EUR/USD

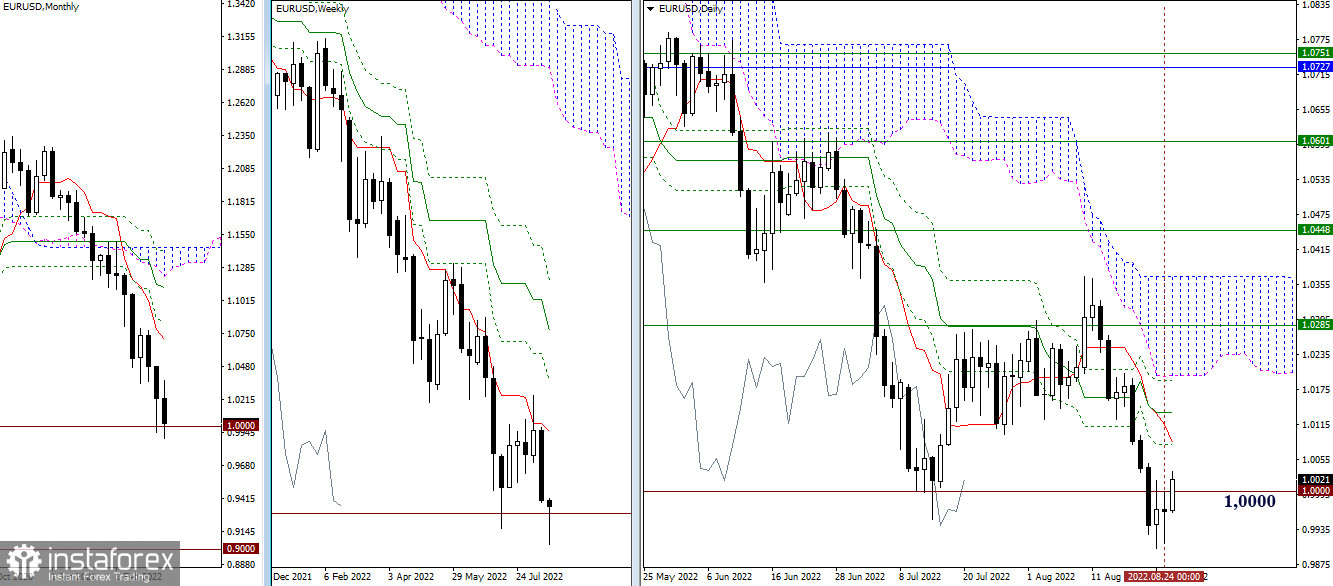

Higher timeframes

The last working day did not bring significant changes. Slowdown and uncertainty persisted. Today we are witnessing bulls attempt to change the situation and implement a corrective upward trend. The aim is to consolidate above 1.0000 and test the resistance of the daily Ichimoku cross, the nearest levels are located at 1.0080 (short-term trend) – 1.0135 (medium-term trend). We can talk about the return of the bearish scenario when the downward trend recovers (0.9901 minimum extremum).

