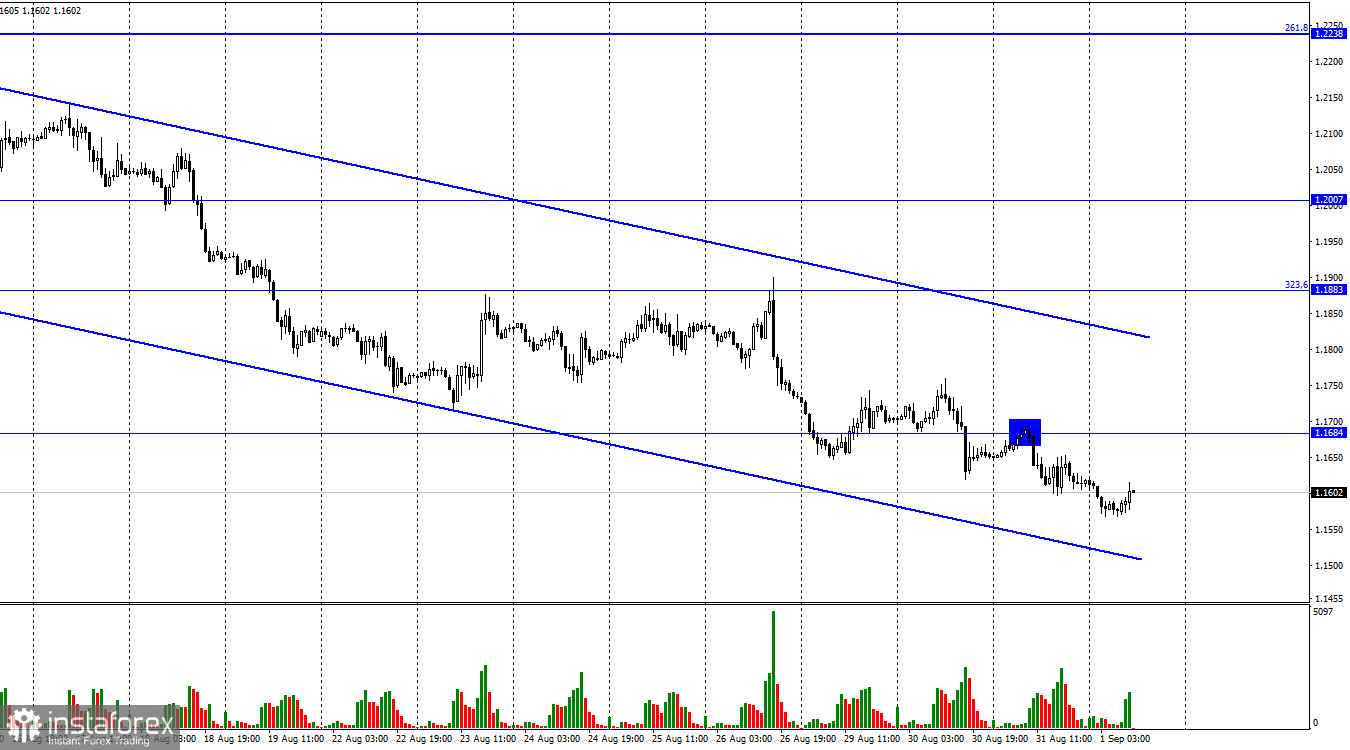

On the H1 chart, GBP/USD continues to fall on Wednesday after settling below the level of 1.1684. The pound may drop even deeper to 1.1496 and 1.1306. The pair is trading right within the descending channel without any attempts to leave it or test its boundaries. The downward movement is very steady. It seems surprising as there were almost no reports in the UK in the first three days of the week. Meanwhile, the ADP report on employment change from the US didn't cause any strong reaction yesterday. The pound keeps depreciating even though the fundamental background is relatively neutral. Yet, this is the only factor GBP can gain support from at the end of the week. Today, the ISM services PMI will be released in the US. Unlike other US indices, this one continues to stay above the mark of 50.0, signaling stability in the service industry.

