Doubts involuntarily arise as EURUSD holds its ground against the backdrop of the S&P 500 falling for six of the last eight trading days and US Treasury yields rising to their highest levels in more than two months. If the US dollar does not want to grow against a favorable background, what will happen if the background changes? However, it cannot be said that it has not changed.

According to Citigroup, gas demand in Europe fell by 12% in August compared to the same period last year due to high prices. At the same time, the company predicts that a decrease in consumer interest in blue fuel by 10% YoY, continued LNG imports, and an increase in storage capacity percentages may reduce fears about an energy crisis. Moreover, EU is actively studying the Spanish experience, according to which the difference between market and government prices is paid through a compensation mechanism. Brussels' intervention in the energy markets may not be as hopeless as it is supposed to reduce the risks of a recession and untie the hands of the ECB.

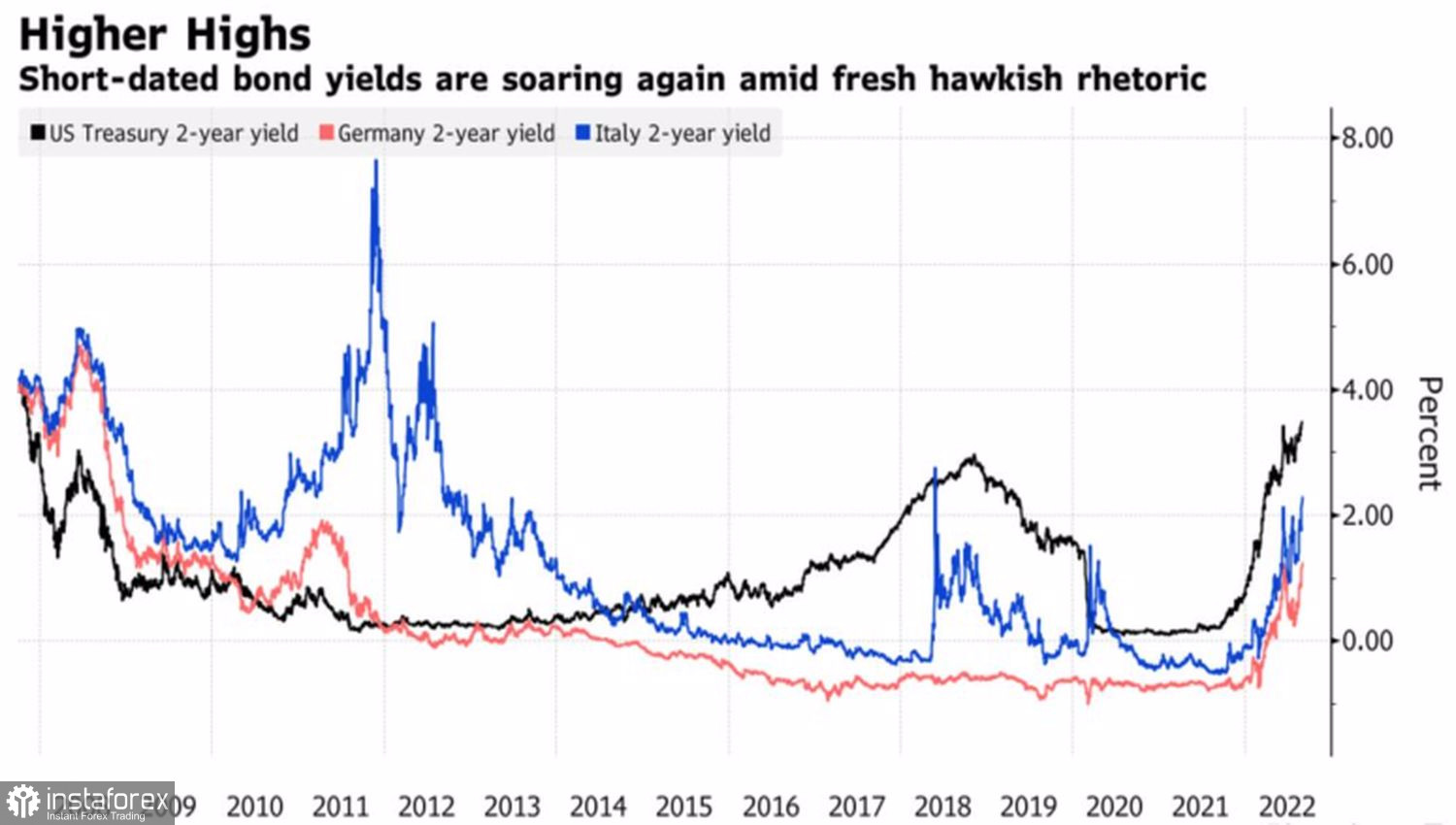

The hawkish rhetoric of Governing Council members, including calls from the heads of the central bank of Netherlands, Austria and Germany for aggressive monetary tightening, led the futures market to expect a 241 bps increase in the deposit rate by July 2023. Even with a 75 bps in September, this suggests that some unthinkable action by the ECB should take place in October, which allows the yields of German and Italian bonds to grow no slower than American ones and supports EURUSD.

