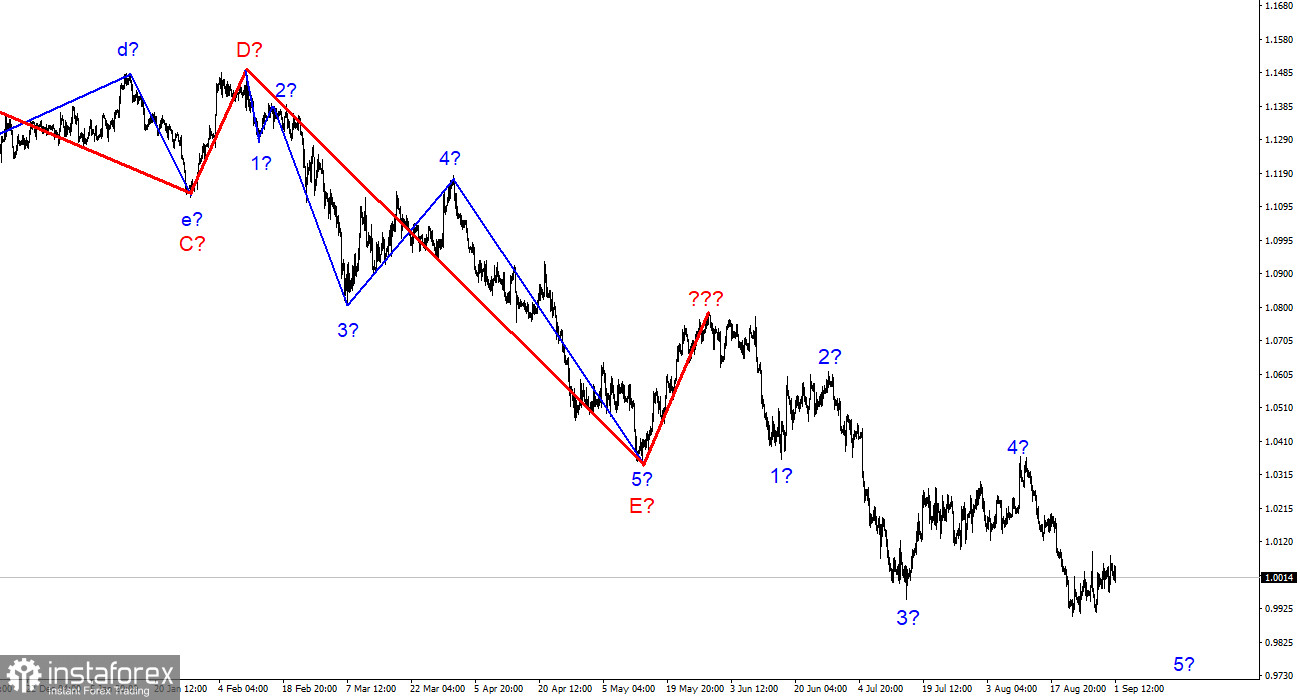

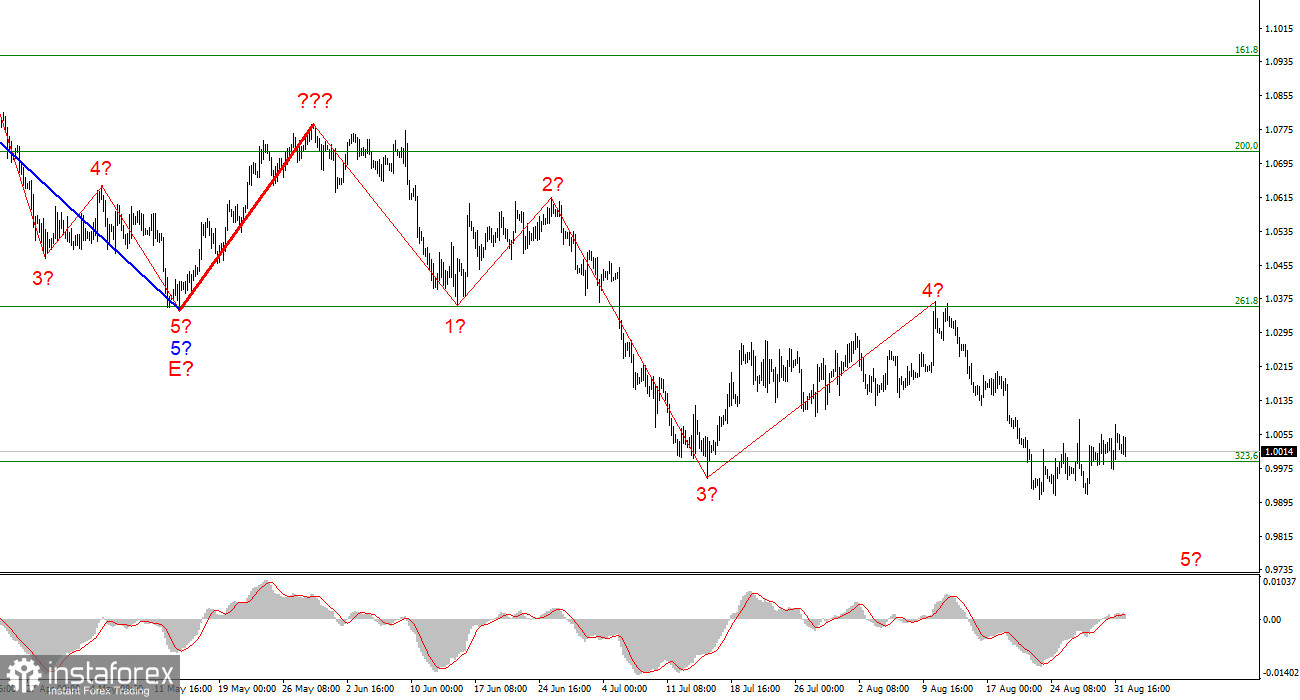

The wave marking of the 4-hour chart for the euro/dollar instrument at the moment still does not require adjustments, although wave 4 turned out to be longer than I expected. The whole wave structure can become more complicated once again, but any structure can always take a more complex and extended form. The construction of the ascending wave, which is interpreted as wave 4 of the downward trend section, is completed if the current wave marking is correct. The instrument continues to build the descending wave 5. The assumed wave 4 has taken a five-wave but corrective form. However, it can still be considered wave 4. There are no grounds to assume the completion of the downward trend segment yet. A successful attempt to break through the 0.9989 mark, which corresponds to 323.6% Fibonacci, indicates the market's readiness to continue reducing demand for the euro. I expect the decline in the quotes of the instrument will resume with targets located below the 1.0000 mark within wave 5. Wave 5 can take on almost any length since wave 4 turned out to be much longer than wave 2 – the waves acquire a more extended appearance as the downward trend section is built.

Inflation and unemployment in the EU kept the euro from falling.

The euro/dollar instrument moved again with low amplitude on Thursday. Several interesting reports were published in the European Union yesterday, and the euro needs to thank them for not being much weaker. Remember that inflation rose to 9.1% y/y (it could have been worse), and unemployment remained at 6.6% (it could have been worse). Why could it be worse? The European economy continues to be stubborn toward recession, and even ECB members are already saying it is inevitable. We need to focus on fighting inflation, and GDP will still fall. Since a recession is almost