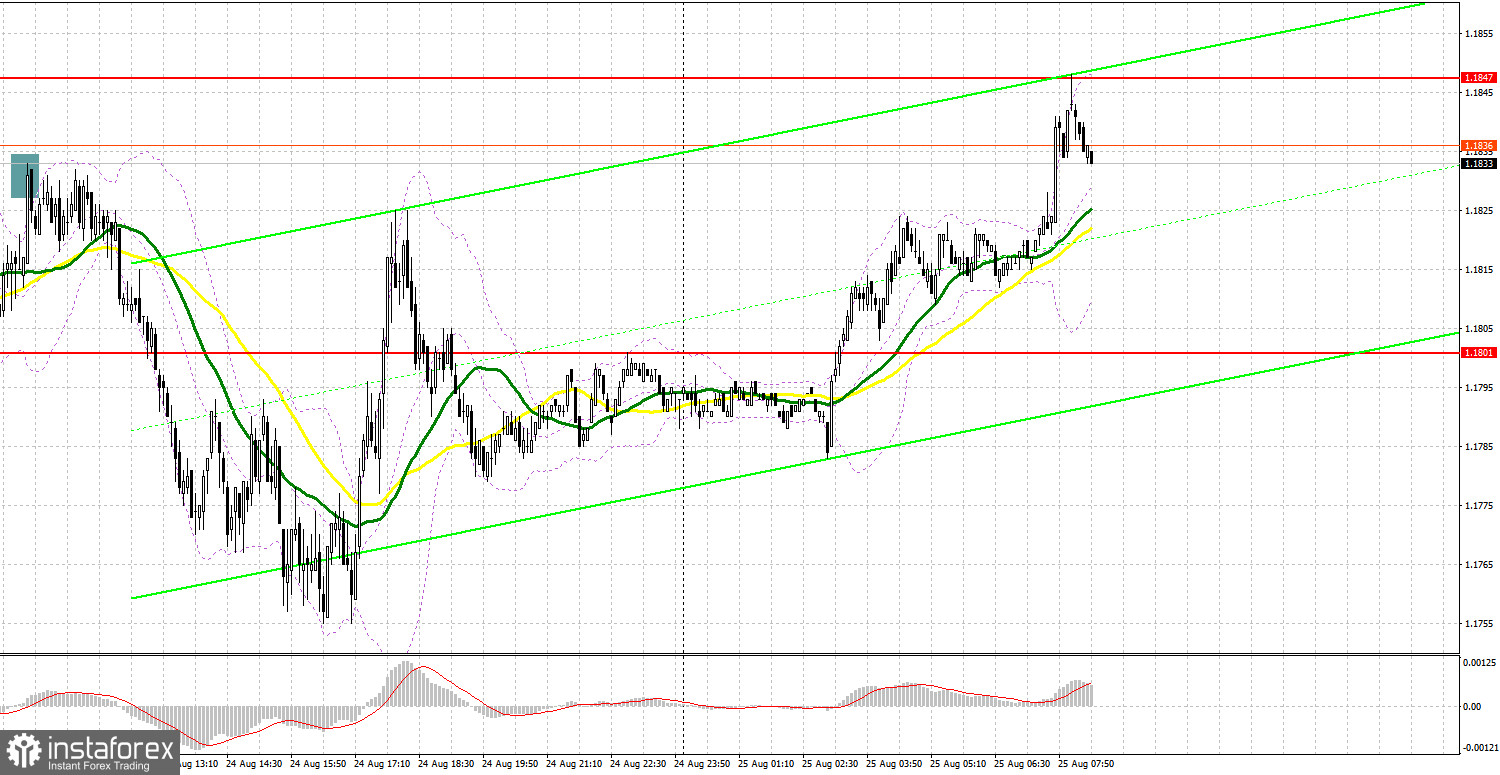

Yesterday, traders received only one signal to enter the market. Let us take a look at the 5-minute chart to figure out what happened. Earlier, I asked you to pay attention to the level of 1.1833 to decide when to enter the market. In the first part of the day, bulls failed to push the price higher. As a result, the pair showed a false breakout of 1.1833, thus forming a sell signal. Thus, the pair dropped by almost 80 pips. Since the volatility surged and the pound sterling moved in the opposite direction, traders did not get any other entry points.

Conditions for opening long positions on GBP/USD:

