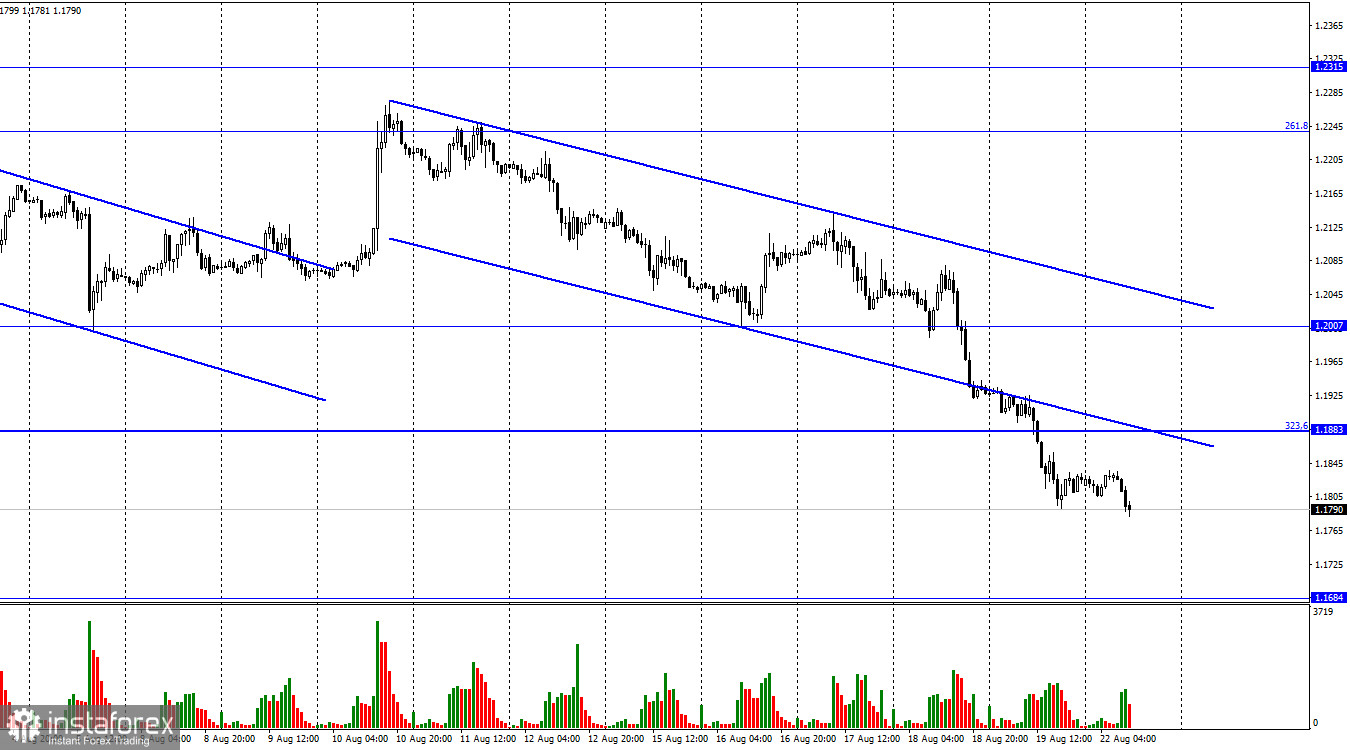

On Friday, GBP/USD continued to depreciate on the H1 chart and settled below the retracement level of 323.6% at 1.1883. So, the next downward target for the sterling may be the level of 1.1684. In general, the pound follows the trajectory of the euro. Therefore, I think it is reasonable to say that both European currencies are falling. Most likely, this decline is attributed to geopolitical factors and the policy of the US Fed rather than to some local reasons within the EU or the UK, or it can be both. The US regulator maintains a hawkish stance on its monetary policy which is a strong driving factor for the national currency. In the meantime, the geopolitical situation in Eurasia remains tense and the conflict in Ukraine is not the only reason for this. China has intensified its activity around Taiwan, and some shooting was observed in Nagorno-Karabakh. Serbia and Kosovo were on the brink of a conflict at the beginning of the month. The global economy has just started to recover from the two years of the COVID-19 pandemic but it seems that peaceful existence is something we can only dream about.

