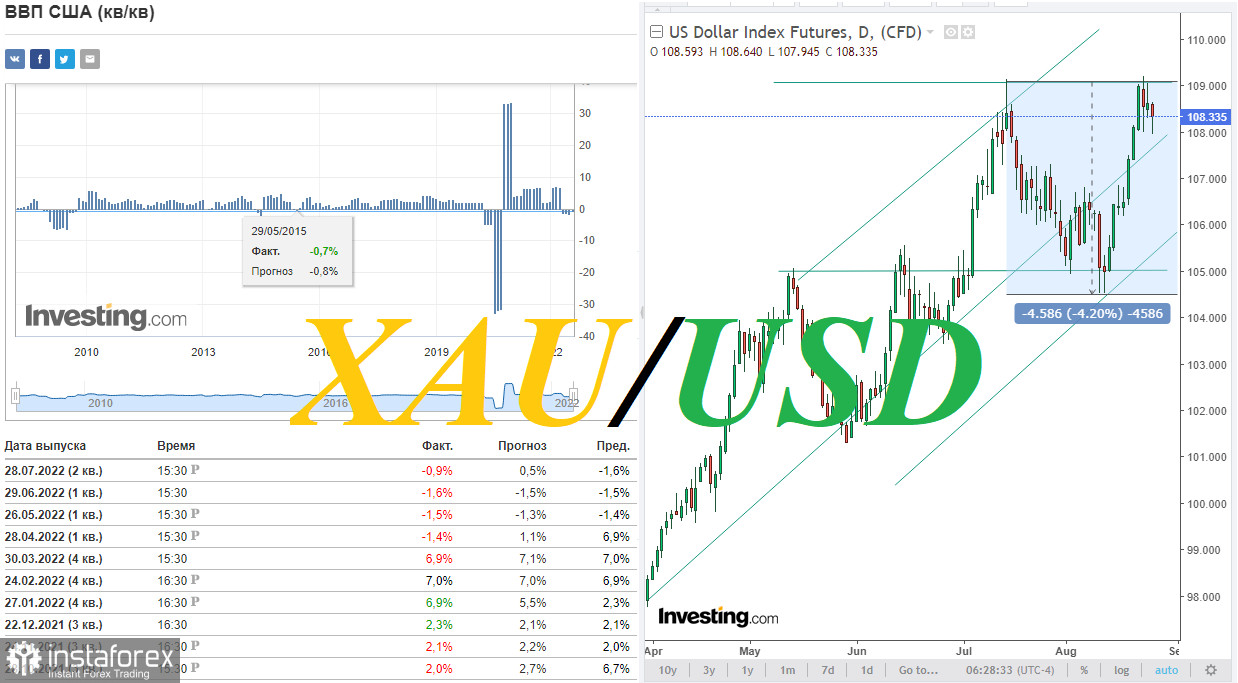

In the absence of news drivers, the dollar fell in the first half of today's trading day. After finishing the past week with a decent gain and breaking through the 109.00 level at the beginning of this week, the DXY dollar index then turned lower.

The reason for fixing long positions in the dollar was not very convincing statistics for the US, published Tuesday. The preliminary PMI indices for the manufacturing and services sector in the US (from S&P Global), as well as data on new home sales, turned out to be disappointing, heightening fears of a recession.

"The August PMI data signaled further warning signs for the health of the U.S. private sector. Demand conditions have deteriorated again, which was caused by the impact of higher interest rates and strong inflationary pressure on consumer spending, which negatively affected activity," S&P Global Market Intelligence said.

At the start of today's European trading session, DXY futures fell to 107.95, but then corrected, rising again to the zone above 108.00. As of this writing, they are trading near 108.33.

Today, a new driver may appear in the dynamics of the dollar. At 12:30 (GMT), the US Bureau of Economic Analysis will publish its updated forecast for GDP for the 2nd quarter and data on the personal consumption expenditure price index, one of the main inflation indicators that FOMC officials use as an indicator of inflation.

At the same time, the US Department of Labor will publish a weekly report on the state of the US labor market with data on jobless claims. The state of the labor market (together with data on GDP and inflation) is a key indicator for the Fed in determining the parameters of its monetary policy.

Thus, at 12:30, key indicators characterizing the current state of the American economy will be published, which are also key for the country's central bank in determining the parameters of its monetary policy.

If the published data disappoint market participants, the dollar decline will increase. It may also move into a medium-term correction phase if market participants consider Fed Chairman Jerome Powell's speech at the Jackson Hole conference tomorrow as "dovish" regarding the prospects for the monetary policy of the US central bank.

Thus, we may be on the verge of a new cycle, short-term or medium-term, in the dynamics of the dollar—ascending or descending.

If today's publication of important macro statistics on the US does not disappoint investors, then the dollar will resume its growth. And after the breakdown of the local multi-month high of 109.20, reached earlier this week, the 110.00 mark will become the next target for DXY growth.

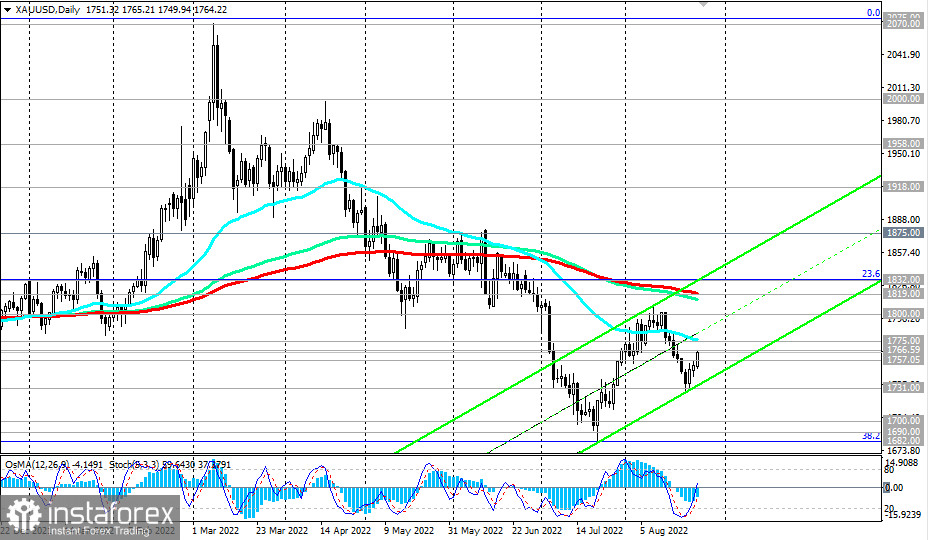

Meanwhile, against the backdrop of a weakening dollar and growing risks of a recession in the United States and in the global economy, gold quotes again moved to growth.

XAU/USD is up for the 3rd day in a row today and is trading near 1764.00 as of this writing, in close proximity to the strong resistance at 1766.00. In case of its breakdown, the important resistance level of 1775.00 becomes the target, the breakdown of which will increase the probability of further corrective growth towards the key resistance levels of 1800.00, 1819.00. Their breakdown will confirm the return of XAU/USD to the long-term bull market zone.