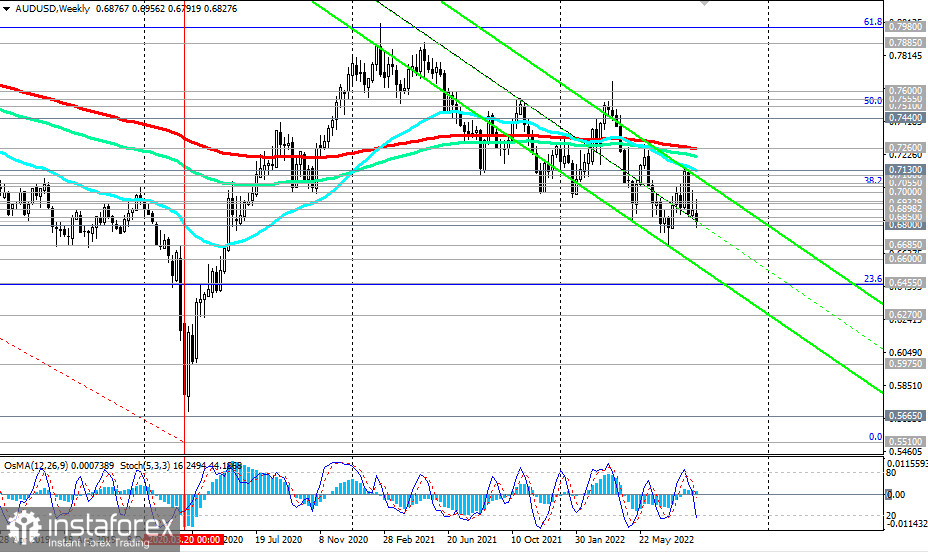

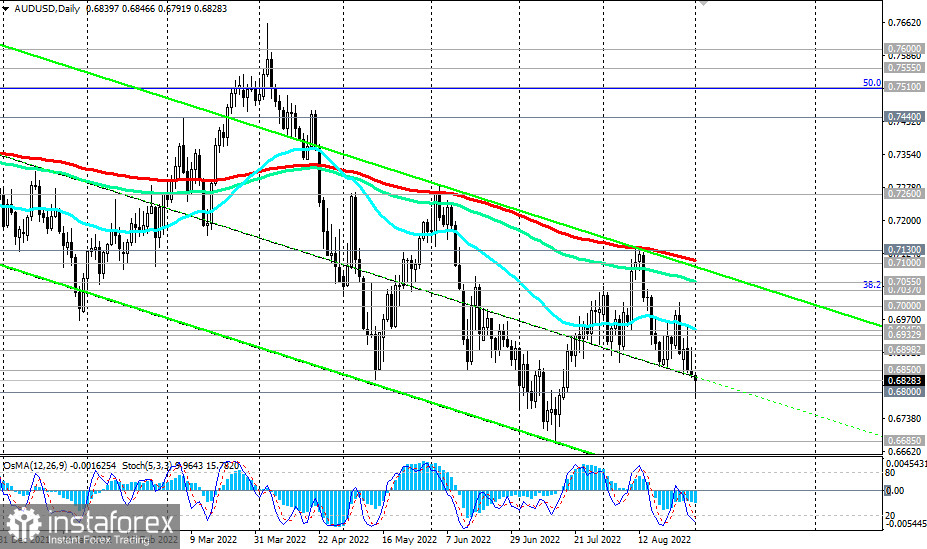

As of writing, AUD/USD is trading near 0.6827, remaining in the bear market zone below key resistance levels at 0.7100 (200 EMA on the daily chart), 0.7260 (200 EMA on the weekly chart), and maintaining a tendency to decline further amid the Fed's continued interest rate hike and the RBA's more restrained approach to this process.

Most likely, after the retest and the breakdown of the "round" support level of 0.6900, AUD/USD will continue to fall inside the downward channel on the weekly chart. Its lower border goes below 0.6600 and below the local 2-year low 0.6685 reached last month.

In an alternative scenario and after the breakdown of the resistance levels of 0.6898, 0.6933 AUD/USD will head towards the resistance levels of 0.7100, 0.7130. The break of the resistance level 0.7260 will again bring AUD/USD into a long-term bull market zone.

In the main scenario, we expect AUD/USD to decline.

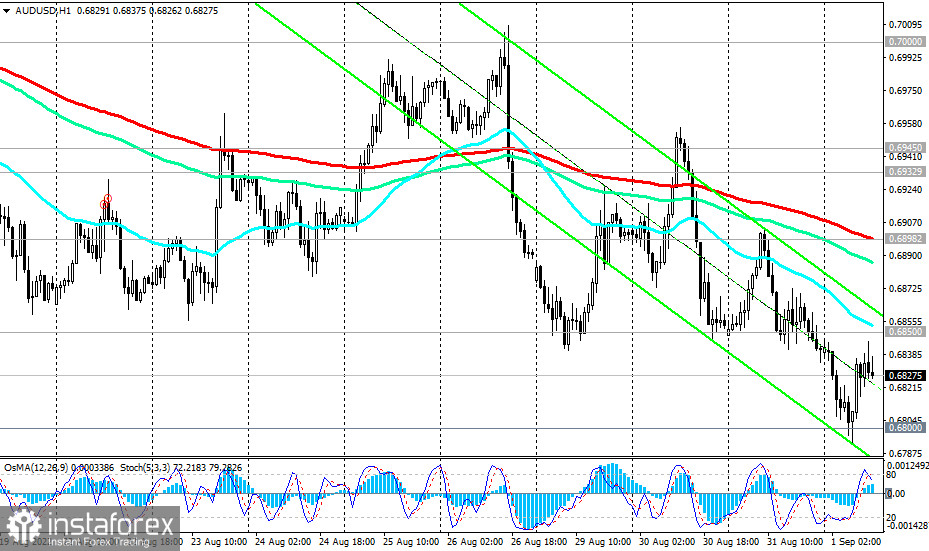

Support levels: 0.6800, 0.6700, 0.6685, 0.6660, 0.6500, 0.6455, 0.6270, 0.5975, 0.5665, 0.5510

Resistance levels: 0.6850, 0.6898, 0.6933, 0.6945, 0.7000, 0.7055, 0.7100, 0.7130, 0.7200, 0.7260

Trading Tips

Sell Stop 0.6790. Stop-Loss 0.6860. Take-Profit 0.6700, 0.6685, 0.6660, 0.6500, 0.6455, 0.6270, 0.5975, 0.5665, 0.5510

Buy Stop 0.6860. Stop-Loss 0.6790. Take-Profit 0.6898, 0.6933, 0.6945, 0.7000, 0.7055, 0.7100, 0.7130, 0.7200, 0.7260