So, we can only guess what changes are ahead of us. Geographically, the US is located far away from these conflicts and potentially dangerous zones. Overall, nothing can threaten its economy if not for the Fed itself. Even amid a high interest rate, hardly anyone doubts that when the monetary tightening is over, the US economy will recover and thrive. The low unemployment rate and the strong labor market will facilitate this process. At the same time, the future of the European region looks rather gloomy. Experts voice concern about the upcoming winter recession triggered by a shortage of fuel and gas that will lead to a shutdown of some businesses. If the ECB and the Bank of England continue to raise the rate, they will put even more pressure on their economies. Meanwhile, inflation is running wild both in the EU and the UK. In the US, inflation has shown signs of a slowdown while nothing like this can be said about the UK or the EU.

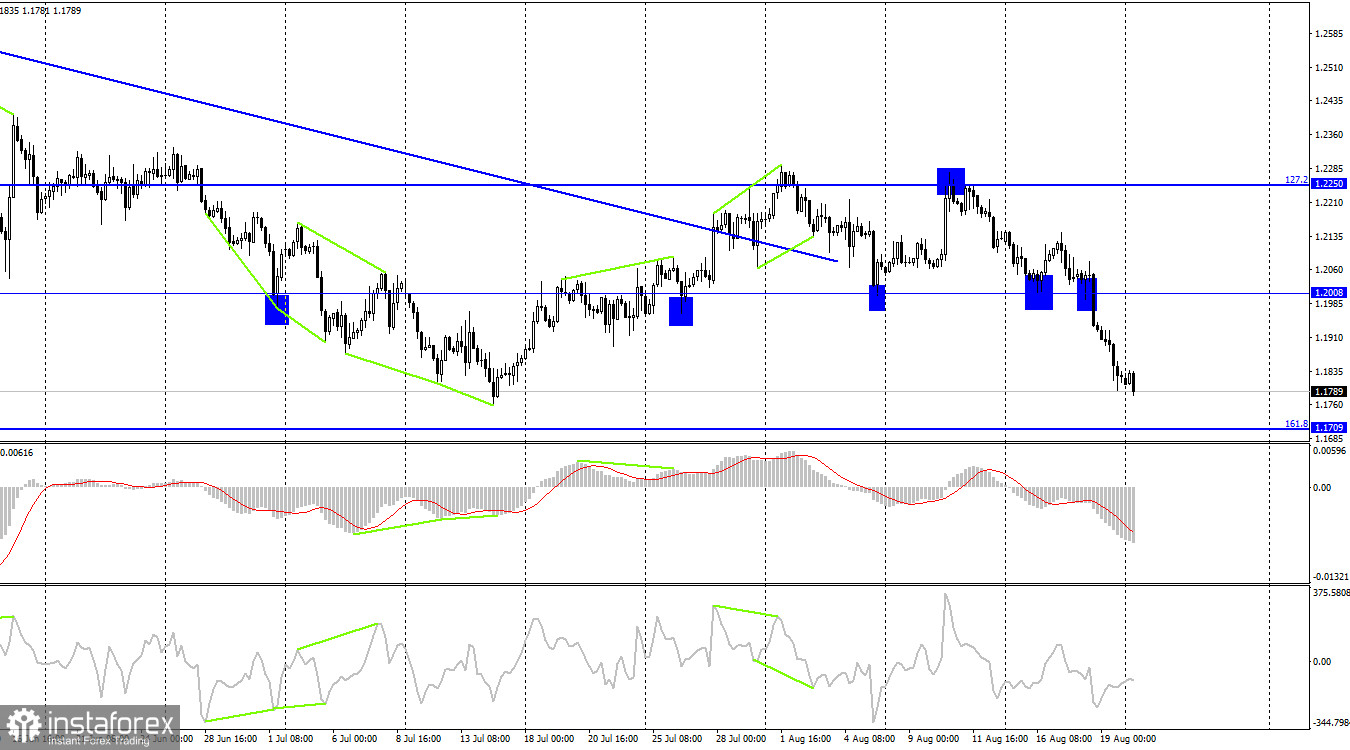

On the 4-hour chart, the pair consolidated below the level of 1.2008 to continue its decline towards the fibo retracement of 161.8% located at 1.1709. There are currently no divergences on the chart. Besides, the trendline is no longer relevant. Yet, the pound failed to gain a foothold above the level of 1.2250. This double bounce can be considered one of the points on the trendline. Therefore, the bearish trend still persists.

