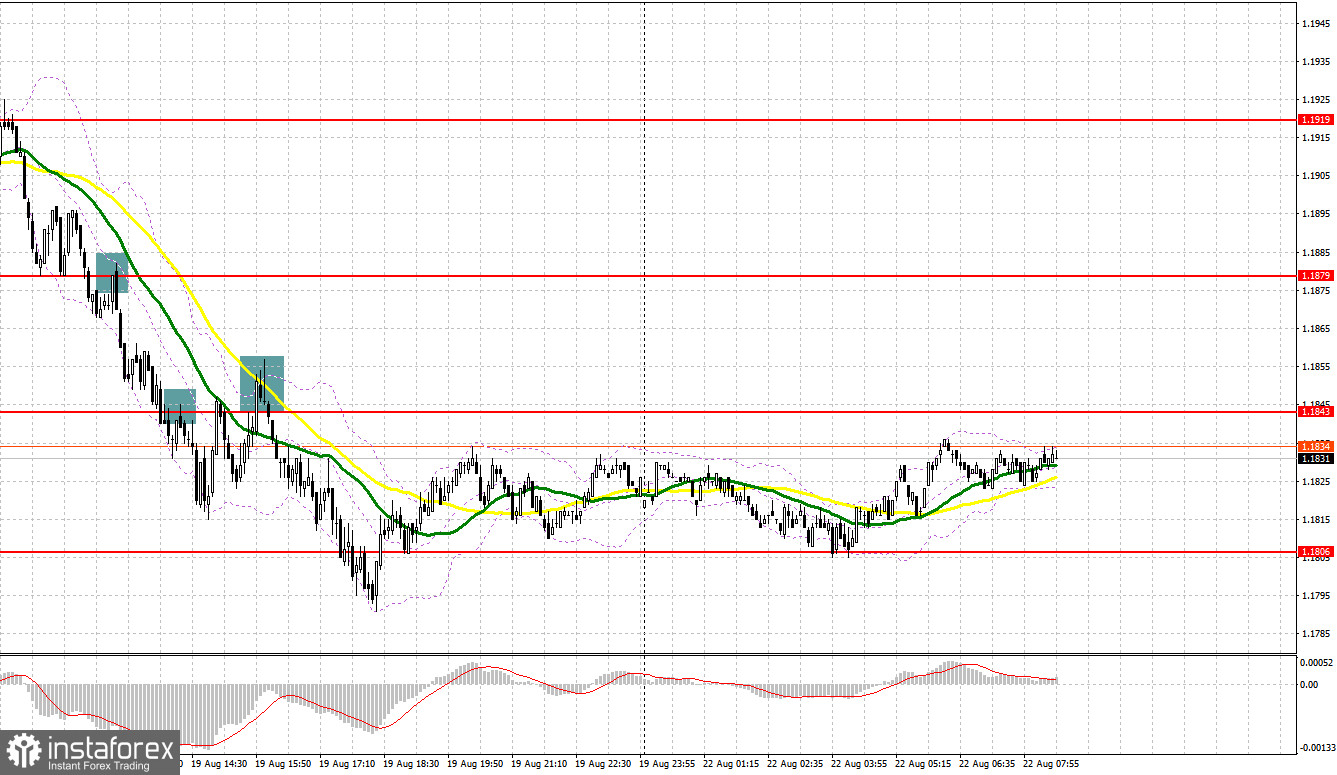

On Friday, there were plenty of good entry points. Let's look at the 5-minute chart and figure out what actually happened. In the morning article, I highlighted the 1.1879 level and recommended making decisions with this level in focus. Several times the pair approached this level. However, a buy signal did not appear as there was no false breakout. As a result, a breakout and an upward test of 1.1879 gave a sell signal. It brought more than 35 pips. After a breakout and an upward test of 1.1843, the bears were able to defend this level in the afternoon. Hence, there was an excellent sell signal on the pound sterling within the trend. The pound/dollar pair declined by almost 40 pips.

