While the UK is in national mourning over the death of Queen Elizabeth II, and market participants are assessing the statements of the new British Prime Minister Liz Truss regarding the future plans of the British government, the pound strengthened against the dollar while remaining vulnerable in the main cross pairs.

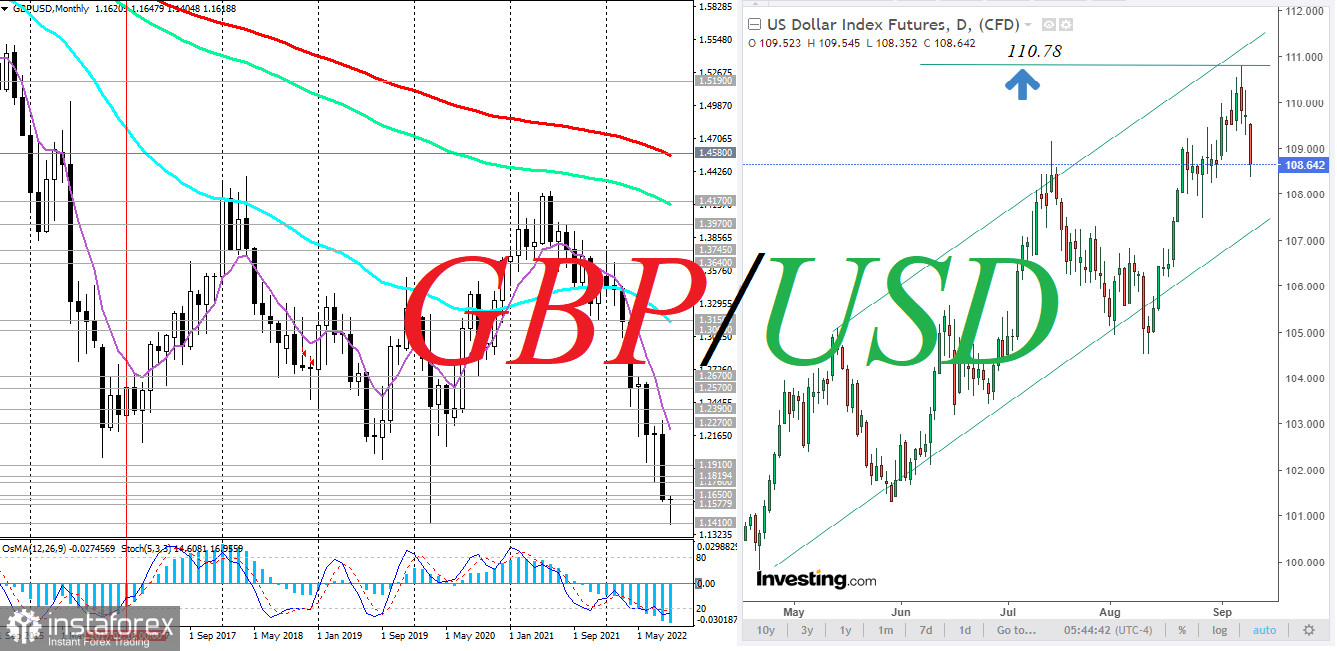

Today, the GBP/USD pair rose to an intra-week high of 1.1647, mainly taking advantage of the weakening dollar. It, in turn, is declining against the background of growing demand for shares and other high-yield assets of the stock market. Investors were also generally positive about the ECB's decision yesterday to raise interest rates by 0.75% rather than 0.50%, as previously thought. In addition, the latest forecasts of economists regarding the rate of GDP growth in the Eurozone suggest that next year the European economy may avoid recession.

"Economic growth rates are declining, but the ECB is not predicting a recession yet," economists say.

The ECB's accompanying statement spoke of the readiness of its leaders to take further steps to tighten monetary policy.

"Curbing the dynamic in inflation is ECB's only concern," said ECB Governing Council member Klaas Knot.

One way or another, investors decided to fix part of long dollar positions at the end of the week, which also led to a decrease in its quotes.

Now market participants will wait for the Fed meeting on September 20–21. US Federal Reserve Chairman Jerome Powell confirmed the readiness of the central bank to continue the policy of high interest rates until the situation with inflation completely stabilizes. The Fed's interest rate is assumed to rise again by 0.75%, which is a bullish factor for the dollar.

In this regard, today market participants will pay attention to the speeches of the Fed representatives Charles Evans, Christopher Waller and Esther George, scheduled for the first half of today's US trading session.

And yet, despite the correction, the dollar retains the potential for further growth. Last Wednesday, its DXY index hit a 20-year high at 110.78. A breakdown of this local resistance level will signal the resumption of the upward dynamics of DXY, and the level of 111.00 will be the nearest target.

As for the pound, important macro statistics on it will be released early next week, and on Thursday (at 11:00 GMT), the Bank of England will announce its decision regarding monetary policy. Most likely, the interest rate will be raised again.

As of this writing, the GBP/USD pair is trading near 1.1618, retreating from today's high of 1.1647. A breakdown of the support level at 1.1578 may be a signal to resume short positions.