Today's key economic event in the EU is the CPI data release. The European Central Bank is increasingly concerned about inflationary pressure, and ECB policymakers are now making more hawkish statements. Klaas Knot, the president of the Dutch central bank, said on Tuesday that he is leaning in favor of a 75 basis point hike in September. This move will obviously be discussed at the upcoming policy meeting. However, ECB policymakers are no longer denying inflationary risks, which suggests that a hawkish policy shift is now on the table.

The latest events, such as falling energy prices, helped the euro recover slightly from parity with USD. Optimistic inflation data could boost demand for EUR. In the meantime, the markets are pricing in a big interest rate hike in September.

Yesterday's inflation data in several eurozone countries were not particularly alarming, even though they exceeded expectations. In Germany, inflation reached 7.9%, a record high level that was already reached in May. Month-on-month, prices rose by 0.3%.

ECB board member Yannis Stournaras stated earlier that the regulator expected prices to peak in 2022 before steadily decreasing in 2023.

Overall, the euro would find it difficult to maintain its upward momentum above 1.000. EUR/USD could still test the low of September 2022 at 0.9615.

"Germany, Italy, and now France are contracting, and it's only going to get worse this fall/winter when energy shortages really bite. Sure, the US faces recession risks too, but we still think that Europe is in much weaker fundamental shape," economists at BBH said in a report.

EUR/USD is likely to be highly volatile on Wednesday, as well as Friday, when the US non-farm payrolls will be released. Furthermore, the ADP payroll report will be released later today.

The yearly Harmonized Index of Consumer Prices was predicted to reach 9% in August, up from 7.9% in July.

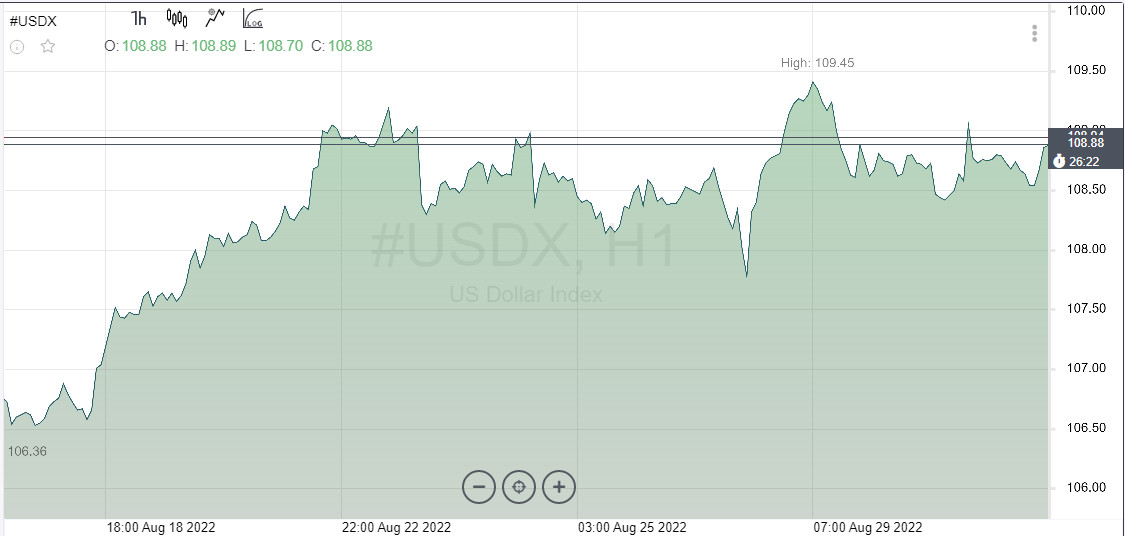

The US dollar index continues to consolidate below 109.00 after closing nearly unchanged for the second day in a row on Tuesday.

The euro's performance will also be determined by risk appetite of investors. According to the latest data from China, the NBS manufacturing PMI increased to 49.4 in August from 49 in July. The services PMI reached 52.6.

Investors are wary of a long-term economic slowdown in China after the Chinese government enacted strict quarantine measures in Shenzhen, Chengdu, and Dalian.

Will EUR bounce back?

EUR/USD managed to recoup some looses it had sustained after the hawkish speech by Jerome Powell. Natural gas futures fell by about 20%, as Germany announced its gas storages were filling up faster than planned. This report gave some support to EUR.

However, the euro's recovery is unlikely to last long due to sky-high electricity prices putting heavy pressure on households and businesses. The president of the European Commission Ursula von der Leyen said the EC was planning to intervene in the energy market to break the correlation between gas and electricity prices. No further details were given.

However, it should be noted that the latest hawkish statements by ECB policymakers could be a response to Jerome Powell's remarks in Jackson Hole. Analysts at Commerzbank believe that European policymakers were trying to convince the market that the EU has no other choice but to stick to the path of normalization to control inflation, even if the eurozone slides into recession.

The latest upsurge of natural gas prices would likely continue to put upward pressure on inflation, fuelling speculation of a more hawkish ECB policy shift at its upcoming meetings.

Analysts at MUFG are convinced that the euro is obviously weak.

"We are more confident that the EUR will continue to weaken in light of the intensifying energy price crisis in Europe with the price of natural gas surging above EUR300 MWh this week. It has prompted us to lower our target and stop-loss both by 2 big figures to 0.9700 and 1.0340 respectively," MUFG's FX analysts said in a report.

The outlook on ECB monetary policy would be in focus of market players alongside the release of inflation data. They would affect market expectations of an interest rate hike. Nevertheless, the euro remains sensitive to natural gas price fluctuations in the EU and would likely react to economic data, such as the manufacturing PMI report, which will be released on Thursday.

Over the past few weeks, EUR has increased following unexpectedly lower macroeconomic data in the US. At the same time, reaction to more positive data releases has been mixed. The euro could be sensitive to this week's data releases in the US, which could determine the pace of Fed rate hikes in September.

"We expect a further rise in euro area HICP inflation in August, but expect the rise to be less sharp than previous increases. Naturally, for the market watching energy prices soar higher the question is how quickly will this feed through to CPI inflation with government subsidies making CPI inflation artificially low for now," an outlook by Nomura said.

The ongoing events and the fundamentals are not favoring EUR bulls. The euro's rise above parity is likely to be temporary, and bears would regain the initiative once again in the future. In terms of monetary policy normalization, the ECB is outpaced by the Federal Reserve, and the EU regulator is strongly lagging behind the Fed.

EUR/USD support levels are located at 0.9985, 0.9950, 0.9915. The pair will encounter resistance at 1.0060, 1.0090, 1.0130.