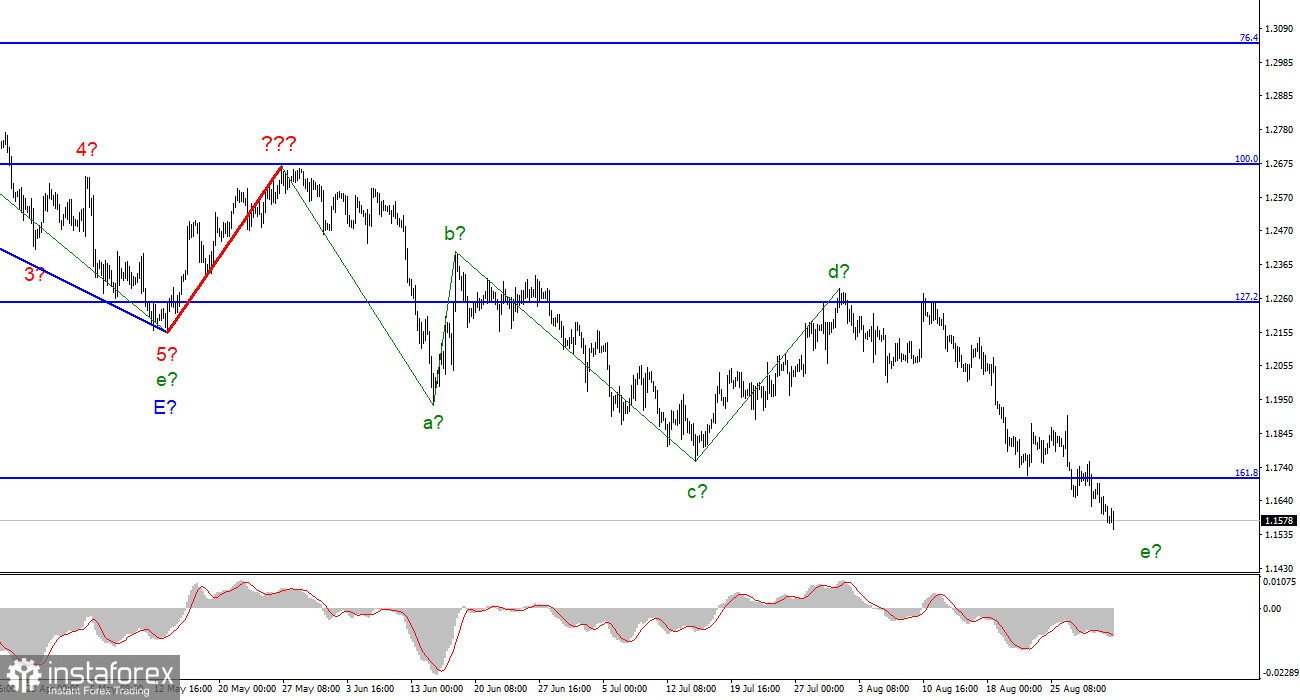

For the pound/dollar instrument, the wave marking looks quite complicated at the moment, but it does not require any clarifications yet. The upward wave, built between May 13 and May 27, does not fit into the overall wave picture, but it can still be considered corrective as part of the downward trend section. Thus, it can now be concluded that the downward section of the trend takes a longer and more complex form. At the moment, we have completed waves a, b, c, and d, so we can assume that the instrument continues to build wave e. If this assumption is correct, then the decline in quotes should continue in the near future. However, I remind you that if impulse structures can become more complicated and lengthened, corrective ones can become even more so. Given the news background and the fact that the Fed will not stop raising interest rates now, the entire downward trend section may take a much longer form. The wave markings of the euro and the pound differ slightly in that the downward section of the trend for the euro has an impulse form. But the ascending and descending waves alternate almost equally. A successful attempt to break through the 1.1708 mark, which corresponds to 161.8% by Fibonacci, indicates that the market is ready for new sales of the British.

The market does not need rest.

The exchange rate of the pound/dollar instrument decreased by 40 basis points on August 31, and today it has lost another 50. The decline in demand for the pound does not proceed quickly or sharply. Nevertheless, it is observed almost daily, providing the instrument with a continuous drop. I find it difficult to say what exactly the reasons were for the fall of the British this week if there was not a single important report in the UK, and the first one was released in the US only yesterday. Nevertheless, it cannot be denied that wave marking implies exactly the decline of the instrument, so the market may not need a new background for sales. Let me remind you that not only the European economy is "walking on the edge of a knife." The British one will not be able to avoid a recession either, and now the most important question is, "how strong will the recessions be in the EU and Britain?" Judging by the actions of the market, they are very strong since neither the pound nor the euro can build even a corrective wave at this time. However, again, it will not forget about the waves.

Both current downward trend sections may complete their construction in the near future, as both have five waves. Thus, perhaps we are now watching the last jerks of both instruments. I will also draw attention to the fact that the European currency is not declining now. The following scenario is also possible: the pound will fall for some time, and then both instruments will begin building corrective structures with at least three global waves. The Nonfarm Payrolls report, which will be released tomorrow, may reduce the demand for the US currency and become the starting point for building a new section of the trend. After all, the descending section must end sooner or later.

General conclusions.

The wave pattern of the pound/dollar instrument suggests a continued decline in demand for the pound. I advise now selling the instrument with targets near the estimated mark of 1.1112, which is equivalent to 200.0% Fibonacci, for each MACD signal "down," but this mark is quite far away, so the instrument may not reach it. Inside the fifth wave, it is necessary to sell more cautiously since the downward section of the trend can end at any moment.

The picture is very similar to the Euro/Dollar instrument at the higher wave scale. The same ascending wave does not fit the current wave pattern, the same three waves down after it. Thus, one thing is unambiguous – the downward section of the trend continues its construction and can turn out to be almost any length.