Market activity dwindled because investors are trying to avoid taking risks ahead of Fed Chairman Jerome Powell's speech at the Jackson Hole symposium, which begins today. Everyone is giving priority to the event, speculating that markets may find the bottom and start rebounding soon.

In fact, many analysts have come up with the theory that the Fed would announce that it will no longer raise rates aggressively. However, looking at the protocol released this month, as well as personal statements from the members, it is likely that the central bank will take advantage of the still-strong labor market and decreasing inflation to continue increasing rates.

If Powell remains hawkish at the Jackson Hole symposium, there will be another collapse and volatility will spike in markets. Dollar, meanwhile, will benefit from this.

Forecasts for today:

EUR/USD

Euro is in consolidation ahead of Fed Chairman Jerome Powell's speech and minutes of the latest ECB meeting on monetary policy. If quotes do not rise above 1.0000, expect a fall to 0.9900.

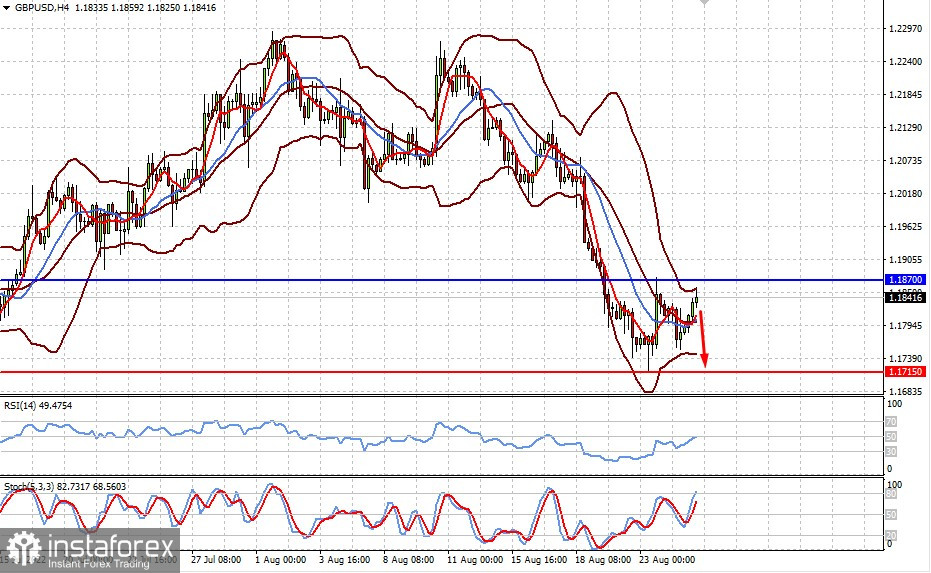

GBP/USD

Pound is also in consolidation because of the start of the Jackson Hole symposium today. If quotes fail to rise above 1.1870, expect a fall to 1.1715.