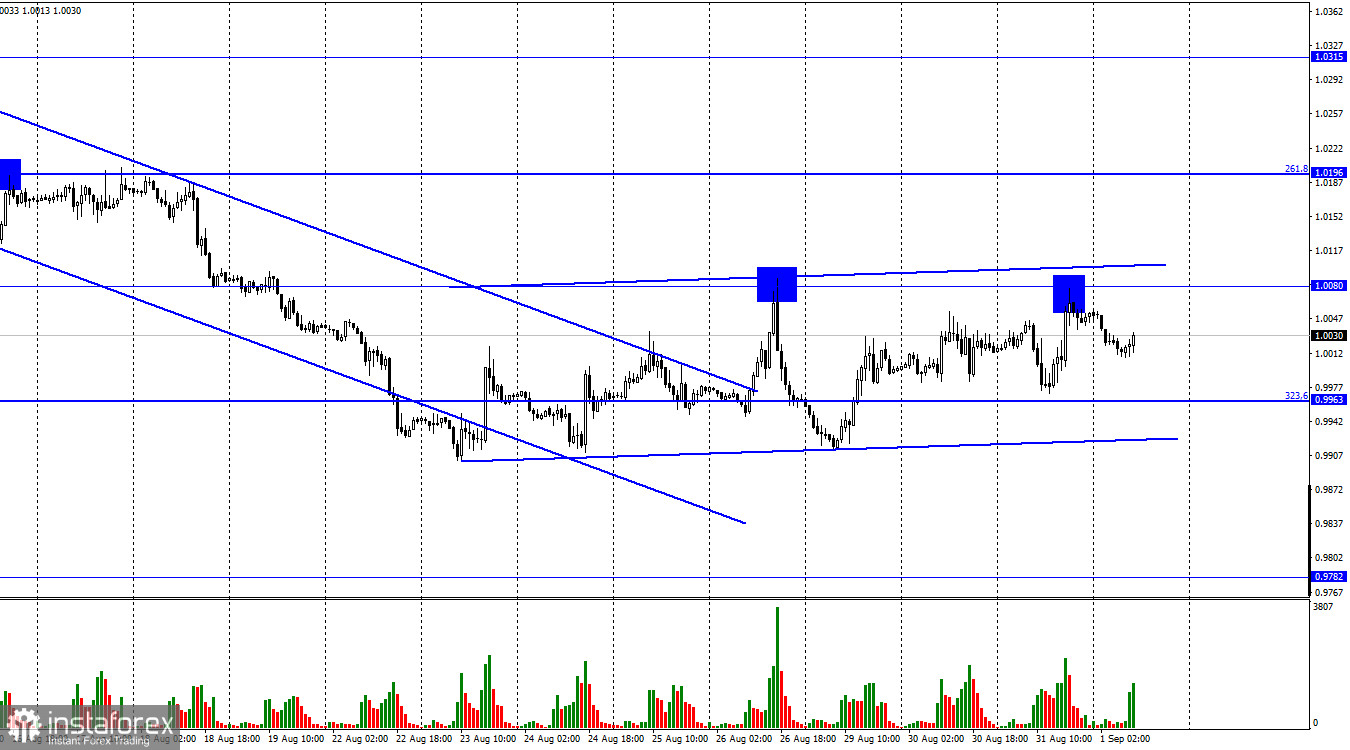

On Wednesday, the EUR/USD pair reversed near the corrective level of 323.6% (0.9963) in favor of the EU currency and increased to 1.0080. The rebound from this level has already worked in favor of the US currency and the resumption of the fall in the direction of 0.9963. However, these levels and the signals are now prioritized less than the almost lateral corridor formed in the last two weeks. It has a slight upward slope, but it is more directed sideways. Thus, I consider the movement over the last two weeks to be horizontal. Fixing the pair's exchange rate above the corridor will increase the likelihood of further growth of the euro, which is given to it with great difficulty. Closing under the corridor – and the euro will resume its fall. Yesterday, the information background was not too strong, but at least it was, unlike the previous days. In the European Union, an inflation report was released in August, which expected a new increase to 9.1% y/y. I was not surprised by the new acceleration of prices. Against the background of this report, bull traders helped the European currency grow a little, but the side corridor is not releasing the pair beyond its limits now.

Thus, the prospects of the euro/dollar remain uncertain. Today, the European Union will release a report on unemployment, which may rise to 6.7%. Unemployment in Europe is worse than in the US or the UK, where it is twice as low. Therefore, this week's reports are unlikely to lead to a strong increase in the EU currency. Yesterday's rumors that the ECB may begin to raise the interest rate more aggressively have no basis yet. Of course, the statements of some ECB representatives cannot be regarded as "water" or "duck," but the decision will be made not only by those few members of the monetary committee who have spoken out. Until recently, the ECB was not going to raise the rate at all, but in the summer, the situation suddenly changed, and traders felt some falsity in the actions and statements of the regulator.

