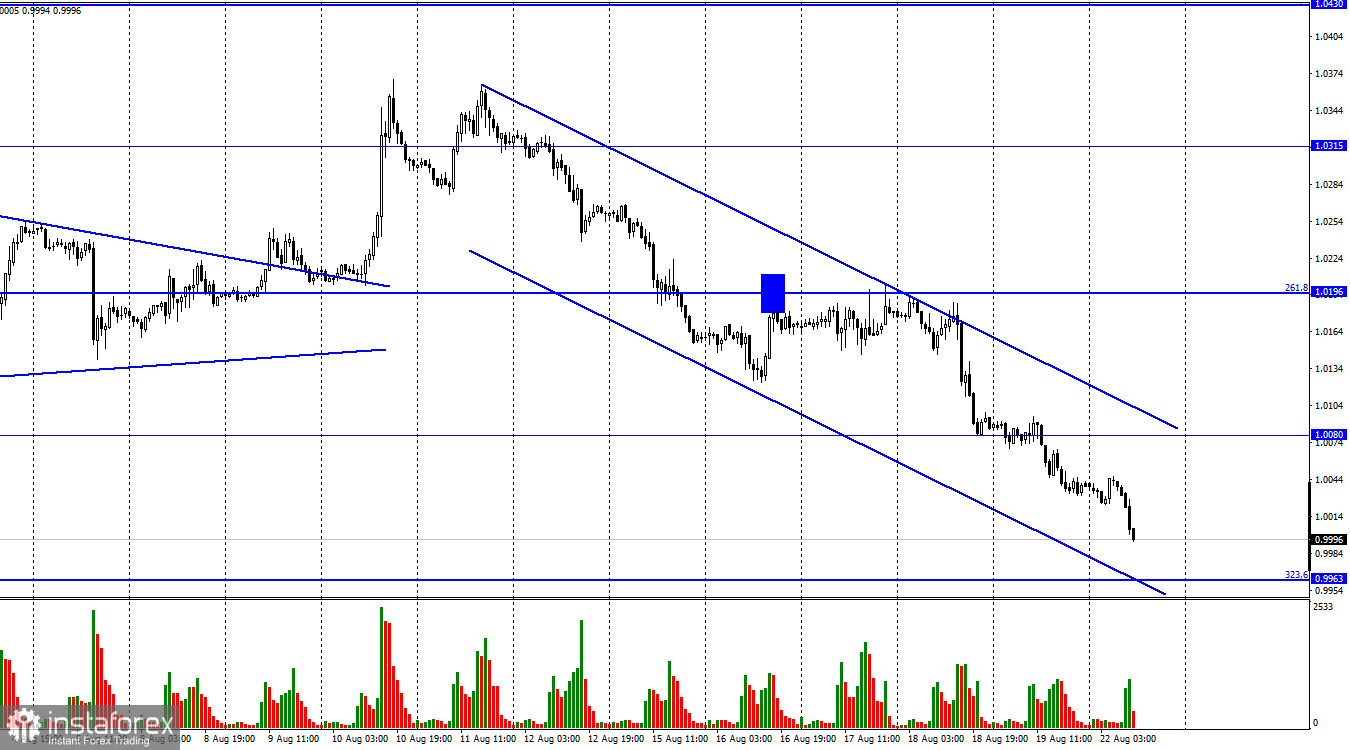

Hi, dear traders! EUR/USD continued to tumble on Friday and settled below 1.0080. On Monday, the pair continued to drop towards the retracement level of 323.6% (0.9963). The downward trend channel indicates the sentiment of traders is bearish. If EUR/USD settles above 0.9963, it could reverse upwards and increase slightly. The cause for EUR's slump is unclear. There were no events on Friday that could trigger a downtrend, and there is nothing on Monday that could trigger it. It seems the euro is tumbling due to low trader demand for EUR amid a huge policy gap between the Fed and the ECB.

This gap is probably the key factor for EUR/USD at this moment. The pair's decline could be long-lasting, as the European regulator is unlikely to accelerate its interest rate hikes. The ECB has increased the rate only once, while the Fed will likely raise interest rates by at least 0.50% at each remaining policy meeting in 2022. As a result, investors are abandoning EUR and switching to USD. This week's economic calendar is light and is unlikely to affect traders significantly. Even then, no event could currently stop traders from dumping EUR and buying USD. Business climate data is not particularly significant. Even then, EU data will likely be more negative than US data. Both the US and EU economies are at a risk of a recession, and neither USD nor EUR will be able to take advantage of this factor.