Yet, the S&P services PMI has dropped to 44.1 which means that two US indices depicting the state of one industry show opposite results. As I see it, the ISM index may decline today as well, thus putting pressure on the US dollar. Tomorrow, traders expect the release of Nonfarm Payrolls that are expected to be below the forecast. The thing is, the US is also balancing on the brink of a recession although some FOMC members still deny this fact. Meanwhile, US GDP growth already shows contraction, while Jerome Powell warned that unemployment might rise. If the unemployment rate gets higher, the labor market will start to weaken. That is why Nonfarm Payrolls may come in worse than expected. So, these two reports is where the pound's main hope lies. In case both of them are negative, GBP may develop a slight upward movement but nothing more.

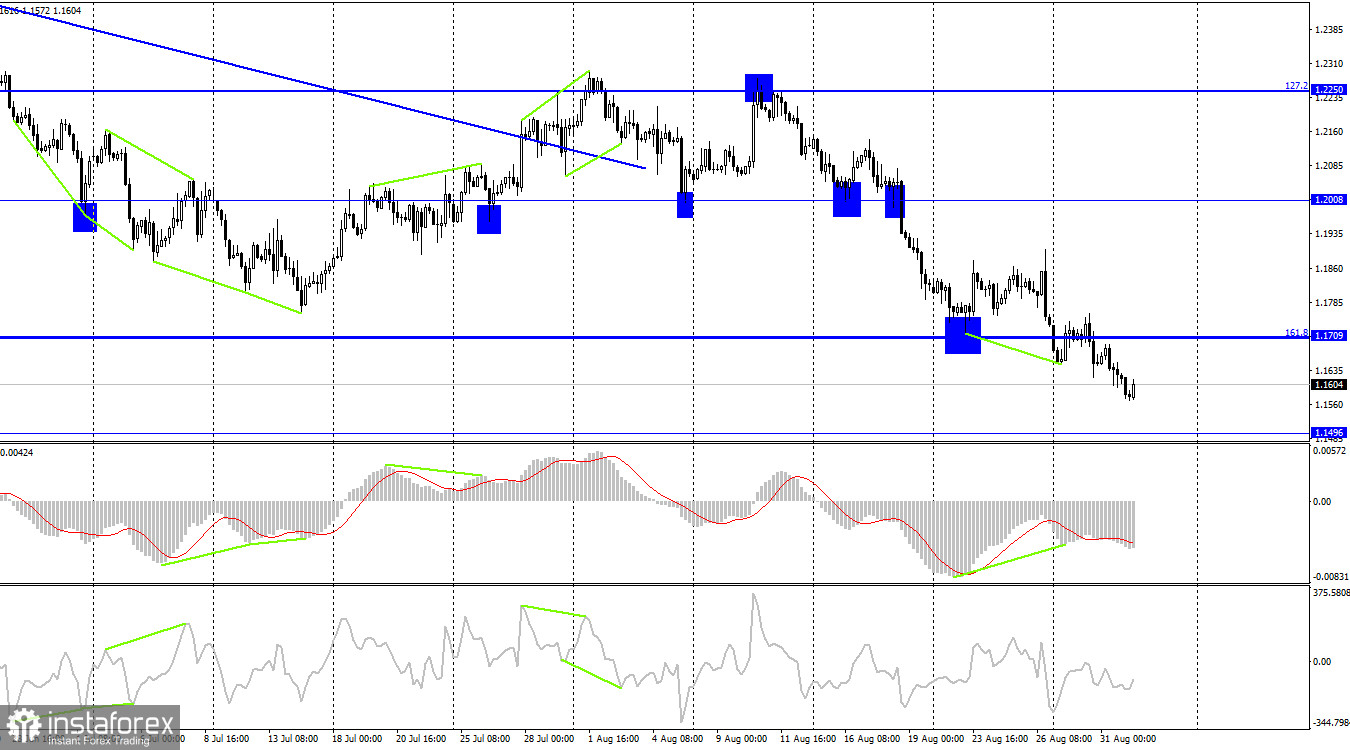

On the 4-hour chart, the pair reversed in favor of the US dollar and consolidated below the Fibonacci level of 161.8% at 1.1709. The price may extend its fall towards the next downward target at 1.1496. None of the indicators are showing any divergences coming. The main focus for now should be on the descending trend channel on the 1-hour chart.

