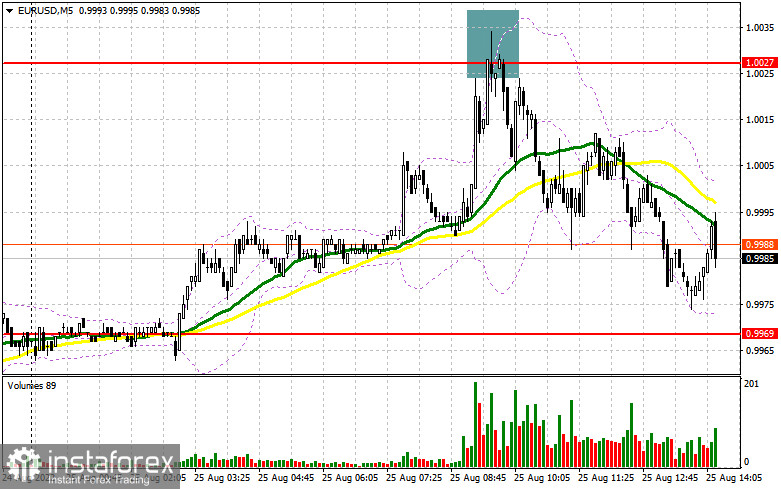

In my morning forecast, I paid attention to the 1.0027 level and recommended making decisions on entering the market from it. Let's look at the 5-minute chart and figure out what happened there. The data for Germany was not as bad as many expected, which kept the demand for the euro. As a result of the pair's growth, a false breakdown in the area of 1.0027 allowed the bears to declare themselves actively - they have already done so several times near parity, which led to a sell signal and then to a 50-point drop in the euro. We did not reach the 0.9969 level, so we could not get an entry point there. In the afternoon, the technical picture changed.

To open long positions on EURUSD, you need:

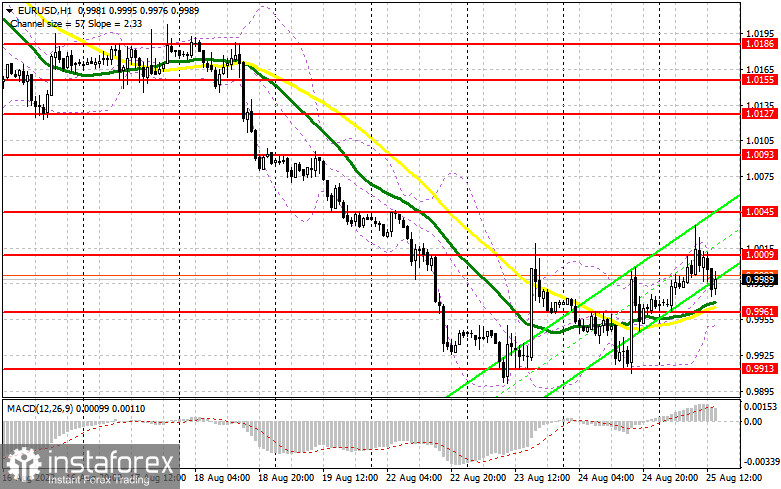

During the American session, some important data on US GDP was released, as well as a report on the number of initial applications for unemployment benefits. But a much more interesting event will be the symposium in Jackson Hole - its first day starts today. The speech of the chairman of the Federal Reserve System is expected tomorrow, so there are no major movements planned today. The bears take advantage of the growth of the euro every time, selling at fairly acceptable levels after an upward correction. Therefore, the initial task of buyers will be to protect the nearest support level of 0.9961, where the moving averages are playing on their side. Only the formation of a false breakdown there will lead to a signal to open long positions in the hope of further recovery of the pair with the prospect of updating the resistance of 1.0009. A breakthrough and a top-down test of this range will occur only in the case of weak data on the US economy, as it has been in the last few days. It will hit the bears' stop orders, giving an additional signal to enter long positions with the possibility of a correction in the 1.0045 area. A more distant target will be the resistance of 1.0093, where I recommend fixing the profits. If EUR/USD declines and there are no buyers at 0.9961 in the afternoon, the pressure on the pair will remain. The best option for opening long positions, in this case, will be a false breakdown in the area of the new annual minimum of 0.9913. I advise buying EUR/USD immediately for a rebound only from 0.9861, or even lower – in the area of 0.9819 parity, with the aim of an upward correction of 30–35 points within a day.