inevitable, it should be accompanied by increased unemployment. Therefore, I believe that this indicator may grow to around 10% in the coming months and years. This is unfortunate news for the Eurozone since the European Union is still considered one of the most stable and economically strong units in the world, and unemployment of 10% does not fit much with this status.

Nevertheless, this is an objective reality. Of course, there was no need to end the European economy before the time. It is better to observe what decisions the ECB will make at the next meetings and what will happen to energy prices this winter. In Europe, there is a strong fear that sanctions against Russia will lead to an even greater increase in electricity, gas, and fuel prices, which will automatically pull up prices for everything else. Some enterprises may reduce production volumes in winter due to gas shortages, while some may stop altogether. All this will cause layoffs and a drop in GDP. Thus, the fact that these processes have not yet begun is encouraging. The bad news is that they are likely to start in the near future. And if the ECB does raise the rate by 0.75% in September, as many analysts are now saying, it will primarily hit the economy, not inflation.

General conclusions.

Based on the analysis, I conclude that the construction of the downward trend section continues. I advise you to sell the instrument with targets near the calculated mark of 0.9397, which equates to 423.6% Fibonacci, for each MACD signal "down," counting on the construction of wave 5. So far, I do not see a single signal indicating this wave's completion.

At the higher wave scale, the wave marking of the descending trend segment becomes noticeably more complicated and lengthens. It can take on almost any length, so I think it's best to isolate the three and five-wave standard structures from the overall picture and work on them.