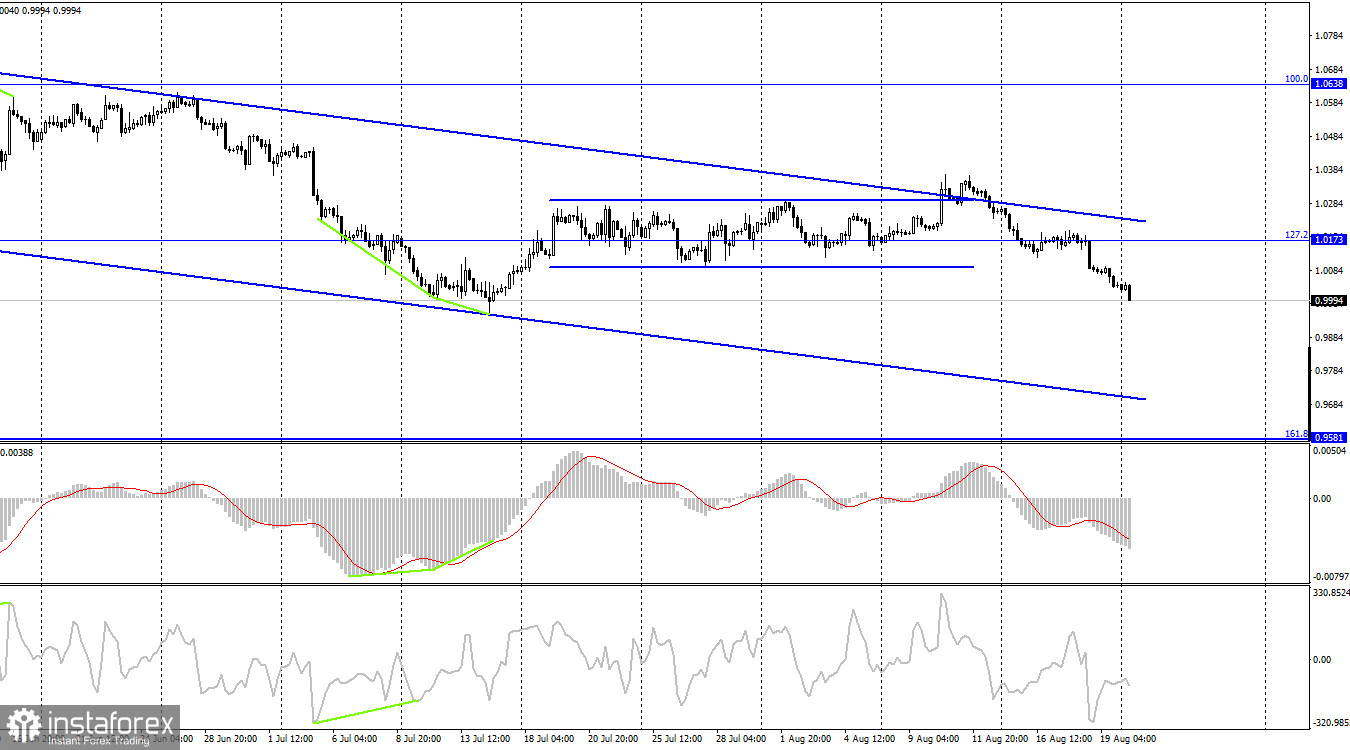

According to the H4 chart, EUR/USD reversed downwards and settled below the retracement level of 127.2% (1.0173). The pair failed to settle above the descending trend channel, indicating that the sentiment of traders remains bearish. EUR/USD could continue to decline towards the Fibo level of 161.8% (0.9581). Indicators show no signs of emerging divergences today.

