Ethereum is on the eve of a key event in its history, but even this did not keep the altcoin from falling. The cryptocurrency fell along with the entire market and tested the support level at around $1500. ETH managed to stop the fall and realize a local bullish momentum, gaining 4.5% over the past day. However, the asset has lost 7% of capitalization over the past seven days. As of August 25, Ethereum reached $1700, but should this be regarded as the end of the correction?

On the daily chart, we see the full viability of the altcoin's local bullish momentum. Ethereum formed four uncertain candles in a row, indicating a decrease in overall trading activity and an advantage for buyers. The altcoin has reached a key support zone, which is on par with the final part of the bullish cup and handle pattern. Keeping the bullish pattern intact indicates that strong buying sentiment continues, suggesting a continued rise in the price of ETH.

Technically, Ethereum also looks poised for a renewed upward trend. The main metrics of the asset indicate the activation of buyers and the presence of bullish momentum. The Relative Strength Index fell below 40 but then reversed upwards and crossed the 50 mark. The movement of the RSI directly indicates growing buying volumes and the presence of bullish momentum. The Stochastic Oscillator also confirms the price reversal and forms a bullish crossover near the oversold zone. The MACD also reverses and does not enter the red zone, which is an important bullish signal.

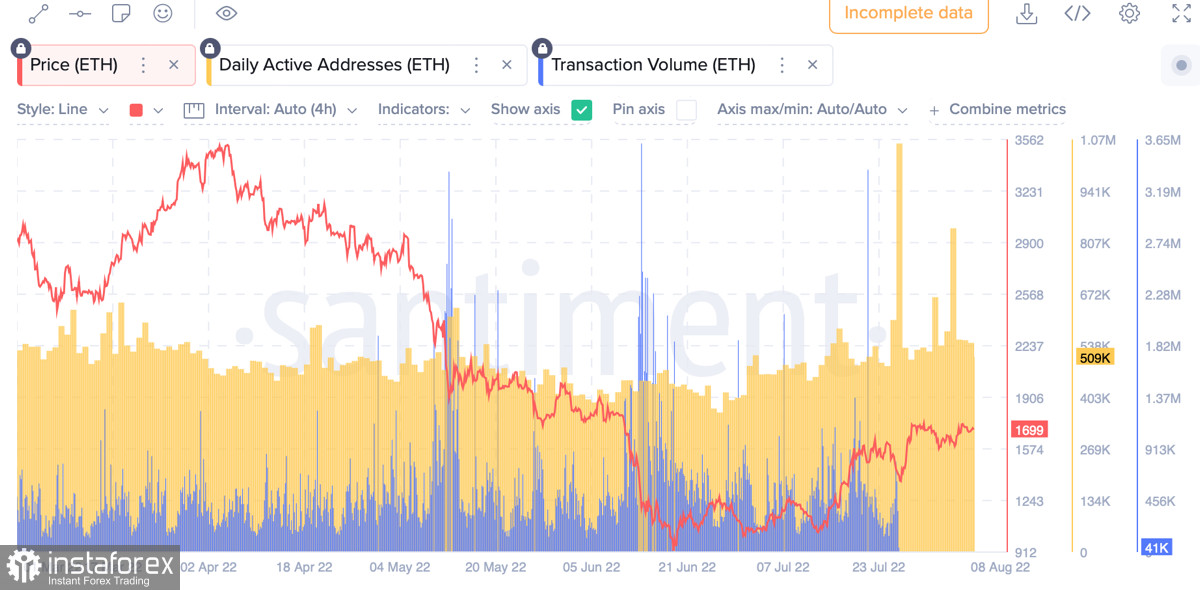

Ethereum technical indicators indicate the final price reversal and the completion of the corrective movement. The main on-chain metrics also show an upward movement, which indicate a fundamental confirmation of the price rebound. The number of unique addresses on the ETH network has been showing strong growth since mid-August, suggesting an influx of new users and investments. This fact is confirmed by the growth in transaction volumes in the Ethereum network, which indicates a growing interest in the altcoin network. In other words, after a local correction, which was of a healing nature, Ethereum again attracts investors due to the fundamental factor for growth.

In addition, there is an active accumulation of ETH coins by large buyers and miners. This creates a shortage of ether coins, which is especially valuable after inflation peaks in early August due to low fees on the ETH network. Active accumulation by long-term investors and a local decline in the overall trading activity in the Ethereum network had a positive impact on the cryptocurrency. According to the New supply on-chain indicator, the number of new coins is decreasing, creating an additional shortage of ETH in the open supply.

However, despite all the positives, it is important to consider the correlation between ETH and BTC. In the coming days, there will be a Jerome Powell symposium, and statistics on unemployment and US GDP growth will also be published. This data can significantly affect Bitcoin, which, in turn, will pull Ethereum along with it. Therefore, if the medium-term prospects of ETH are not in doubt, then everything will depend on Bitcoin regarding the short-term situation.