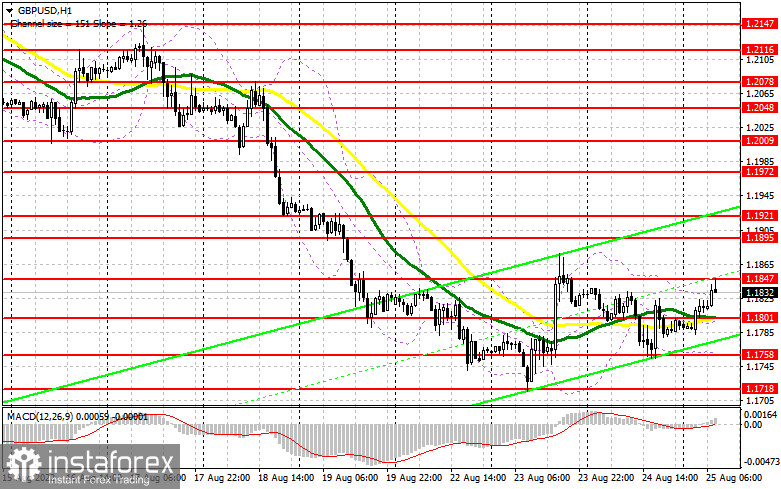

Today, the UK is not going to disclose any fundamental data. What is more, reaction to the retail sales figures is likely to be limited. Traders are likely to shift their attention to the reports on the US economy. That is why buyers of the pound sterling have every chance to see a further rise and an exit from the triangle pattern. It will be better to go long near the support level of 1.0801, where there are bullish moving averages. This will allow the pair to return to 1.1849. A breakout and a downward test of this area will prove the ongoing rise in the pound/dollar pair, thus forming a buy signal with the target at 1.1895, where it is recommended to lock in profits. The next target is located at 1.1934. If the pair declines and buyers fail to protect 1.1801, pressure on the pair will surge. A breakout of this level may allow bears to leave the triangle. In the event of this, it will be better to avoid buy orders until the price hits the next support level of 1.1758. It will be possible to buy there only after a false breakout. Traders may also go long after a bounce off 1.1718 or even lower – from 1.1684, expecting a rise of 30-35 pips within the day.

Conditions for opening short positions on GBP/USD:

Yesterday, sellers did their best to keep control over the market. However, weak data from the US prevented them from doing so. The absence of statistical data is likely to support buyers. That is why the pound sterling may jump to 1.1849 as early as at the beginning of the European session. It will be better to sell the pound sterling after a false breakout of this level, thus allowing the pair to return to the intermediate support level of 1.1801. There, we can see moving averages. A breakout and test of this level will give a sell signal with the target at 1.1758. This will overshadow all the attempts made by buyers. The next target is located at 1.1718, where it is recommended to lock in profits. If the pound/dollar pair increases and bears fail to protect 1.1849, the likelihood of a more significant upward correction will jump. Thus, the pair may return to 1.1895. A false breakout of the level will give a short signal. If bears fail to be active, it will be wise to sell the asset just after a rebound from 1.1934, expecting a decline of 30-35 pips.

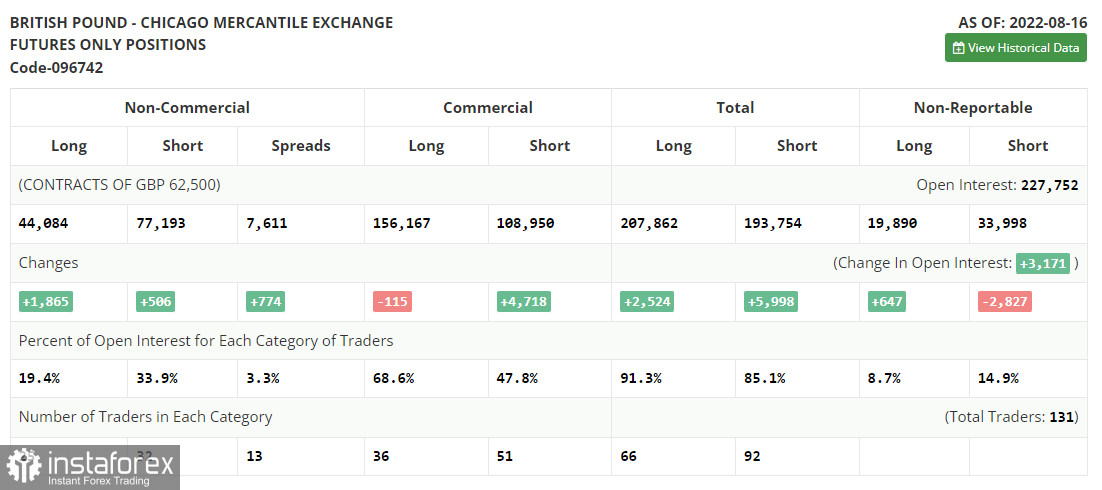

COT report

According to the COT report from August 16, the number of both short and long positions increased. However, these changes are not reflecting the real state of affairs any more. The pound/dollar pair has been under pressure since the middle of the previous week. The number of those who want to buy the pound sterling is likely to reduce due to the current macroeconomic conditions. What is more, the US dollar may rise even higher amid the meeting of bankers at the Jackson Hole forum. If Fed Chair Jerome Powell announces that the regulator will remain stuck to its current stance, the greenback will gain in value. The recent COT report unveiled that the number of long non-commercial positions increased by 1,865 to 44,084, whereas the number of short non-commercial positions inched up by 506 to 77,193. This led to an even greater drop in the negative value of the non-commercial net position to – 33,109 from -34,468. The weekly closing price remained almost unchanged at 1.2096 versus 1.2078.

Signals of indicators:

Moving Averages

Trading is performed above 30- and 50-day moving averages, thus pointing to bulls' attempt to prolong correction.

Note: The period and prices of moving averages are considered by the author on the one-hour chart that differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

If the pair declines, the support level will be located at the lower limit of the indicator - at 1.1758.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 30. It is marked in green on the graph.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). A fast EMA period is 12. A slow EMA period is 26. The SMA period is 9.

- Bollinger Bands. The period is 20.

- Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are a total number of long positions opened by non-commercial traders.

- Short non-commercial positions are a total number of short positions opened by non-commercial traders.

- The total non-commercial net position is a difference in the number of short and long positions opened by non-commercial traders.