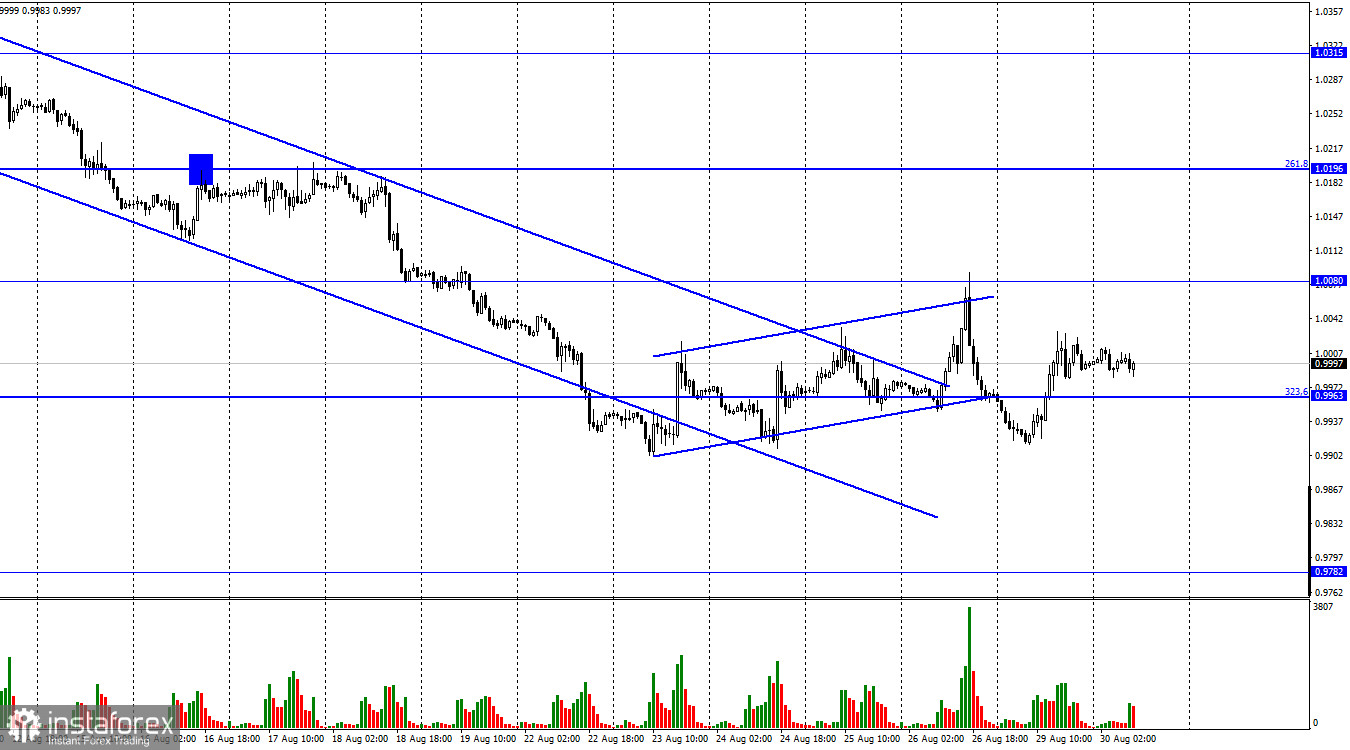

The EUR/USD pair made a reversal on Monday, favoring the rise of the European currency. The quote settled above the fibo retracement level of 323.6% at 0.9963. So, the pair may well move towards the next upper target at 1.0080. On the other hand, consolidation below the level of 0.9963 will open the way for a further decline towards 0.9782. Not so long ago, the price left the ascending trend channel and before that, it exited the descending channel. This is how two trends were canceled in just a week. As I see it, this may be an indication of a flat movement. We can already see a sideways channel on the 4-hour chart although it is still too vague and short-term. However, I recommend keeping this possibility in mind. It was reported on Tuesday morning that the ECB is about to introduce another large-scale rate hike at its September meeting. This did not come as a surprise to traders as Christine Lagarde warned a month ago that two rate hikes would take place in 2022.

After the economic symposium in Jackson Hole, where ECB officials were present as well, it became clear that the rate might go up to 0.75% as the EU regulator is determined to fight inflation. Thus, Isabel Schnabel said that the ECB should bring inflation back to its 2% target as soon as possible. For the past six months, the ECB was being urged to do something about inflation. Early in 2022, Christine Lagarde said that monetary tightening would be detrimental to the economy. Obviously, she has changed her mind, and the EU is now ready to sacrifice economic growth for the sake of lower consumer prices. By the way, the same thing is happening in the US. If so, the euro may get some support although I don't think this will happen. For example, the Bank of England is actively raising the rate but the pound is depreciating against the US dollar anyway. The same may be true for the euro/dollar pair.