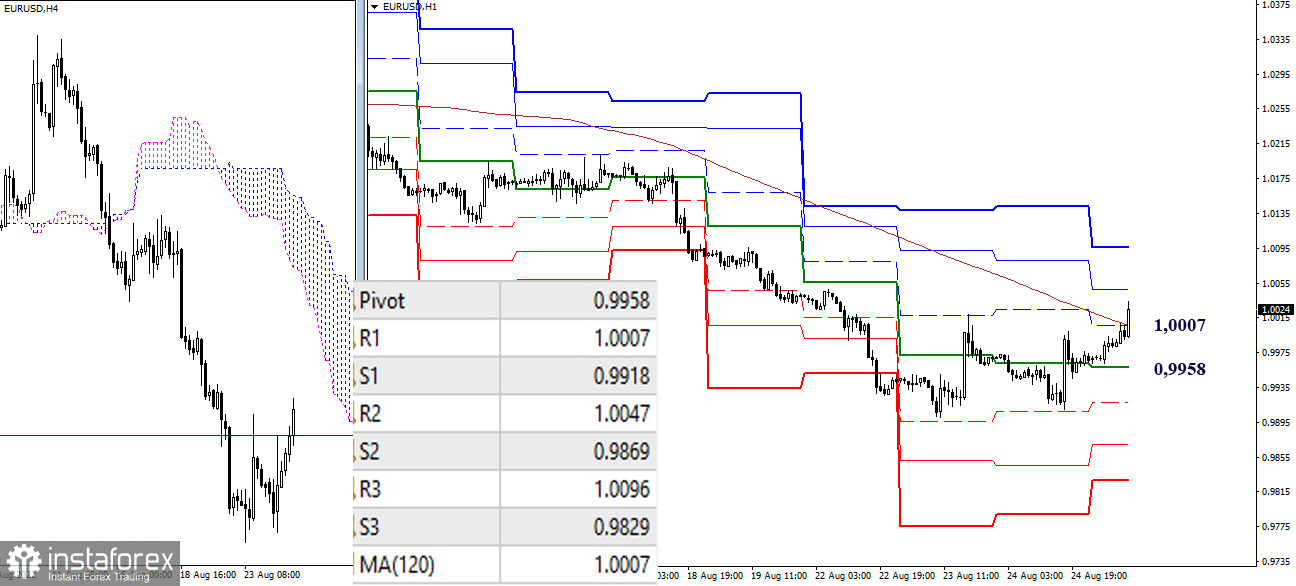

H4 – H1

In the lower timeframes, there is a struggle for a weekly long-term trend (1.0007). Consolidation above and reversal of the moving average will change the current balance of power. Intraday upside targets 1.0047 – 1.0096 (resistance of classic pivot points) can now be added to the targets of the higher timeframes. When the players return to the side of the central pivot point (0.9958) and exit the correction zone (0.9901), bearish sentiment and prospects will return to the market. Within the day, classic pivot points (0.9918 – 0.9869 – 0.9829) can serve as support today.

