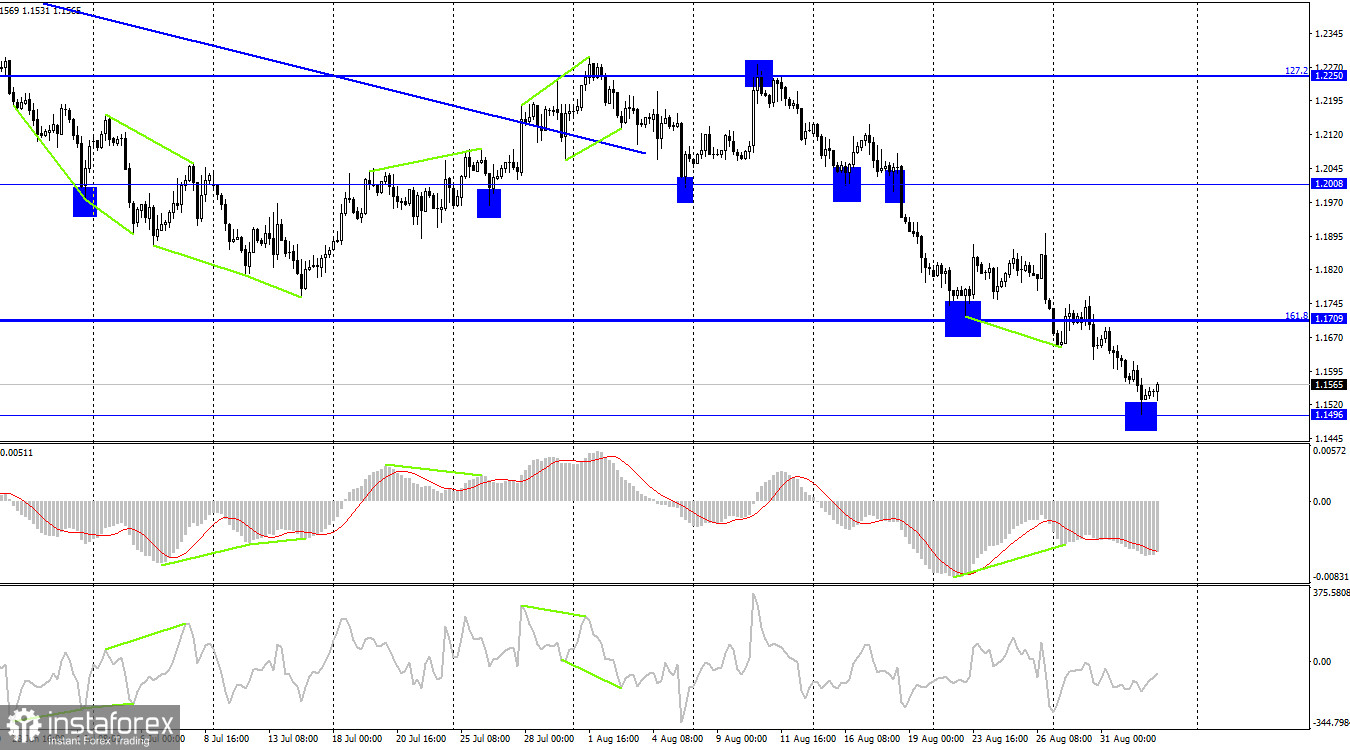

Hello, dear traders! On Thursday, the pound/dollar pair continued falling on the daily chart and rebounded from the lower limit of the downtrend channel. However, after a rebound, the pair failed to rise. That is why today, the British pound may go on sliding towards the 423.6% correctional level located at 1.1306. Yesterday, the information flow was quite weak. Traders paid attention only to the US services PMI data disclosed by ISM. The indicator reached 52.8 points, exceeding traders' expectations. That is why the US dollar received unnecessary support. Today, the US is going to publish the non-farm payrolls data. The report is likely to determine the pace of the key interest rate in the next three meetings in 2022. Although Jerome Powell intends to lower inflation to 2%, the labor market data may force him to revise his plans.

At the moment, there are no reasons for concern. Every month, the number of new jobs increases at an appropriate pace. Nevertheless, the Fed hikes the key interest rate at every meeting. That is why the unemployment rate may also jump. If the number of jobs in the non-farm sector starts falling, the British pound will have a chance to rise. The same situation is with the unemployment rate. If it increases, the pound sterling may slightly gain in value. Notably, at the moment, the unemployment rate is at the lowest level last seen five decades ago. However, the Fed supposes that it may rise to 4-5%. In this case, the greenback may decline. If both reports unveil strong data, the British currency will continue dropping. However, traders should keep in mind that the pound sterling has been decreasing for the whole week. Thus, it may lose its downward momentum, ignoring strong data from the US.

On the four-hour chart, the pound/dollar pair dropped to 1.1496 and rebounded from it. The pair reversed and began rising slowly towards the 161.8% correction level at 1.1709. If the price settles below 1.1496, it will have more chances to decline to the 200.0% Fibonacci level of 1.1111.