Dynamics of European and American bond yields

Overcoming the energy crisis may suggest the idea of breaking the downward trend for the main currency pair, but we will not give wishful thinking. The euro has too strong an opponent. The Fed is ready to sacrifice the economy but break the back of inflation. Jerome Powell and his team are not going to make a soft landing—they are following a strategy with the paradoxical name "growth recession." We are talking about significantly slowing down the expansion of GDP below the trend of 1.5–2%, increasing unemployment and thus reducing domestic demand and returning inflation to the 2% target.

This requires not only tighter financial conditions, but also a positive real federal funds rate. Now it is about -6%, so there is no end in sight to the tightening of monetary policy. The euro may rattle its main competitor in the short term, but then the US dollar will bounce back.

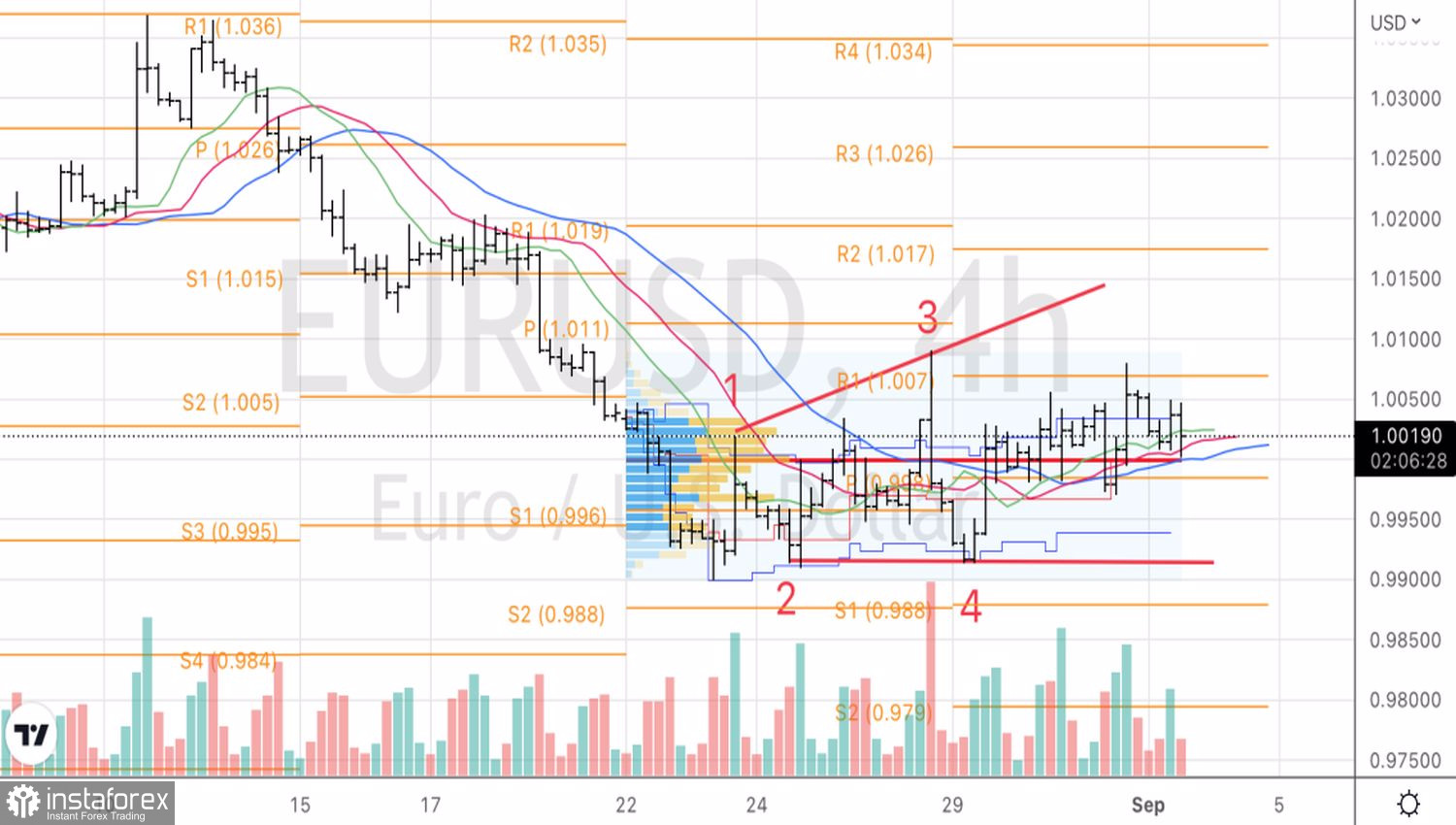

Technically, on the 4-hour chart, the EURUSD is swinging around fair value in the form of parity, like a pendulum. The break of the resistance at 1.0055 and 1.007 can be used to build longs formed on the fall of the pair just below one.