The euro-dollar pair ended the trading week on a minor note, below the parity level. EUR/USD bulls tried to remind themselves, tried to counterattack, but the prevailing fundamental background did not allow them to win back at least part of the lost positions. The only achievement of the bulls of the pair is that they did not allow the bears to enter the area of the 98th figure. The support level of 0.9900, which is currently the key price barrier (replacing the "sacred" level of 1.0000) restrained the onslaught of the bears. And apparently, further events will develop around this target.

The EUR/USD pair showed increased volatility at the end of the trading week. The benchmark PCE index was published on Friday, and an hour and a half later, the long-awaited speech by Federal Reserve Chairman Jerome Powell took place in Jackson Hole. These events provoked almost 150-point price fluctuations for the pair.

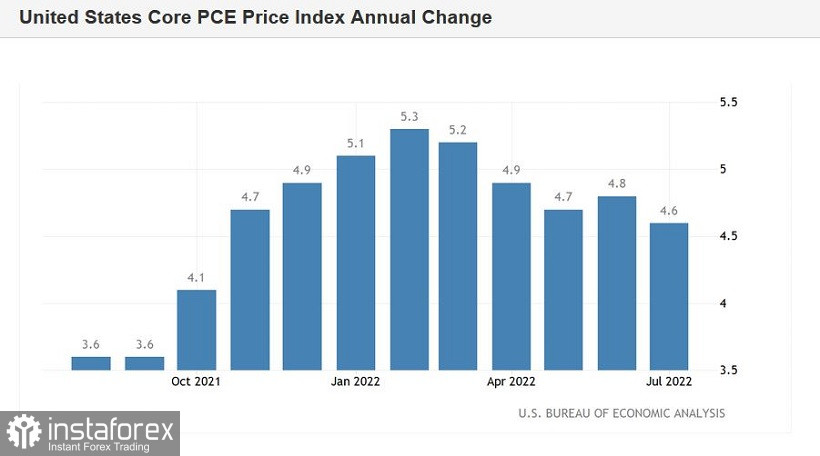

The inflation report was not in favor of the greenback: all components of the release came out in the red zone, reflecting the slowdown in indicators. Thus, the basic price index of personal consumption expenditures in monthly terms increased by only 0.1% in July, with a forecast of 0.2% growth. On an annualized basis, it rose by 4.6% last month after a June increase to 4.8%. The overall PCE index was also disappointing, taking into account energy and food prices – it grew by 6.3% year-on-year, thereby slowing the growth rate (in June it was marked at 6.8%).

Thus, one of the key inflation indicators taken into account by the Fed when forming an interest rate decision turned out to be in the red zone, supplementing reports on CPI growth, producer price index and import price index (which also reflected a slowdown in growth in July).

The EUR/USD pair jumped to 1.0089 after the release of the report, thereby updating the weekly high. And, perhaps, bulls would have tried to develop success if Powell had not come to the bears' aid. He dispelled the doubts of dollar bulls by voicing unambiguously hawkish rhetoric.

In his speech, the head of the Fed tried to maintain a certain balance in order not to provoke excessive turbulence in the markets. Let's face it: this time it didn't work out. The days of "semitones" are in the past, so Powell had to resort to fairly categorical and unambiguous comments, with a minimum number of "buts" and "if".

The main, key and main message voiced by the head of the Fed is that the US central bank will continue to raise interest rates and will keep them at a high level, even if it harms (and it will undoubtedly harm) households and businesses. Powell actually said that Americans will have to put up with the slowdown in economic growth and the weakening of the labor market. "This is a sad price for reducing inflation," Powell stated.

In addition, he commented on the July data on the growth of inflation in the United States. As mentioned above, the key indicators showed a slowdown in their growth. But Powell did not attach much importance to this. According to him, although inflation slowed down last month, "it is still very far from the target level."

In other words, Powell has joined the hawkish wing of the Committee, whose representatives support the aggressive pace of monetary policy tightening. In particular, the chairman of the St. Louis Fed, who has the right to vote this year, announced last week that he would support the idea of a 75-point rate hike at the September meeting. The rest of his colleagues who have spoken over the past two weeks have also indicated their hawkish position. However, unlike Bullard, they have not yet decided on a "step". For example, according to Loretta Mester, market expectations regarding the results of the September meeting are between 50 and 75 points – for a final decision, "we need to see more data." Powell voiced a similar position. According to him, the magnitude of the rate increase at the September meeting "will depend on the totality of statistical data and changing forecasts."

Thus, Powell supported the dollar following the results of his latest speech. He made it clear that the central bank would not look back at the "side effects" and would increase the interest rate with the knowledge that this could harm households and businesses. After his speech, the scenario of a 75-point rate hike at the September meeting returned to the agenda. According to the CME Group FedWatch Tool, the markets now estimate the probability of this scenario being implemented at 60%. Therefore, it is not at all surprising that US stock indexes fell on Friday, and the dollar again became the favorite of the foreign exchange market.

Before the next Fed meeting, the results of which will be announced on September 21, the August Nonfarm, as well as key data on the growth of inflation in the United States for August, will still be published. The dynamics of these indicators will tip the scales towards a 50-point or 75-point scenario. However, the very fact that these two options are among the most likely ones will push the greenback up throughout the market. Given this circumstance, it is advisable to use any more or less large-scale corrective movements in the EUR/USD pair to open short positions. The downward targets are 1.0000 (if the corrective impulse flares up and fades around 1.0050), 0.9950, 0.9910 (the lower line of the Bollinger Bands indicator on the daily chart).