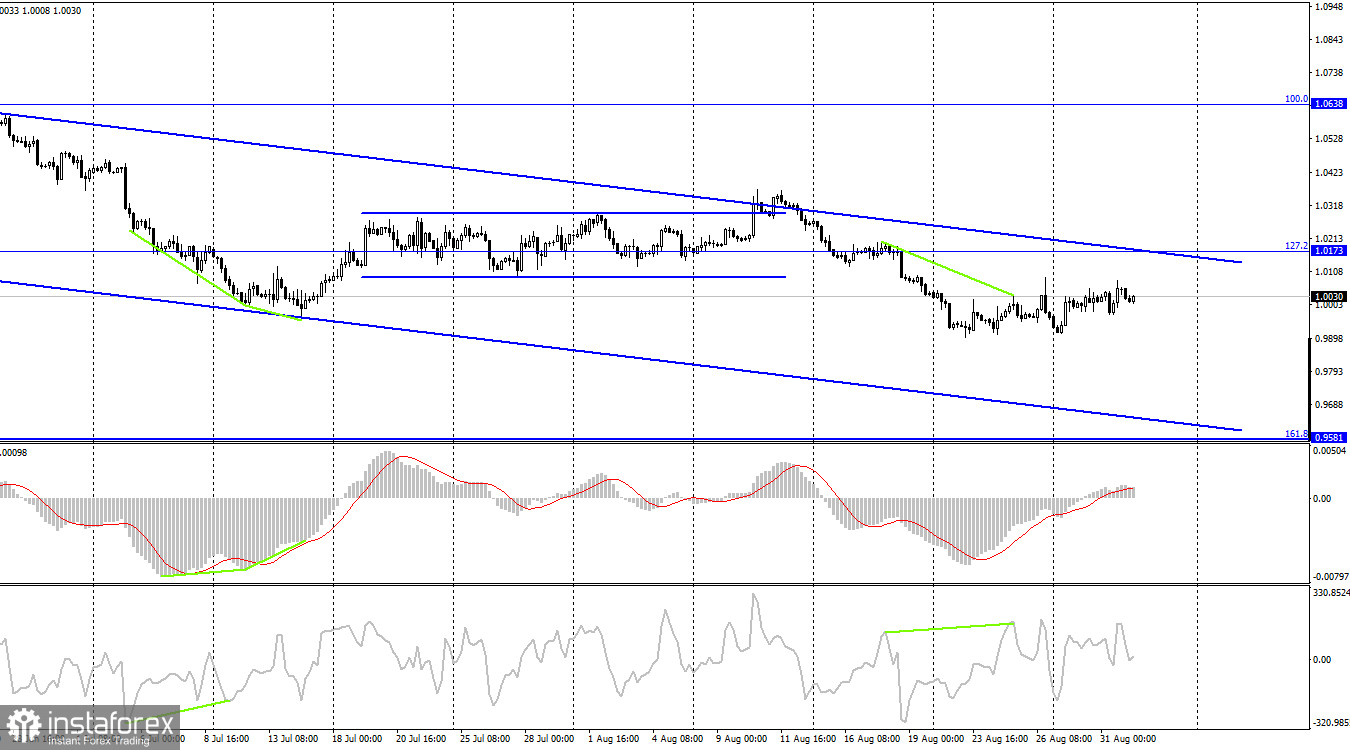

On the 4-hour chart, the pair reversed in favor of the US currency and anchored under the corrective level of 127.2% (1.0173). Thus, the process of falling can be continued in the direction of the Fibo level of 161.8% (0.9581). The "bearish" divergence of the CCI indicator has already been canceled, but the pair's growth is weak. The current upward pullback may be short-lived. The downward trend corridor still reflects the mood of traders as "bearish."