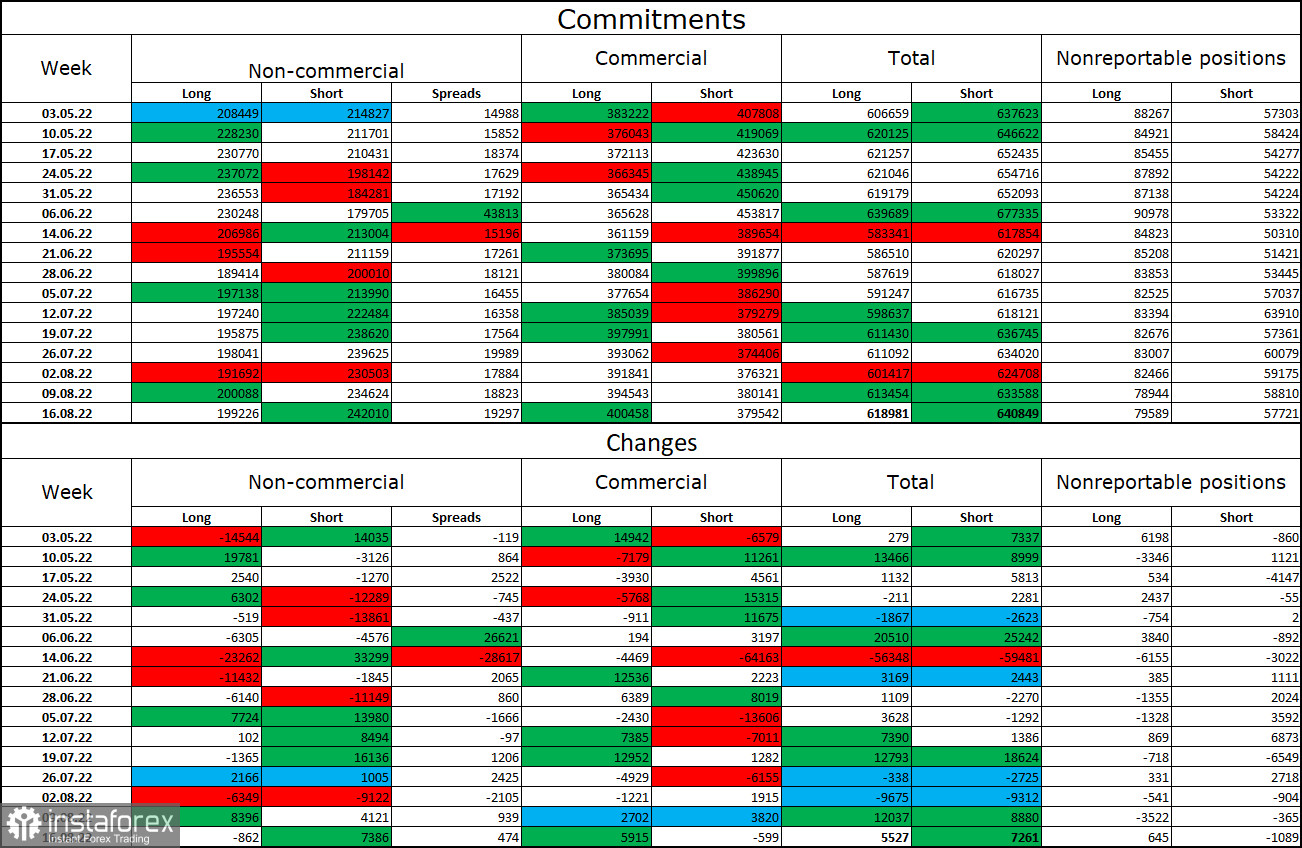

Commitments of Traders (COT) report:

In the previous week covered by the report, traders closed 862 Long positions and opened 7,386 Short positions, indicating that major players have become more bearish on EUR/USD once again. The total number of open Long positions now stands at 199,000 against 242,000 Short positions. Although the pair's chances for growth have steadily increased over the last weeks, the latest COT reports have indicated that bulls have not managed to improve their situation. The euro has failed to rise significantly in the last 5-6 weeks. EUR/USD is likely to resume its decline in the future.

US and EU economic calendar:

There are no significant events on the economic calendar in both the EU and the US.

Outlook for EUR/USD:

Earlier, traders were recommended to open new short positions with 1,0080 and 0,9963 being targets. Now, short positions can be opened if EUR/USD settles below 0.9963 on the H1 chart targeting 0.9581. Long positions can be open if the pair settles above the descending trend channel on the H4 chart, with 1.0638 being the target.