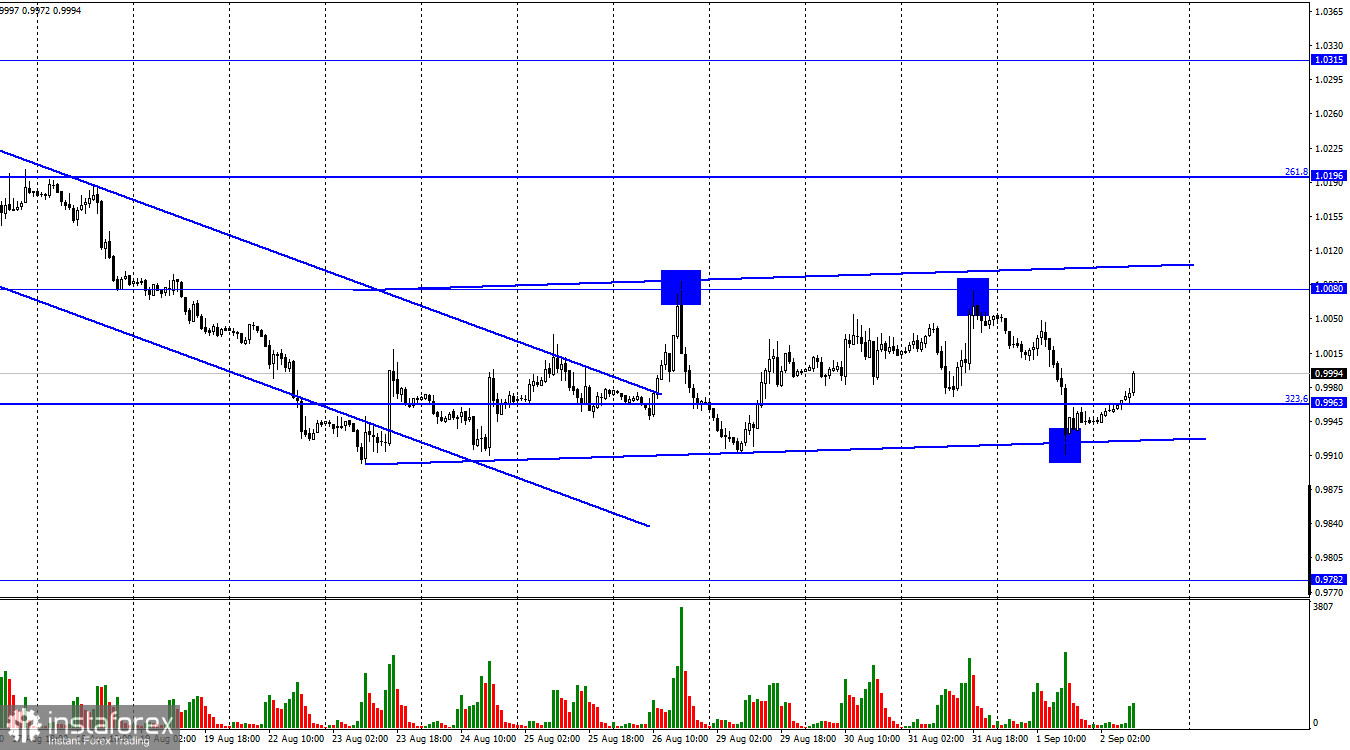

The EUR/USD dropped to the lower boundary of the sideways channel on Thursday and then rebounded from it. So, the pair reversed in favor of the euro which initiated a rise towards 1.0080 and the upper boundary of the channel. The pair is still trading flat although trading activity is rather high. As I see it, traders are either waiting for a new driver to leave the channel or they are simply not ready to buy the dollar. Why am I talking about the US dollar? Despite its rapid growth in 2022, the currency still has high upside potential. Thus, at the symposium in Jackson Hole, Jerome Powell confirmed the intention of the central bank to pursue a further rate hike. In addition, many FOMC members supported his view. So, the regulator is ready to sacrifice economic growth in order to stabilize prices. No one is talking about a recession but everyone mentions high inflation that needs to be stopped.

In the meantime, EU traders can only rely on speculations. The ECB is believed to raise the rate by 0.75% in September but there has been no confirmation yet. Therefore, the Fed is much stronger than the ECB in terms of monetary policy. So, the US dollar has a solid ground for further growth. The same is true for the British pound which has already lost hope and continues to tumble. So, I expect the euro/dollar pair to settle below the sideways channel and extend its fall towards the level of 0.9782. The Nonfarm Payrolls report will be of great importance today. In case the data is negative, the greenback may considerably depreciate. Yet, it will still be close to the upper line of the channel and won't leave it. This scenario still suggests a further rise of the dollar and a close below the channel a bit later. I think that Nonfarm Payrolls will not change the market sentiment which remains mostly bearish.

