Bitcoin is one step closer to the final breakdown of the important $20k level. The price of the cryptocurrency tested the $19.5k milestone but subsequently recovered above $20k. BTC started the current trading day with a local increase, thanks to which the price reached $20.2k. The protection of the round mark provoked a local impulse of positive in the market. However, the general situation in the crypto market indicates that a serious upward trend in Bitcoin should be forgotten.

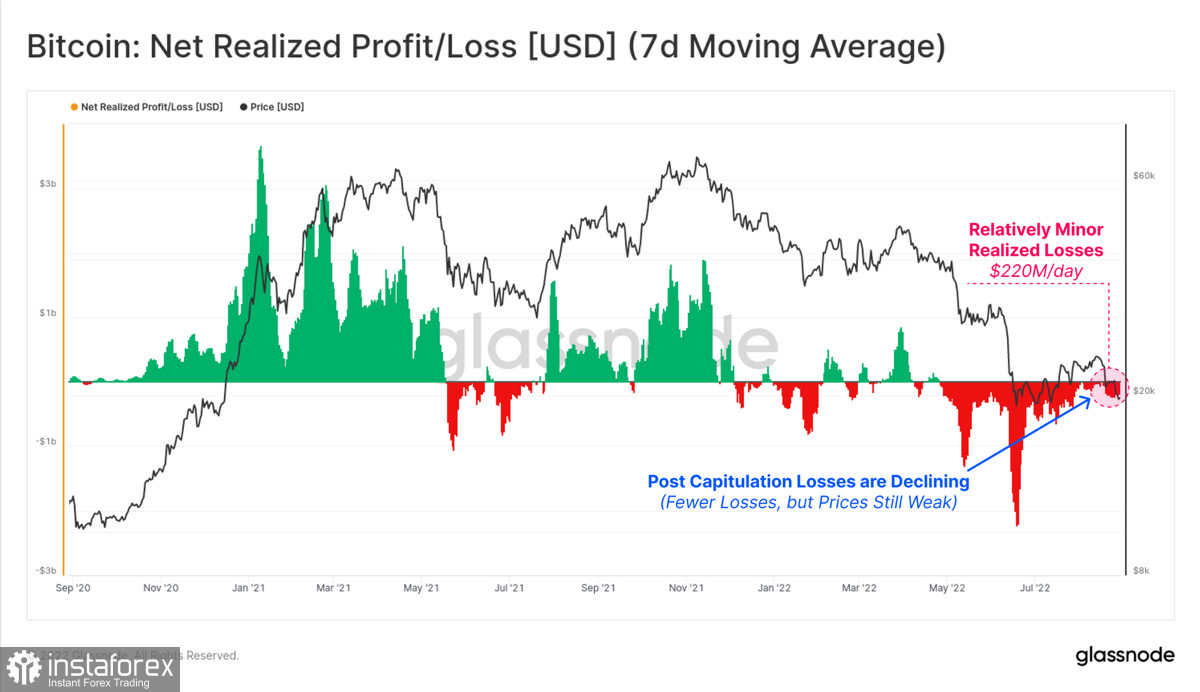

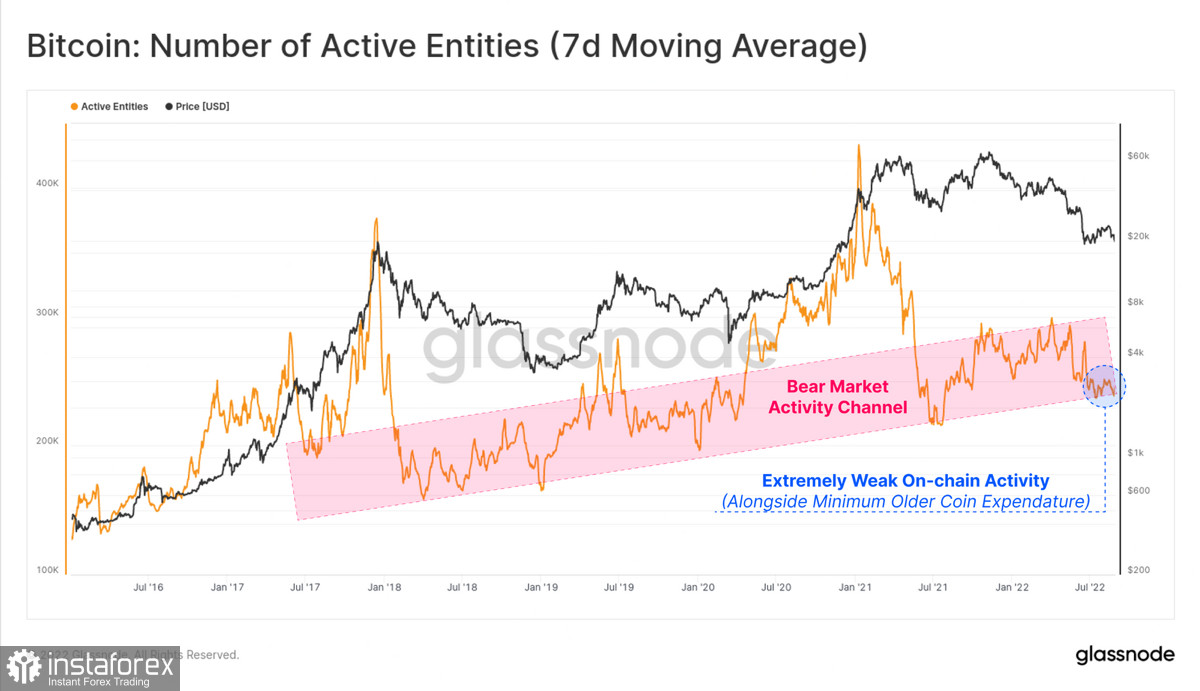

Glassnode experts are wondering how the price of Bitcoin manage to maintain its current positions. The cryptocurrency is still under pressure from miners who are selling BTC to cover current costs. Speculative investors who have joined the market during a local upward trend prefer the strategy of selling cryptocurrencies to breakeven. At the same time, Bitcoin network activity remains low. On the one hand, this cancels out the strength of the bearish pressure, as a result of which the price was unable to break through the $20k level. However, on the other hand, this points to the fundamental problems of the cryptocurrency and the entire market. As a result of these problems, there is no reason to believe that the situation will change in the near future.