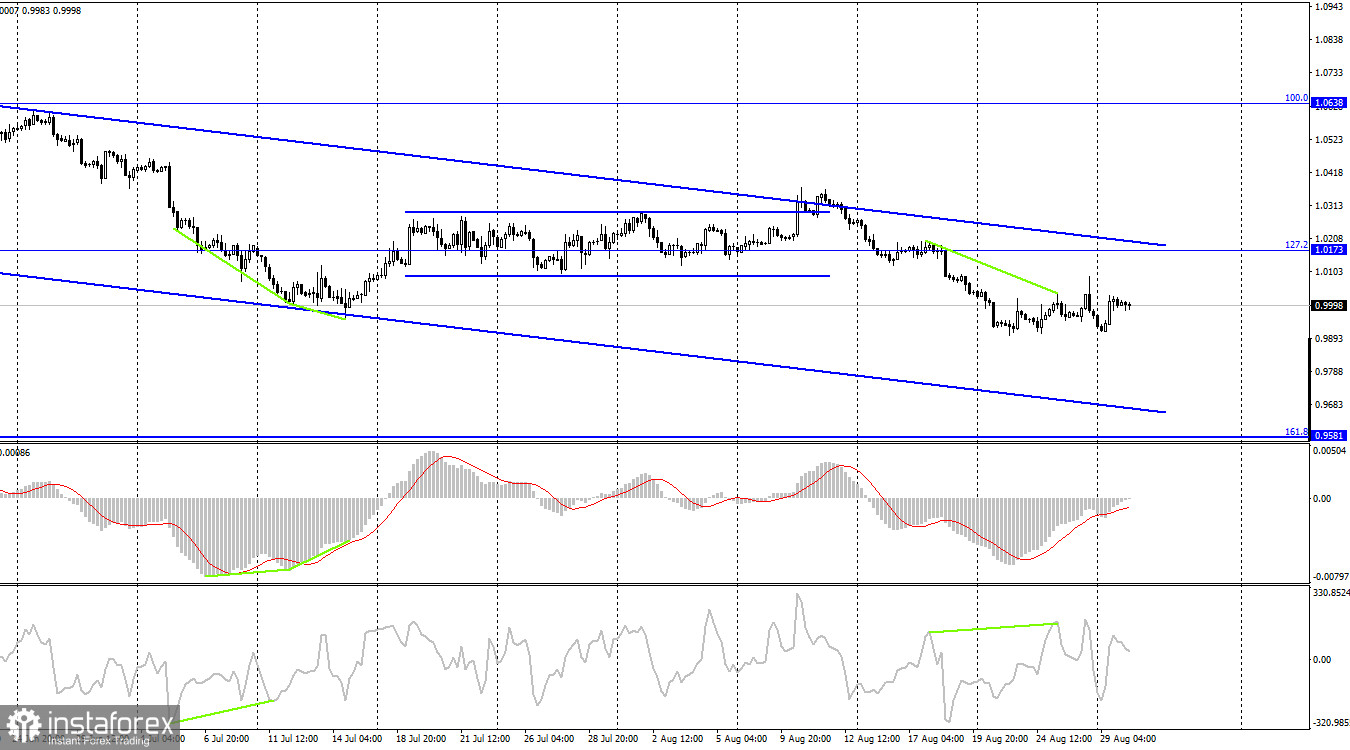

On the 4-hour chart, the pair reversed in favor of the US dollar and consolidated below the retracement level of 127.2% at 1.0173. Therefore, the pair may continue to fall towards the fibo level of 161.8% located at 0.9581. The CCI has formed a bearish divergence so that it declined to the level of 0.9581. The ongoing upside pullback may also be short-lived. The downward trend channel confirms the bearish sentiment of the market.