***

GBP/USD

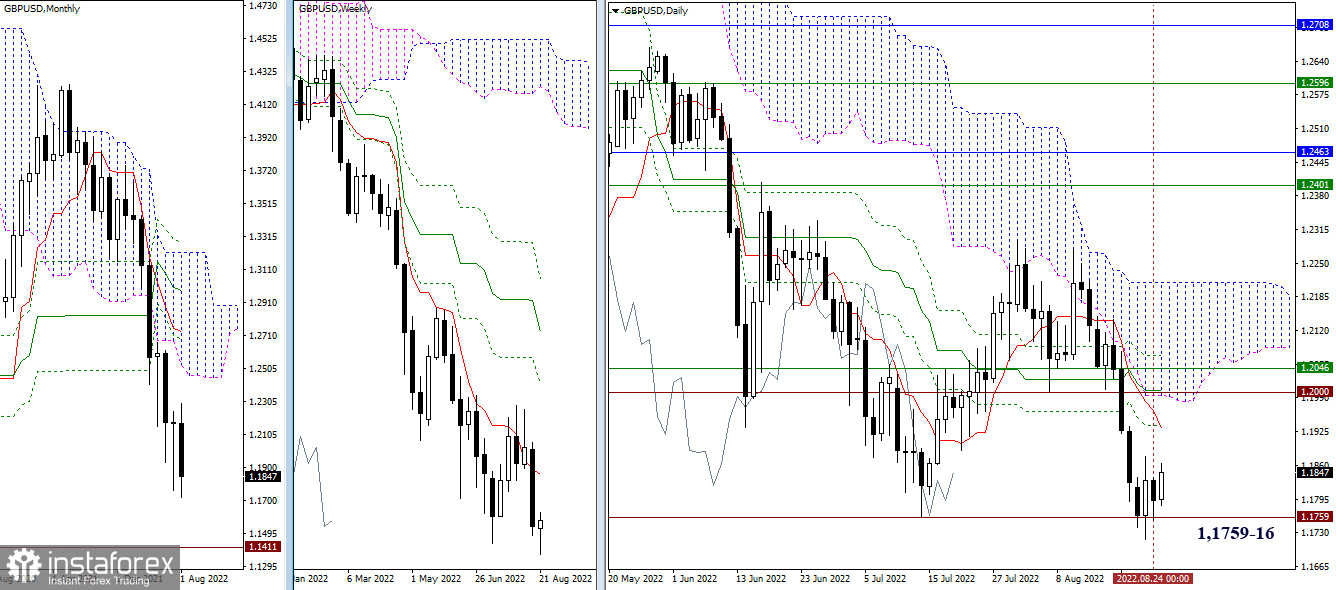

Higher timeframes

The development of the situation is not observed. The pair prefers to consolidate using the previous minimum extremum (1.1759) as support. The reference points for the rise now are the levels of the higher timeframes, which have accumulated in a fairly wide resistance zone of 1.1936 – 1.2000 – 1.2046 – 1.2073. In case of completion of the consolidation or correction and the resumption of the downward trend (1.1716), we can expect new activity of the bears. The most significant benchmark in this direction is 1.1411 (2020 low).

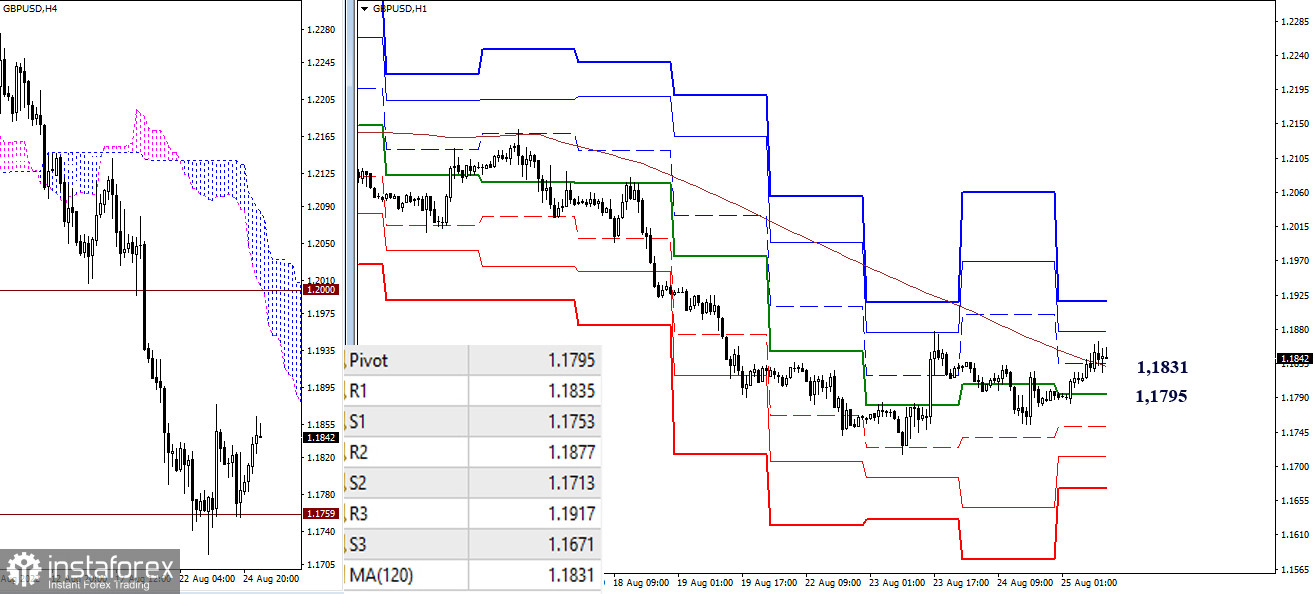

H4 – H1

The pair is in the correction zone, now testing the strength of the weekly long-term trend (1.1831). Consolidation above and reversal of the moving average will help bulls to continue restoring their positions. Further, reference points for the rise within the day can be noted at 1.1877 – 1.1917 (resistance of the classic pivot points). For bears, the main task is to exit the correction zone (1.1716) and continue the downward trend movement, the reference points of which are now at 1.1713 and 1.1671 (classic pivot points) within the day.

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)