To open short positions on EURUSD, you need:

The bulls took advantage of the moment of good fundamental statistics and updated the maximum not only yesterday but also on August 23, which leaves the door open to the test of the weekly resistance of 1.0045. Therefore, the bears need to make a lot of effort to protect the nearest level of 1.0009, formed by the results of the first half of the day. If it happens that the data on the pace of contraction of the American economy is better than economists' expectations, the demand for the dollar may return, especially in the conditions of the beginning of the symposium. The optimal scenario for opening short positions will be a false breakout at 1.0009, leading to a repeated movement of the euro down to 0.9961. A breakdown and consolidation below this range on strong data on the US economy, as well as a reverse test from the bottom up – all this forms an additional sell signal and a larger pair movement to the 0.9913 area, where I recommend taking the profits. A more distant target will be the 0.9861 area. In the event of an upward movement of EUR/USD in the afternoon, as well as the absence of bears at 1.0009, the situation will return to the control of buyers. In this case, I advise you to postpone short positions to 1.0045, but only if a false breakdown is formed. You can sell EUR/USD immediately on a rebound from the maximum of 1.0093, or even higher – from 1.0127 with the aim of a downward correction of 30-35 points.

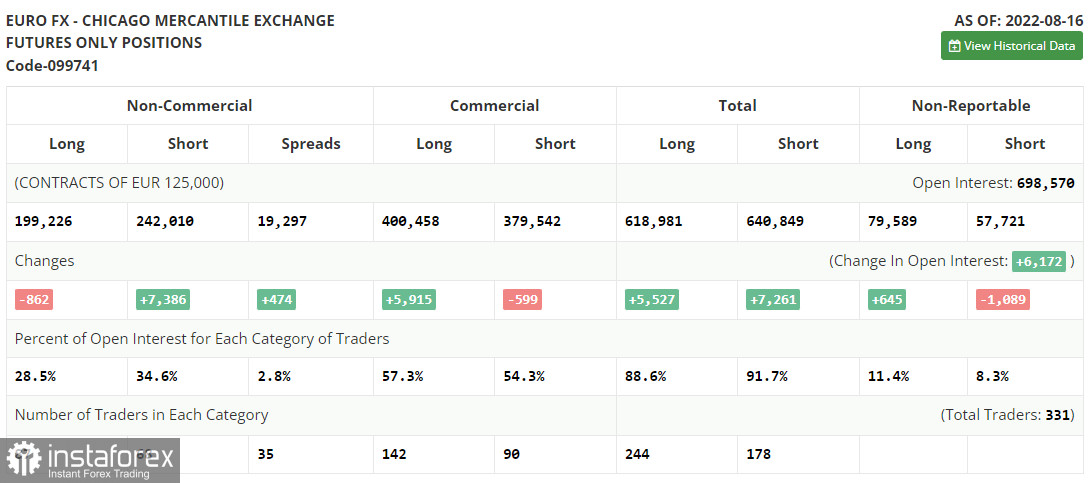

The COT report (Commitment of Traders) for August 16 recorded a sharp increase in short and a reduction in long positions, which confirms the current position of the European currency against the US dollar. The risk of an impending recession in the US is now combined with the risk of more serious problems in the eurozone, which will begin this autumn against the background of a sharp rise in energy prices and further inflation, which the European Central Bank is still struggling with at a fairly moderate pace. At the end of this month, a meeting of American politicians will take place in Jackson Hole, where the key word will be for Fed Chairman Jerome Powell. The further direction of the pair will depend on this, as a strong dollar harms the American economy and further accelerates inflation, which the central bank is struggling with. The COT report indicates that long non-commercial positions decreased by 862 to 199,226, while short non-commercial positions jumped by 7,386 to 242,010. At the end of the week, the total non-commercial net position remained negative and decreased to -42,784 against -34,536, which indicates a return of pressure on the euro and a further fall in the trading instrument. The weekly closing price decreased to 1.0191 against 1.0233.

Signals of indicators:

Moving Averages

Trading is conducted around the 30 and 50-day moving averages, which indicate market uncertainty with the direction.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In the case of growth, the upper limit of the indicator at around 1.0009 will act as resistance.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.