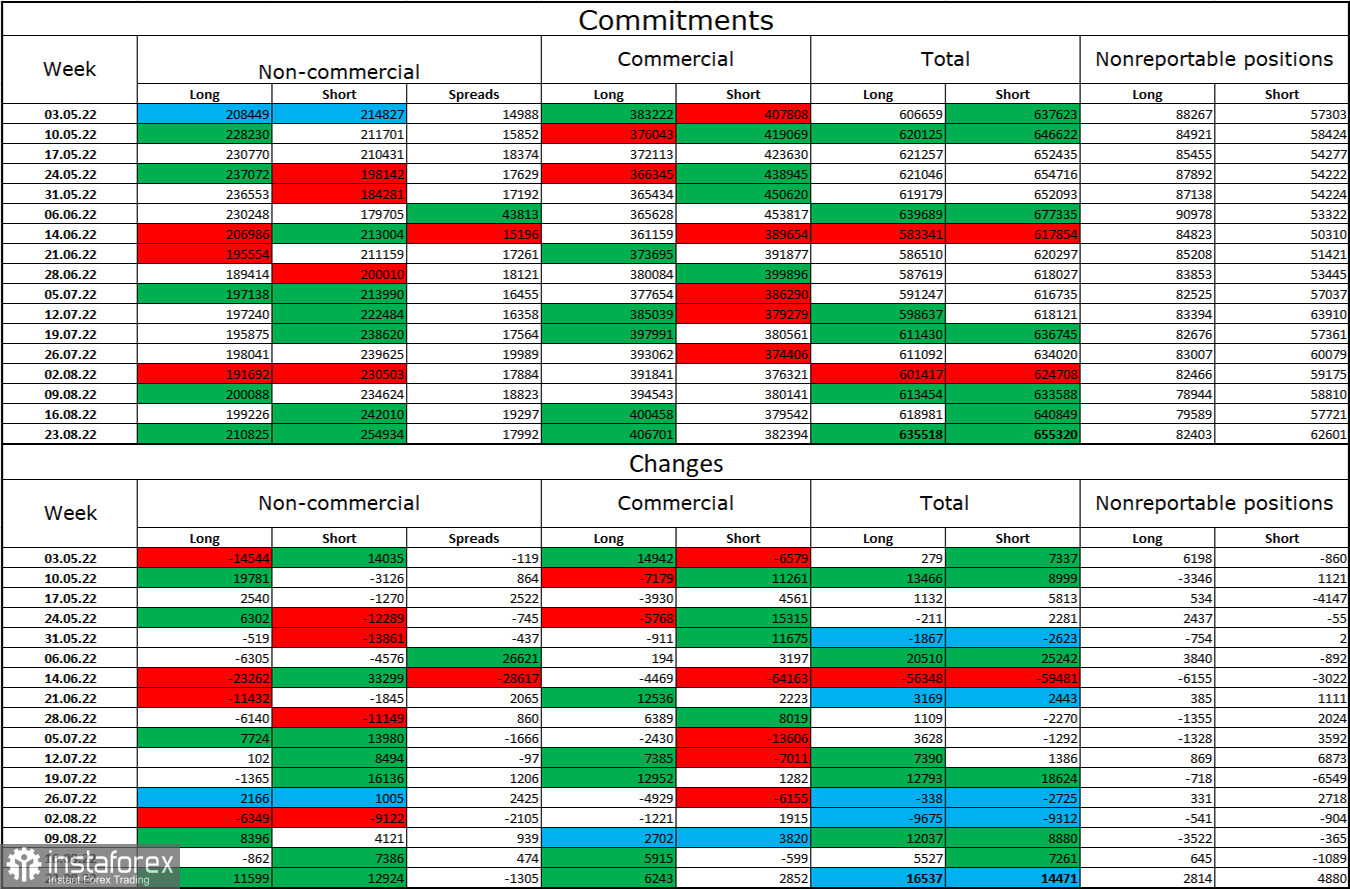

Commitments of Traders (COT) report:

Last week, traders opened 11,599 long contracts and 12,924 short contracts. This signals that large market players became more bearish on the pair. The total number of opened long contracts is 211,000 and the number of short ones is 255,000. The difference is not big but euro bears are still prevailing. In the last few weeks, the likelihood of an uptrend in the euro was getting higher. Yet, recent COT reports showed that bulls failed to gain a strong foothold in the market. The euro couldn't develop a proper upside movement in the past 6 weeks. Therefore, I can hardly see any chances for growth. Given the COT data, I think EUR/USD will continue to depreciate.

Economic calendar for US and EU:

On August 30, the economic calendar has no important events both in the US and in Europe. So, the information background will not influence the market today.

EUR/USD forecast and trading tips:

You can sell the pair if the price closes below the level of 0.9963 on H1 with the target at 0.9782. It is better to buy the pair when the quote settles firmly above the descending channel on H4 with the target at 1.0638.