What is needed to open long positions on GBP/USD

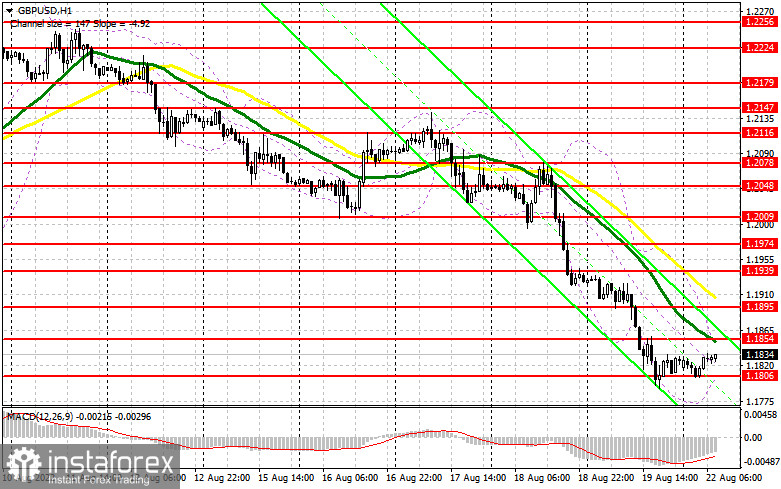

The pound sterling nearly plunged to yearly lows following the weak GfK Consumer Confidence indicator. The pound sterling is likely to touch them in the near future. Now, there are no positive fundamental factors for the British currency. So, traders are unwilling to open long positions. Today, there will be no crucial economic reports which could affect the trajectory of the pair. For this reason, traders will focus on the nearest support level of 1.1806 formed last Friday. The bulls could try to defend this level. If they manage to engineer a false breakout there, it will give a buy signal with the prospect of an upward correction. Notably, the pound sterling has been trying to begin a correction for some time. In so, GBP/USD is likely to rise to the resistance level of 1.1854 where the moving averages are passing in negative territory. A breakout and a downward test of 1.1854 will undermine the weekly bearish trend. Speculators will start closing short positions, providing another buy signal. If this scenario comes true, the price is likely to advance to 1.1895 where I recommend locking in profits. If GBP/USD drops and the bulls show no activity at1.1806, the pressure on the pair will only escalate. In this case, it is better to postpone long positions until the next support level of 1.1764 support. It would be wise to open long positions at this level only after a false breakout. You can buy GBP/USD immediately at a bounce from 1.1707 or a low of 1.1643, keeping in mind an upward intraday correction of 30-35 pips.

What is needed to open short positions on GBP/USD

The bears keep the market under control thanks to the UK's dismal macro statist. The economic reports are getting worse and worse every day. Today, the optimal scenario for opening short positions will be a rise from the resistance level of 1.1854 formed last Friday. However, the bears need a false breakout at 1.1854 as many indicators signal that the pound sterling is oversold. It may limit a downward movement at the beginning of the week. A false breakout of 1.1854 will give a good sell signal with the possibility of a new decline to the weekly low of 1.1806. A breakout and an upward test of this level will provide a new sell signal. If so, the pair may fall to 1.1764. A more distant target will be the 1.1707 level where I recommend locking in profits. If the price touches this level, it is highly likely to slip to yearly lows. If GBP/USD grows and the bears show no energy at 1.1854, the likelihood a larger upward correction will increase significantly. The bulls are sure to grab the chance, pushing the pair to 1.1895. Only a false breakout of this level will generate a new sell signal with the prospect of a further decline. If the bulls remain inactive at this level, it is better to sell GBP/USD immediately at a bounce from 1.1895, keeping in mind a downward intraday correction of 30-35 pips.

COT report

The COT report for August 9 logged a drop in short positions and a rise in long ones, which led to an increase in the negative delta. A smaller contraction in UK's second-quarter GDP indicates that the economy is coping well with the crisis. However, it does not mean that households pay less for utility bills, which only exacerbates the cost-of-living crisis in the country. Some analysts predict that by the end of this year the UK economy is likely to slide into a recession. For this reason, traders are cautious when opening new positions. The GBP/USD pair is also vulnerable to the Fed's monetary policy decisions. Last week, the US revealed its CPI data that showed a slowdown in inflation. It has significantly fueled demand for risky assets although risk appetite will hardly last for long. This is why the pound sterling is unlikely to start a rally. The pound/dollar pair could move within a wide sideways channel until the end of the month. The price will hardly reach new monthly highs during this time. The COT report revealed that the number of long non-commercial positions rose by 12,914 to 42,219, while the number of short non-commercial positions fell by 9,027 to 76,687. As a result, the negative value of the non-commercial net position grew to -34,468 from -56,409. The weekly closing price dropped to 1.2038 from 1.2180.

Signals of technical indicators

Moving averages

EUR/USD is trading below 30- and 50-period moving averages. It means that the bears are trying to take the upper hand.

Remark. The author is analyzing a period and prices of moving averages on the 1-hour chart. So, it differs from the common definition of classic daily moving averages on the daily chart.

Bollinger Bands

In case of a rise, the upper border at 1.1854 will act as a resistance. In case of a decline, the lower border at 1.1805 will act as support.

Definitions of technical indicators

- Moving average recognizes an ongoing trend through leveling out volatility and market noise. A 50-period moving average is plotted yellow on the chart.

- Moving average identifies an ongoing trend through leveling out volatility and market noise. A 30-period moving average is displayed as the green line.

- MACD indicator represents a relationship between two moving averages that is a ratio of Moving Average Convergence/Divergence. The MACD is calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA. A 9-day EMA of the MACD called the "signal line".

- Bollinger Bands is a momentum indicator. The upper and lower bands are typically 2 standard deviations +/- from a 20-day simple moving average.

- Non-commercial traders - speculators such as retail traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Non-commercial long positions represent the total long open position of non-commercial traders.

- Non-commercial short positions represent the total short open position of non-commercial traders.

- The overall non-commercial net position balance is the difference between short and long positions of non-commercial traders.