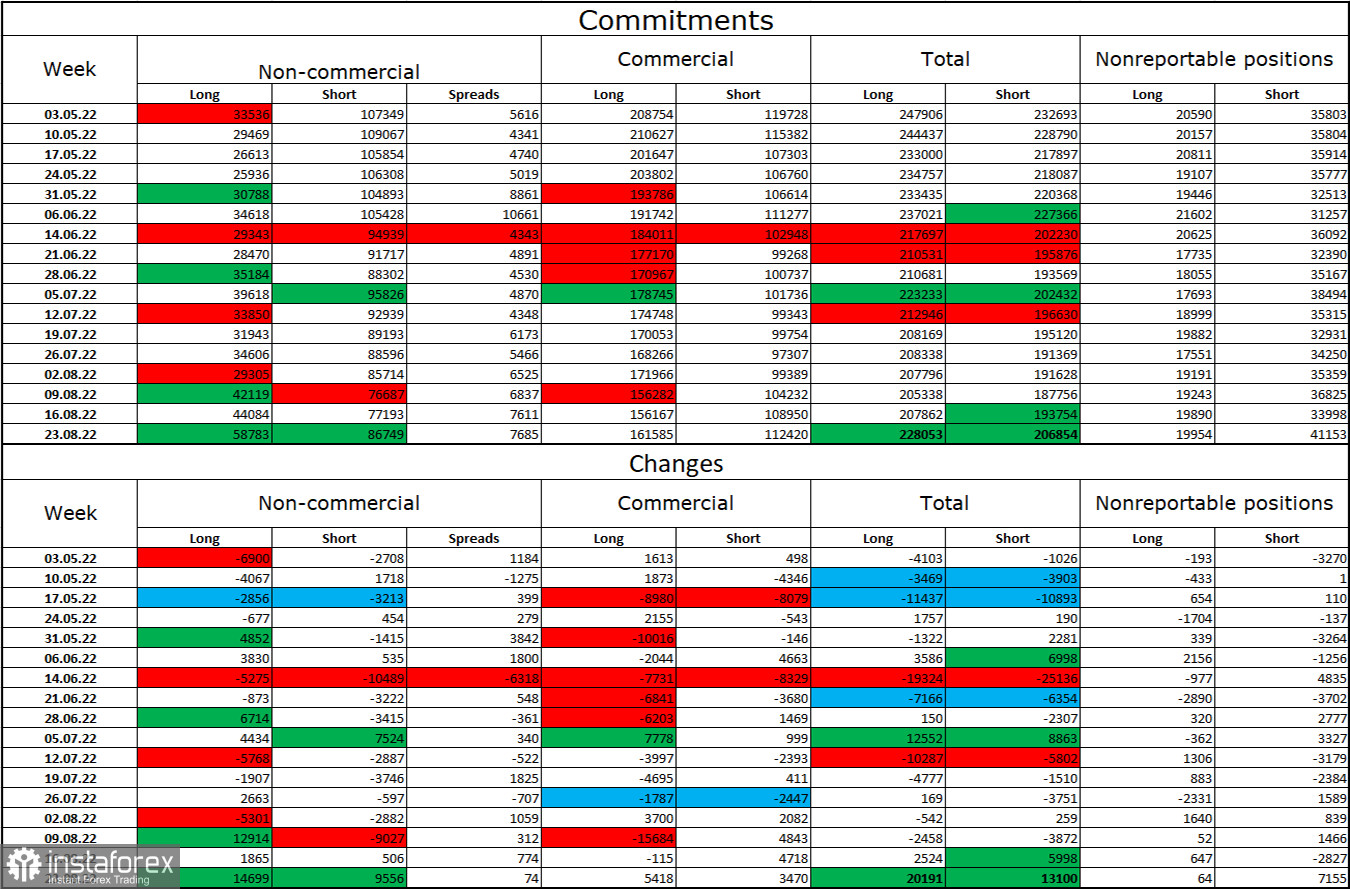

COT report

This week, sentiment among the non-commercial traders has become less bearish compared to the previous week. The number of long positions opened by speculators increased by 14,699, whereas the number of short positions advanced by 9,556. Thus, the overall sentiment remains bearish. The number of short positions still exceeds the number of long ones. However, the difference has become smaller. Most big traders continue selling the pound sterling, but their sentiment is slowly changing to the bullish one. However, it is likely to be a long-lasting process. In recent weeks, the pound sterling was inching up but then resumed falling. Judging by the COT reports, the British pound is likely to go on losing value.

Macroeconomic events in the US and the UK:

US - Average Hourly EarningsUS - Nonfarm PayrollsUS - Unemployment Rate

Today, the US macroeconomic calendar is rich in important events, whereas, in the UK, the situation is the opposite. That is why the information flow is likely to have a significant influence on the market today.

Outlook for GBP/USD and trading recommendations:

If the pair closes below 1.1684 on the one-hour chart, traders may open sell positions with the target at 1.1496. New sell orders could be initiated if the pair closes below 1.1496 with the target at 1.1306. Traders may go long if the price consolidates above the downtrend channel on the daily chart. In this case, the target will be located at 1.2007.