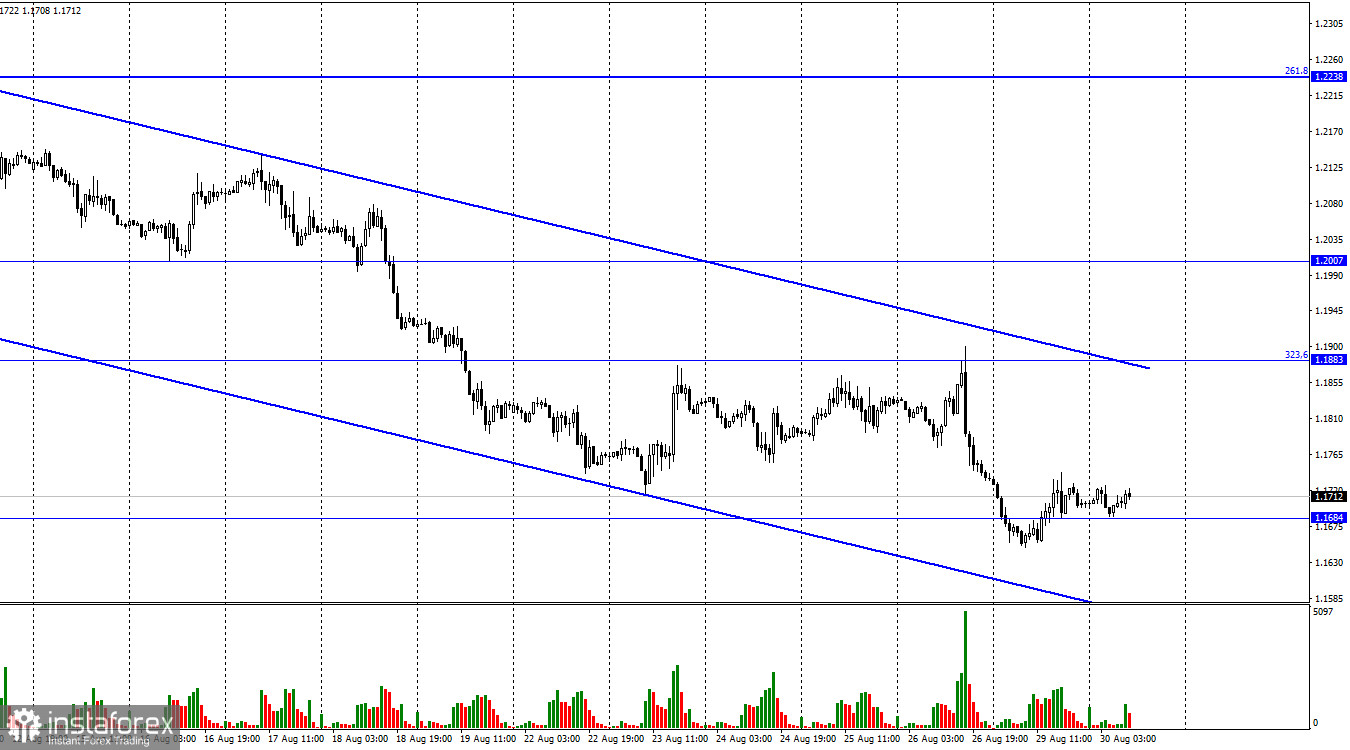

Hi, dear traders! According to the H1 chart, GBP/USD reversed upwards on Monday and settled above 1.1684. The pair could rise further towards the upper line of the descending trend channel and the retracement level of 323.6% (1.1883). If GBP/USD settles below 1.1684, it could continue to fall towards 1.1496. At the moment, the pound sterling has managed to rise by 100 points from Monday's lows. However, it would not be enough to start a new uptrend. Similarly to EUR/USD, GBP/USD will likely fail to take advantage of the Bank of England's interest rate hikes. Unlike the ECB, the UK regulator is increasing interest rates rapidly. Nevertheless, GBP/USD continues to decline, despite BoE's policy tightening.

At this point, not even another rate increase in September would give support to the pound sterling. Amid the current bear market, the pair is unlikely to advance soon. The daily chart suggests the downtrend is very strong, and such trends are quite difficult to reverse. The pound sterling could surge strongly afterwards, but at this point, the pair will likely continue to drop. Market players are now focusing on the US dollar's stability, the Fed's monetary policy tightening, and the geopolitical situation, which is boosting demand for safe haven currencies. The upcoming US unemployment and labor market data, which are set to release on Friday, might change the situation in the market. These data releases might be worse than expected due to the recession in the US economy. The Fed could potentially slow down the pace of interest rate increases due to the economic downturn.

According to the H4 chart, the pair reversed upwards after a bullish divergence emerged on the MACD. GBP/USD could continue to climb towards 1.2008 for some time. If the pair settles below the Fibo level of 161.8% (1.1709), it could resume its decline towards 1.1496.

