Markets supposed that Jerome Powell would announce a slowdown in the interest rates hike or even unveil the first cut planned for the next year. Instead, the Fed's chair stated high inflation risks and the necessity of a further rise in the benchmark rate. The fact is that there are a lot of negative economic factors, including the overheated labor market and the wasteful policy of the White House. It seems that the US government is simply distributing money among people. All such actions will inevitably have long-term consequences that could be eliminated only by means of monetary policy tightening. In fact, the Fed has no other tools to affect the situation. Meanwhile, markets relied on the inflation slackening and extremely overbought US dollar. However, these factors have just a short-lived effect. Against the backdrop, the US currency started rapidly gaining in value. Notably, the euro showed quite good performance as it was falling at the slowest possible pace. This could be explained by the fact that the euro is significantly oversold. Since today, the macroeconomic calendar is absolutely empty, the single currency may slide a bit deeper.

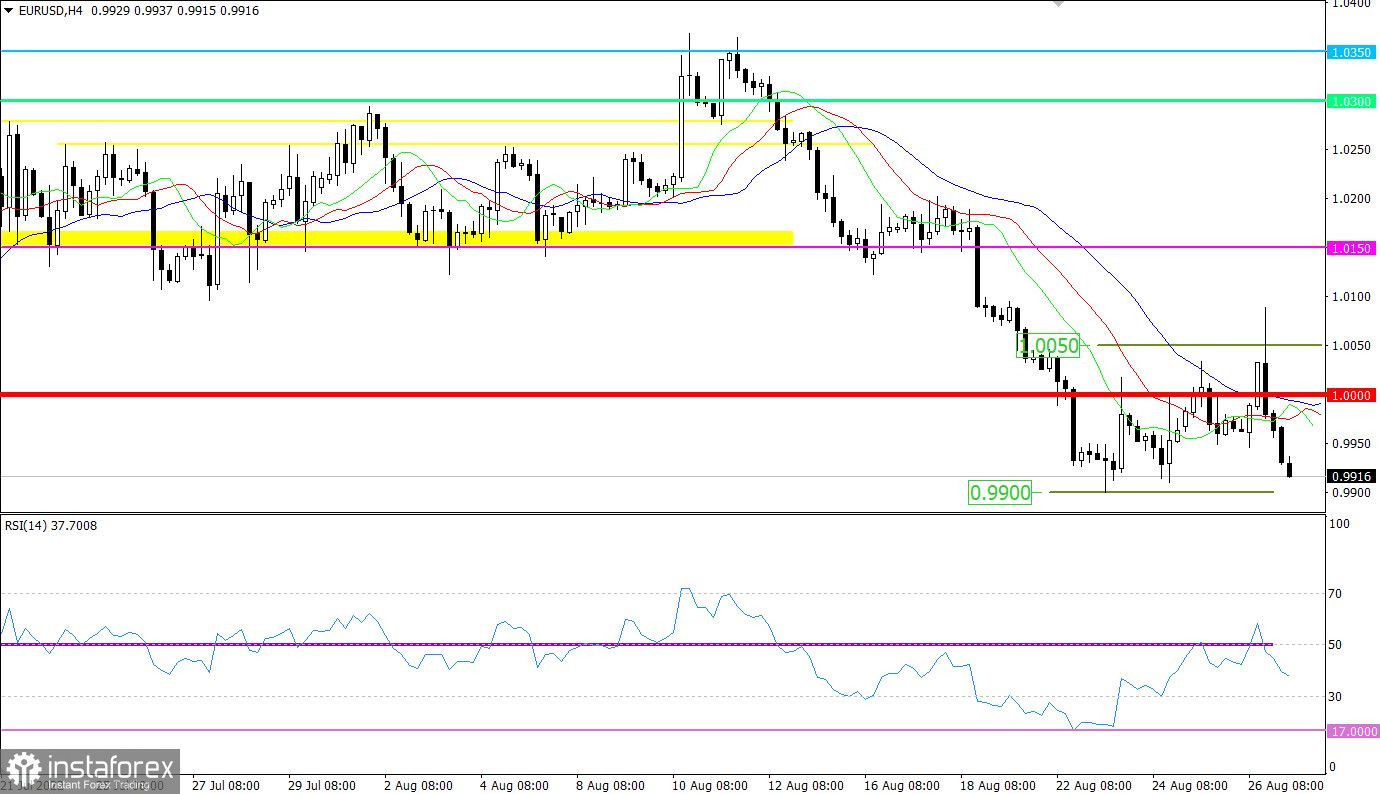

On Friday, the euro/dollar pair jumped above the control level of 1.0050. However, it failed to consolidate at this level. The pair reversed, allowing speculators to enlarge the volume of dollar positions.On the four-hour chart, the RSI technical indicator is moving in the lower area, thus pointing to the bearish sentiment.

On the same time period, the Alligator's moving averages have numerous intersections, though being below the parity level of 1.0000, which points to a sell signal. On the daily chart, the MAs are headed downwards. A signal of the trend continuation will appear, if the indicator settles below the parity level.

Outlook

If the euro settles below 0.9900 on the four-hour chart, the downtrend is likely to continue.Until then, the pair may rebound, repeating the scenario recorded on August 23 and 24.In terms of the complex indicator analysis, we see that the indicator is providing sell signals on the short-term, intraday, and mid-term periods.