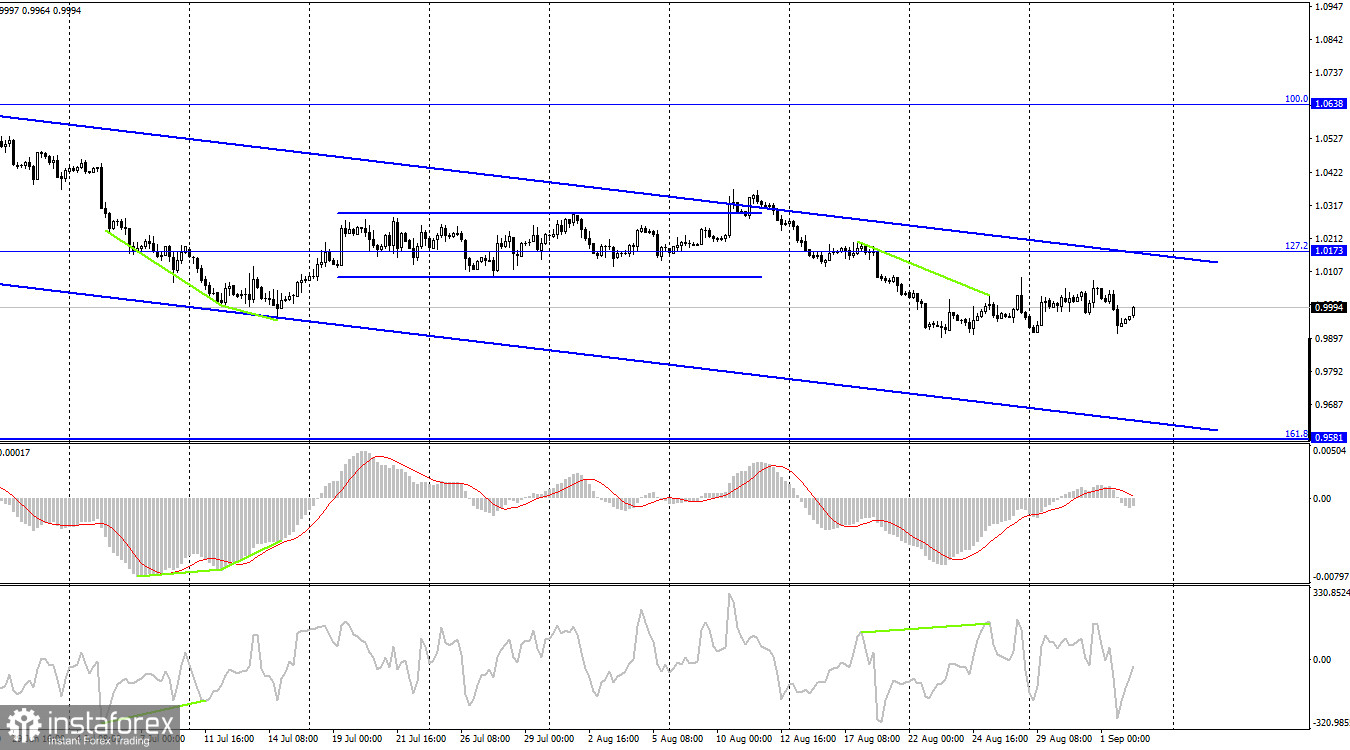

On the 4-hour chart, the pair reversed in favor of the US dollar and consolidated below the retracement level of 127.2% at 1.0173. Therefore, the pair may continue to fall towards the fibo level of 161.8% located at 0.9581. The bearish divergence of the CCI has already been canceled but the upward momentum is very weak. The ongoing upside pullback may be short-lived. The downward channel confirms the bearish sentiment of the market.