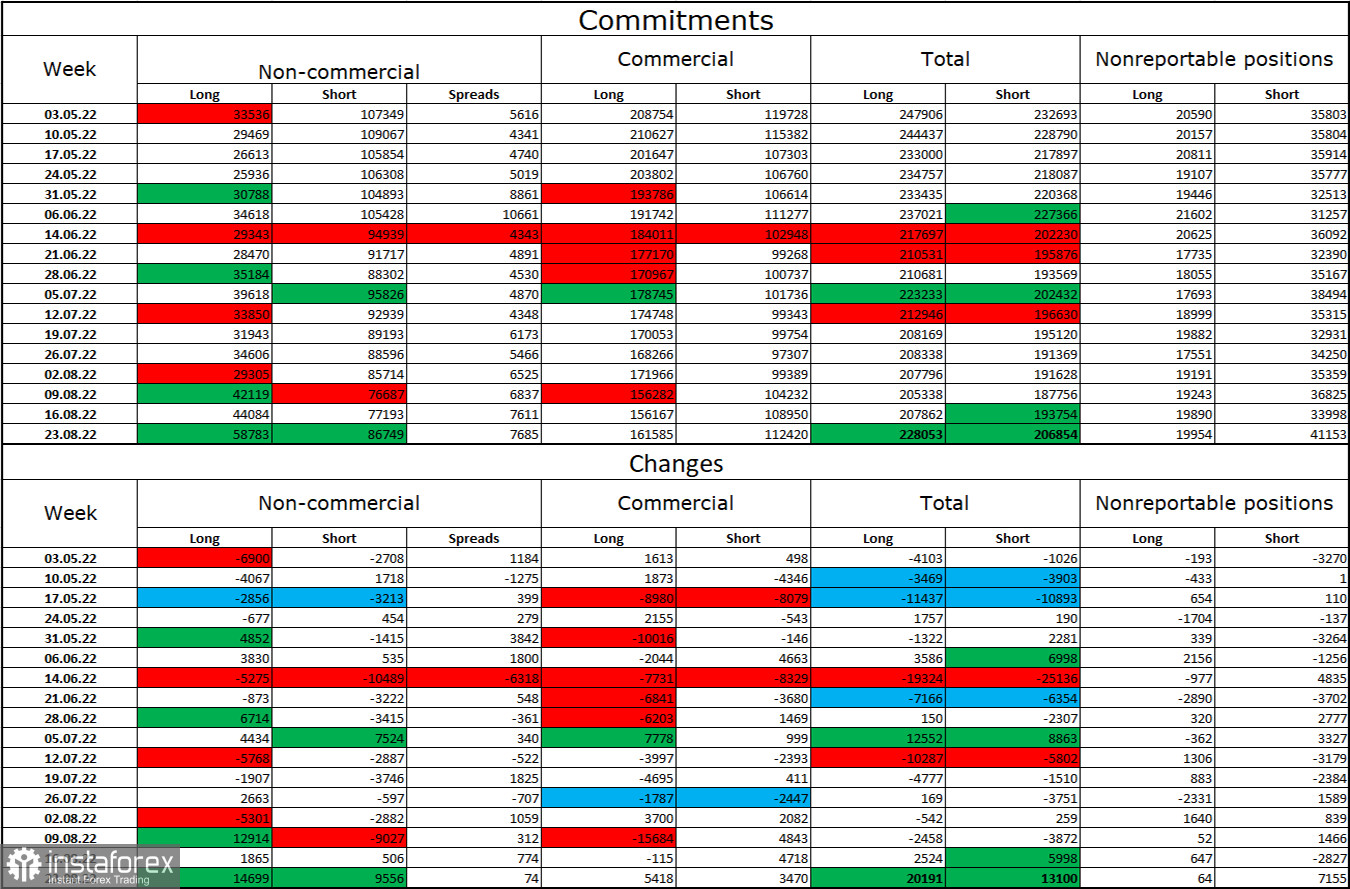

Commitments of Traders (COT) report:

Non-commercial traders became slightly less bearish in the last week covered by the report. Traders opened 14,669 Long and 9,556 Short positions. Market players remain bearish on GBP/USD, and Short positions continue to outnumber Long ones greatly. However, more traders are now net long on GBP/USD than before. Major players remain bearish on the pound, and it will take a lot of time for them to become predominantly bullish. Over the past several weeks, the pound sterling's upward movement has been limited. Now, GBP has begun to fall once again, and the COT reports suggests that GBP is more likely to continue its decline than begin a new long-term uptrend.

US and UK economic calendar:

There are no important events in both the UK and the US today.

Outlook for GBP/USD:

Earlier, traders were recommended to open short positions if GBP/USD bounced off 1.1883 on the H1 chart, with 1.1709 being the target. The pair has reached both the target level and 1.1684. New short positions can be opened if the pair closes below 1.1684, with 1.1496 being the target. Long positions can be opened if the pair settles above the descending trend channel targeting 1.2007.