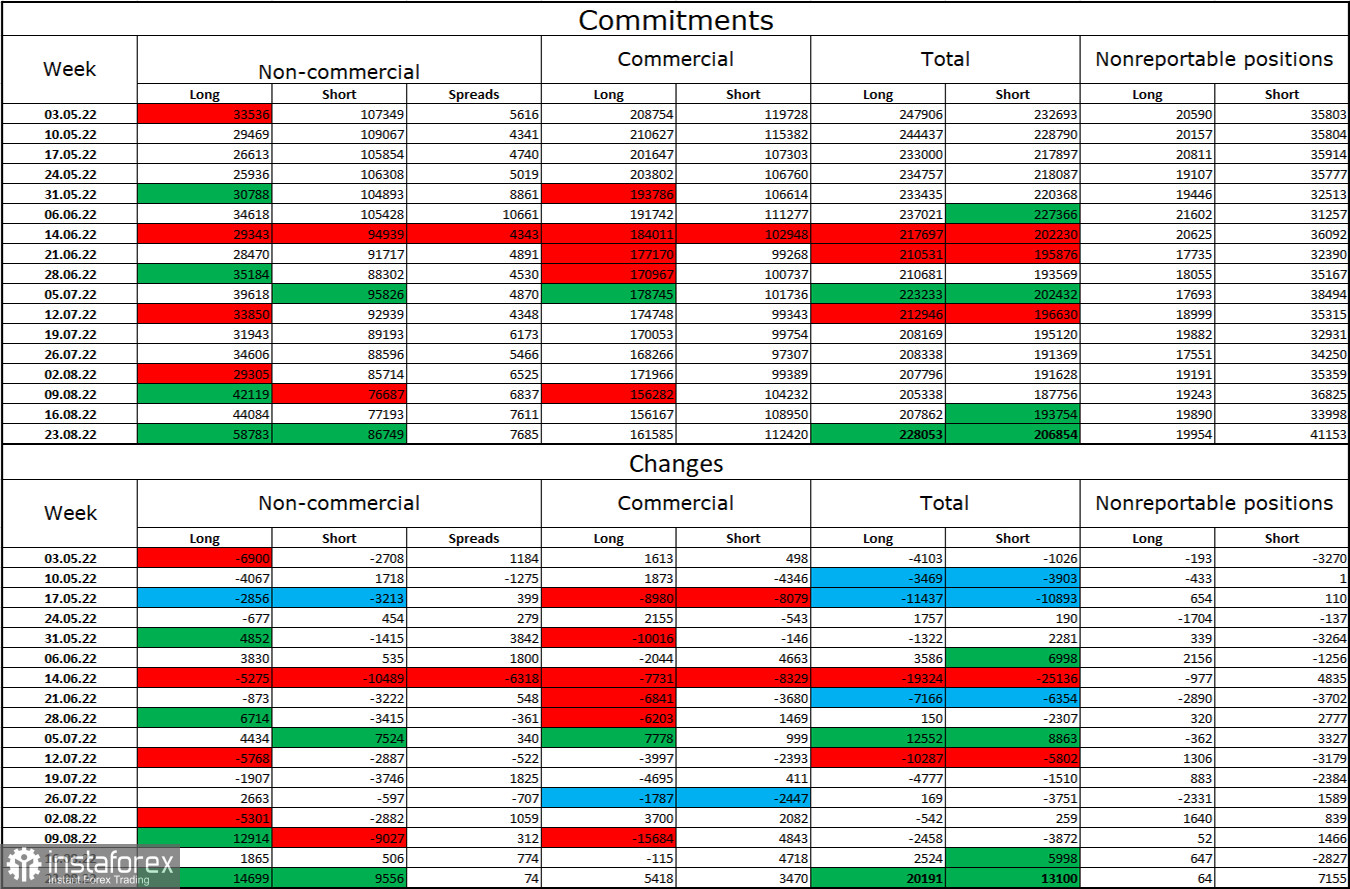

Commitments of Traders (COT) report:

Economic calendar for US and UK:

US - Initial Jobless Claims (12-30 UTC).

US - ISM Manufacturing PMI (14-00 UTC).

On Thursday, the economic calendar for the UK is empty. In the US, an important report from ISM will be published. Therefore, the influence of the information background in the second half of the day can be quite strong.

GBP/USD forecast and trading tips:

I would recommend selling the pound when the price closes below the level of 1.1684 on H1 with the target at 1.1496. These trades can be kept open for now. Buying the pound is possible when the price settles firmly above the descending trend channel on H1 with the target at 1.2007.