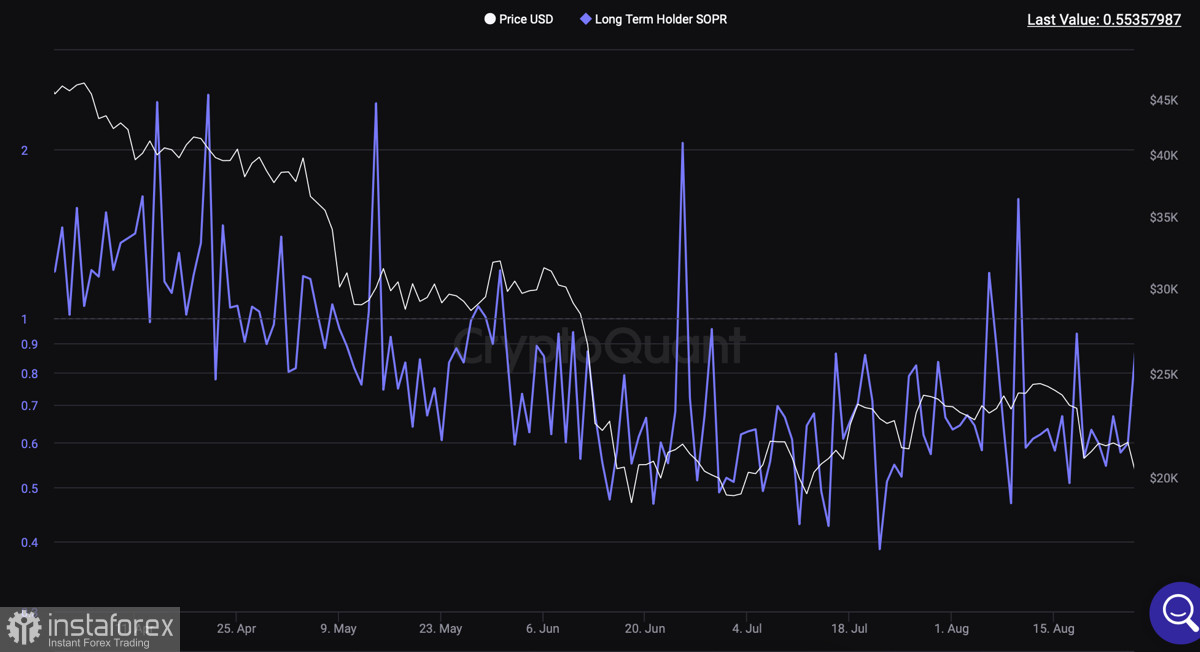

At the same time, Glassnode analysts note that the net realized profit/loss metric is gradually returning to the green zone (profit). This indirectly indicates a recovery in demand and potential bullish market power. In addition, there is a steady interest of long-term investors in Bitcoin. Holders continue to accumulate BTC coins and do not hesitate to store them on exchanges and cold wallets. Thanks to this, the number of BTC out of circulation reached 4.7 million. These facts indicate that the long-term audience continues to believe in the fundamental qualities of Bitcoin.

However, the fundamental background continues to be full of negative forecasts and news. Following Jerome Powell, other Fed officials continued to give signals about the continuation of the current aggressive monetary policy. The main argument of the department is the strength and stability of the American economy, which will not allow the United States to fully enter the recession phase. Analyzing the situation, JPMorgan experts came to the conclusion that the Fed had largely overestimated the US economy. The bank is confident that the risk of a recession is approaching critical values. In this regard, bank analysts advise their clients to avoid investing in shares of technology giants and cryptocurrencies.

Given the weak trading activity on the Bitcoin network, there is no doubt that such forecasts will exacerbate the overall liquidity situation in the crypto market. The number of unique users will continue to decline, which will eventually lead to even more stagnation and consolidation of BTC in a narrow range, if we consider the price movement in the long term. Glassnode experts also noted that the seven-day moving average of the number of active addresses is testing the lower limit of the bearish channel. If the metric continues to fall, this will be a critical decrease in the number of active addresses, which has not been recorded for more than five years.

Technically, the cryptocurrency continues to fluctuate within a narrow range of $19k–$24.6k. Bitcoin is struggling to break through the important psychological level of $20k due to a liquidity crisis. Large players use every opportunity to accumulate free volumes, shown by the liquidation of a position for $200+ million over the past day. The $19k–$20.5k range is where uncollected liquidity is concentrated, and partly, for this reason, the price continues to stay within this range.

On the daily chart, the cryptocurrency received a bullish momentum and continues to implement it. As of writing, the price reached $20.5k, but the activation of sellers reduced the price to $20.2k. Technical metrics continue to signal local bullish impulses, but in general, the situation points to continued consolidation in the current range. Trading volumes in the Bitcoin network are at their lows, which prevents the asset from realizing bullish/bearish impulses. The stochastic oscillator formed a bullish crossover in the oversold zone but failed to capitalize on the success. The situation is similar to the RSI index, which rebounded from the lower border of the bullish zone, but it was not possible to build on the success due to selling pressure.

A negative signal for Bitcoin in the short term could be a decline in the S&P 500 index. The indicator continued to fall, while Bitcoin remained near $20k. Likely, a pause in the collection of liquidity will not be able to prevent the further fall of the cryptocurrency. Given the fundamental background and the total weakness of buyers, a short idea is relevant for BTC/USD right up to the local bottom at $17.7k. Local bullish prospects for Bitcoin will open upon successful completion of the trading day above $20.8k. However, as we can see, the bears have enough strength to keep the price within the downward trend.