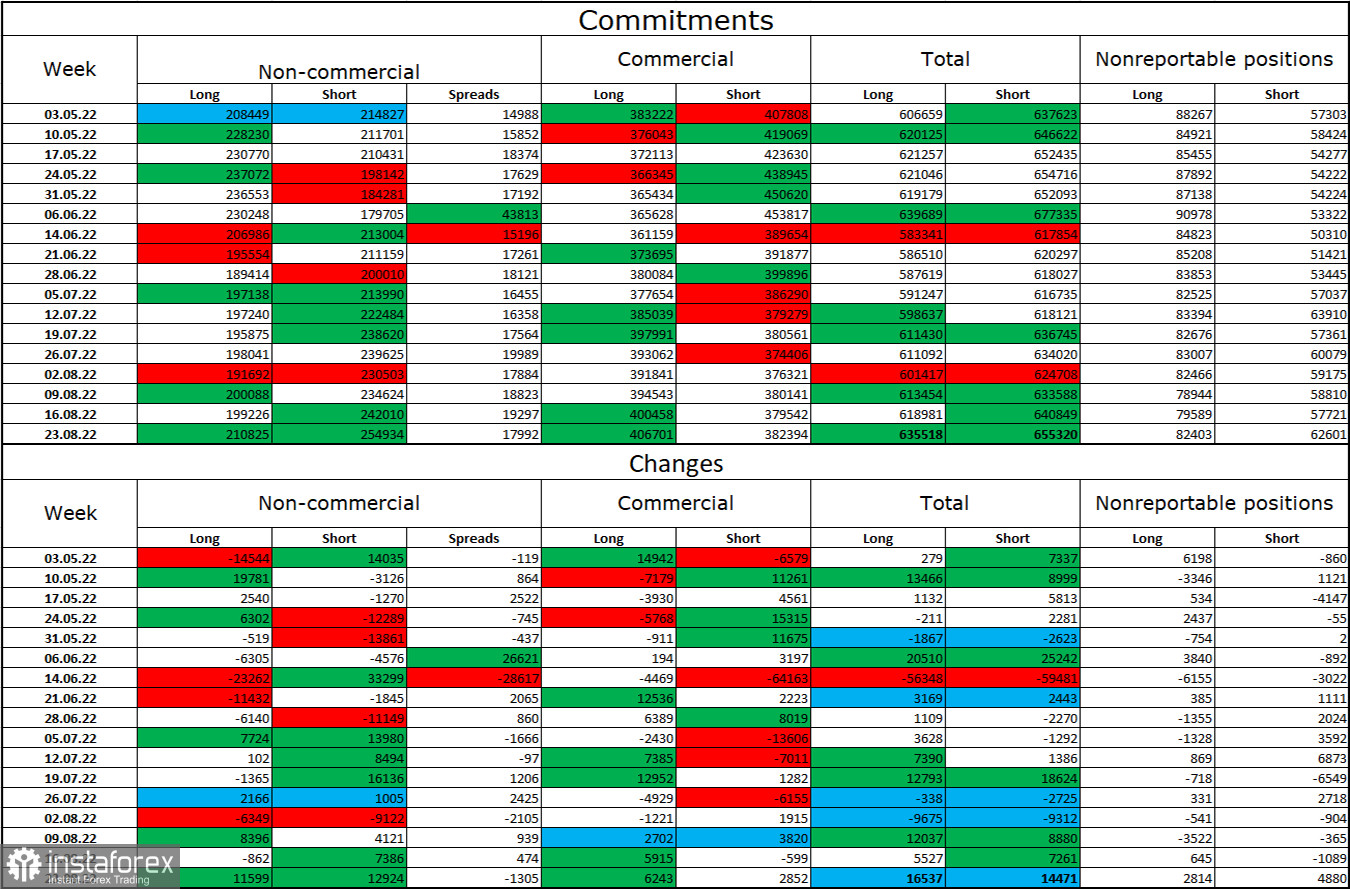

Commitments of Traders (COT) report:

Last week, traders opened 11,599 long contracts and 12,924 short contracts. This signals that large market players became more bearish on the pair. The total number of opened long contracts is 211,000 and the number of short contracts is 255,000. The difference is not big but euro bears are still prevailing. In the last few weeks, the likelihood of an uptrend in the euro was getting higher. Yet, recent COT reports showed that bulls failed to gain a strong foothold in the market. The euro failed to develop a proper upside movement in the past 5-6 weeks. Therefore, I can hardly see any chances for strong growth. Given the COT data, I think EUR/USD will continue to depreciate.

Economic calendar for US and EU:

US - Average Hourly Earnings (12-30 UTC).

US - Nonfarm Payrolls (12-30 UTC).

US - Unemployment rate (12-30 UTC).

On September 2, the economic calendar for the EU shows no important events. Meanwhile, the US will release three major reports. Therefore, the influence of the information background on the market may be quite strong today.

EUR/USD forecast and trading tips:

It is possible to sell the pair when the price closes below the sideways channel on H1 with the target at 0.9782. I recommend buying the euro only when the quote settles firmly above the descending channel on H4 with the target at 1.0638.