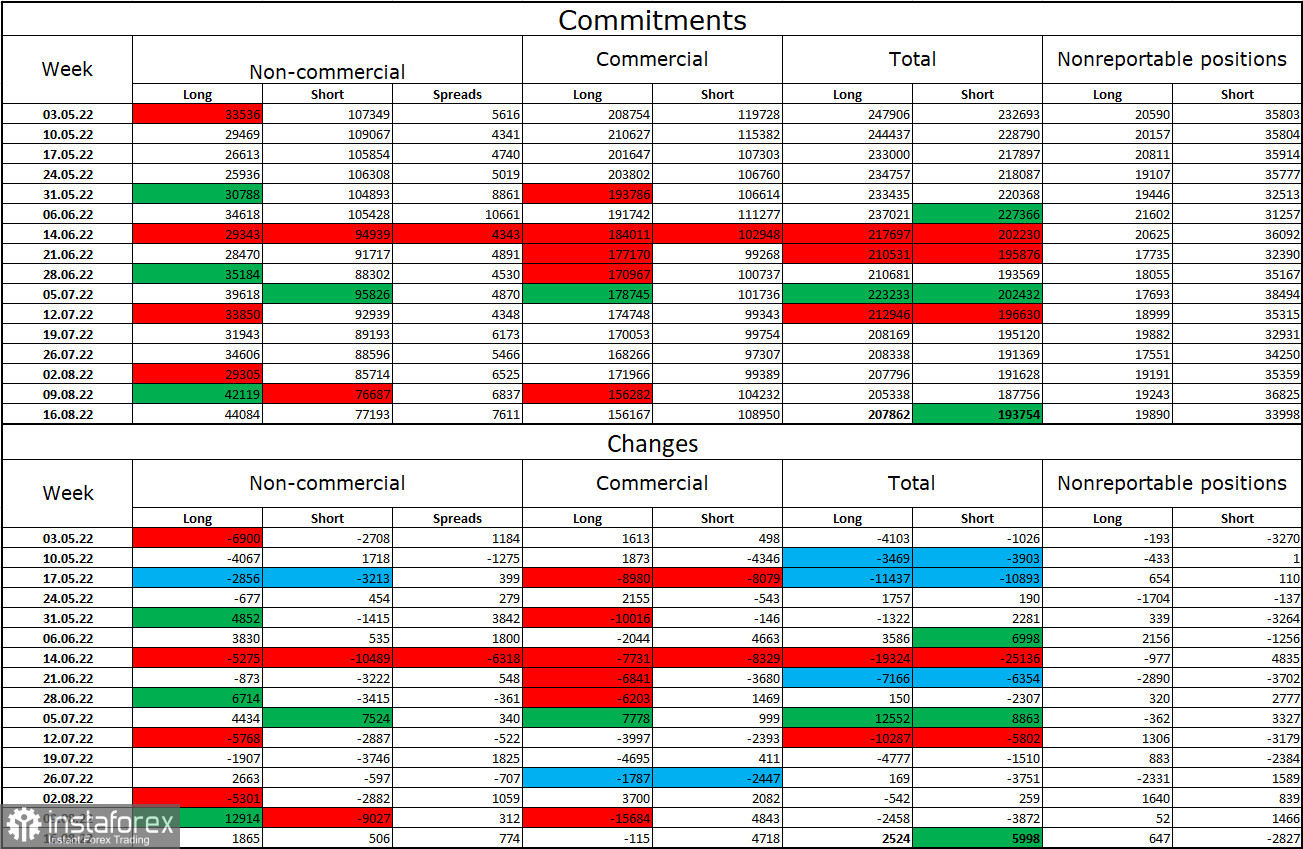

Commitments of Traders (COT) report:

The sentiment of the non-commercial group of traders became much less bearish over the past week. The number of open long positions increased by 1,865 while the number of short ones fell by 506. Therefore, the overall sentiment of large market players remains bearish, and the number of short contracts still considerably outweighs the long ones. Major market participants still prefer to stay short on the pound. Their strategy might be gradually changing towards buying the sterling, but this process may take some time to develop. In recent weeks, GBP has been performing very poorly. Meanwhile, the COT report confirms that the pound is more likely to extend its decline rather than develop an uptrend.

Economic calendar for US and UK:

On Monday, the economic calendar in the US and the UK shows no events. Therefore, the information background won't influence traders' sentiment today.

GBP/USD forecast and trading tips:

I would recommend selling the pound as soon as the price settles below the level of 1.2208 on the H1 chart with the target at 1.1709. These trades can be kept open at the moment. It is advisable to buy the pound when the quote settles firmly above the descending trend channel on H1 with the target at 1.2238.