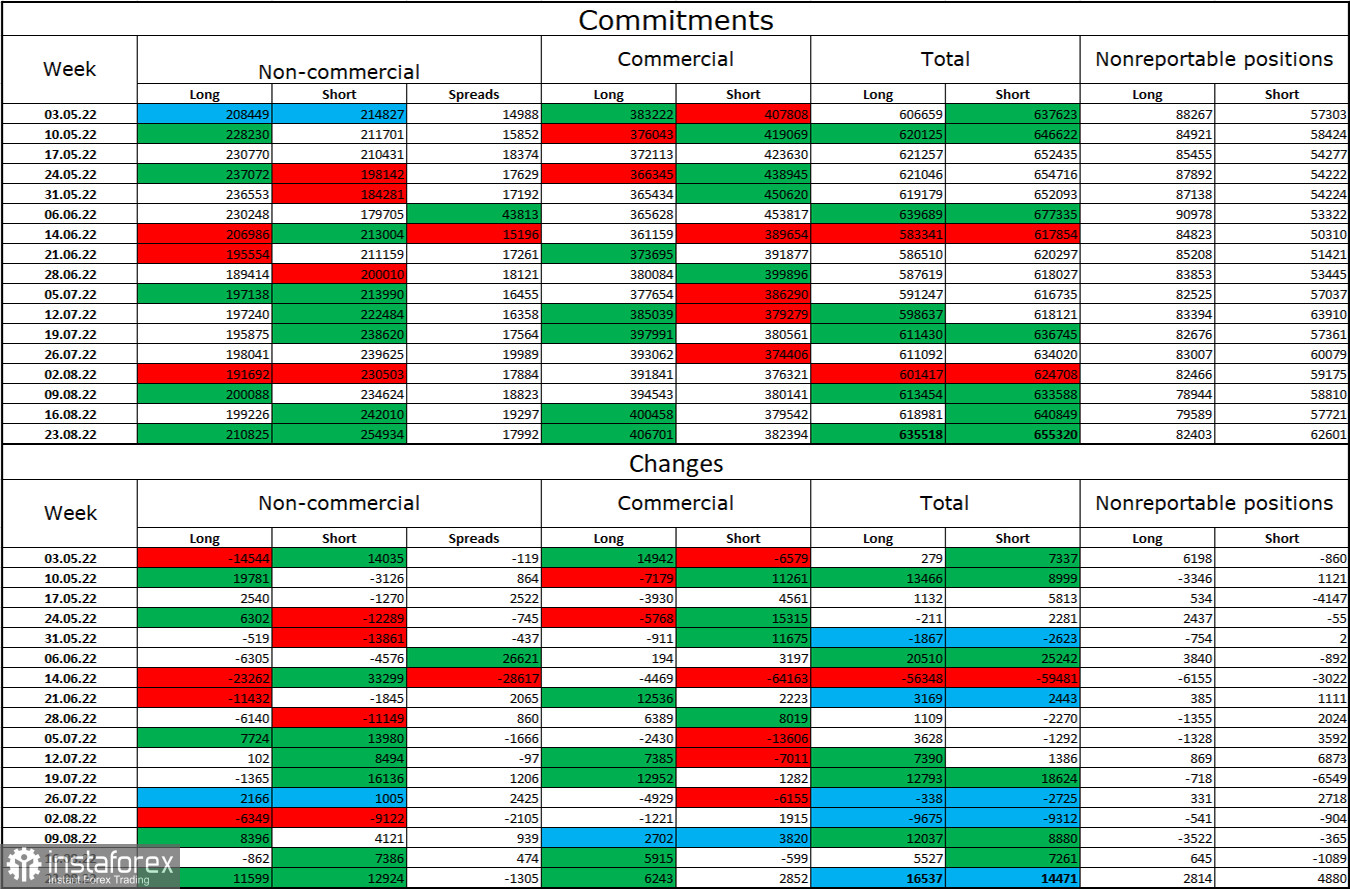

Commitments of Traders (COT) Report:

Last reporting week, speculators opened 11,599 long contracts and 12,924 short contracts. This means that the "bearish" mood of the major players has intensified again. The total number of long contracts concentrated in the hands of speculators now amounts to 211 thousand, and short contracts – 255 thousand. The difference between these figures is still not too big, but it remains not in favor of euro bulls. In the last few weeks, the chances of the euro currency's growth have been gradually increasing, but recent COT reports have shown no strong strengthening of the bulls' positions. The euro currency has not shown convincing growth in the last five or six weeks. Thus, it is still difficult for me to count on the strong growth of the euro currency. So far, I am inclined to continue the fall of the euro/dollar pair, judging by the COT data.

News calendar for the USA and the European Union:

EU - unemployment rate (09:00 UTC).US - number of initial applications for unemployment benefits (12:30 UTC).US - index of business activity in the manufacturing sector (PMI) from ISM (14:00 UTC).On September 1, the calendars of economic events of the European Union and the United States contain several entries, but I believe that only the ISM index will matter for traders. The influence of the information background on the mood of traders today may be average in strength.EUR/USD forecast and recommendations to traders:New pair sales are possible when closing under the side corridor on the hourly chart with a target of 0.9782. I recommend buying the euro currency when fixing quotes above the descending corridor on the 4-hour chart with a target of 1.0638.