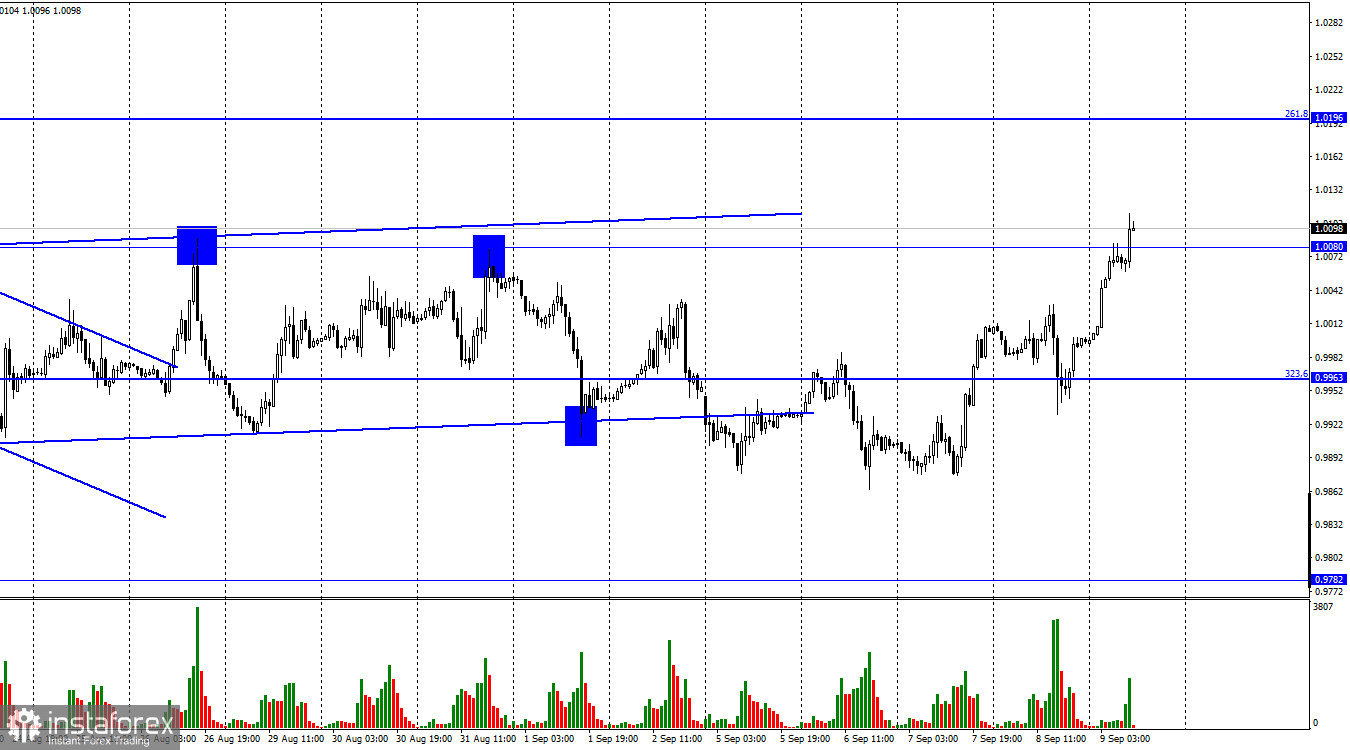

Hello, dear traders! On Thursday, the euro/dollar pair reversed and resumed rising. Today, it consolidated above 1.0080. That is why it may continue climbing to the 261.8% Fibonacci level located at 1.0196. It is the remaining reaction to the ECB meeting, the results of which were unveiled yesterday.

Notably, the ECB decided to raise the key interest rate by 0.75% to 1.25%. This is one of the largest increases in the history of the ECB. What is more, during the press conference, Christine Lagarde said that at the next meetings in 2022, the regulator might also raise the benchmark rate to push inflation to the targeted level of 2%. Christine Lagarde assumed that the total number of increases would be more than 2, but less than 5. Thus, these words gave us a reason to think that at the next meetings the interest rates will increase by 0.50-1.00%. If the ECB keeps its promises, the situation for the single currency will change dramatically. If a month ago, no one expected the ECB to take tough measures against inflation, now the key rate could be raised to 3% by the end of the year. However, such measures could not be enough for inflation to return to 2%. Nevertheless, it is expected to slow down. Whatever it was, the euro received the necessary support, which it lacked for several months.

However, first of all, traders should price in the meeting results so that we can see where the current may move. The higher it climbs, the more chances it will have for a further rise. The fact is that the energy crisis may allow bears to return to the market. Traders fear that the crisis may lead to a long-lasting recession. What is more, the key interest rate hike will also cool down the economy. It is still unclear which factor traders will consider the most important one – recession or high interest rates.

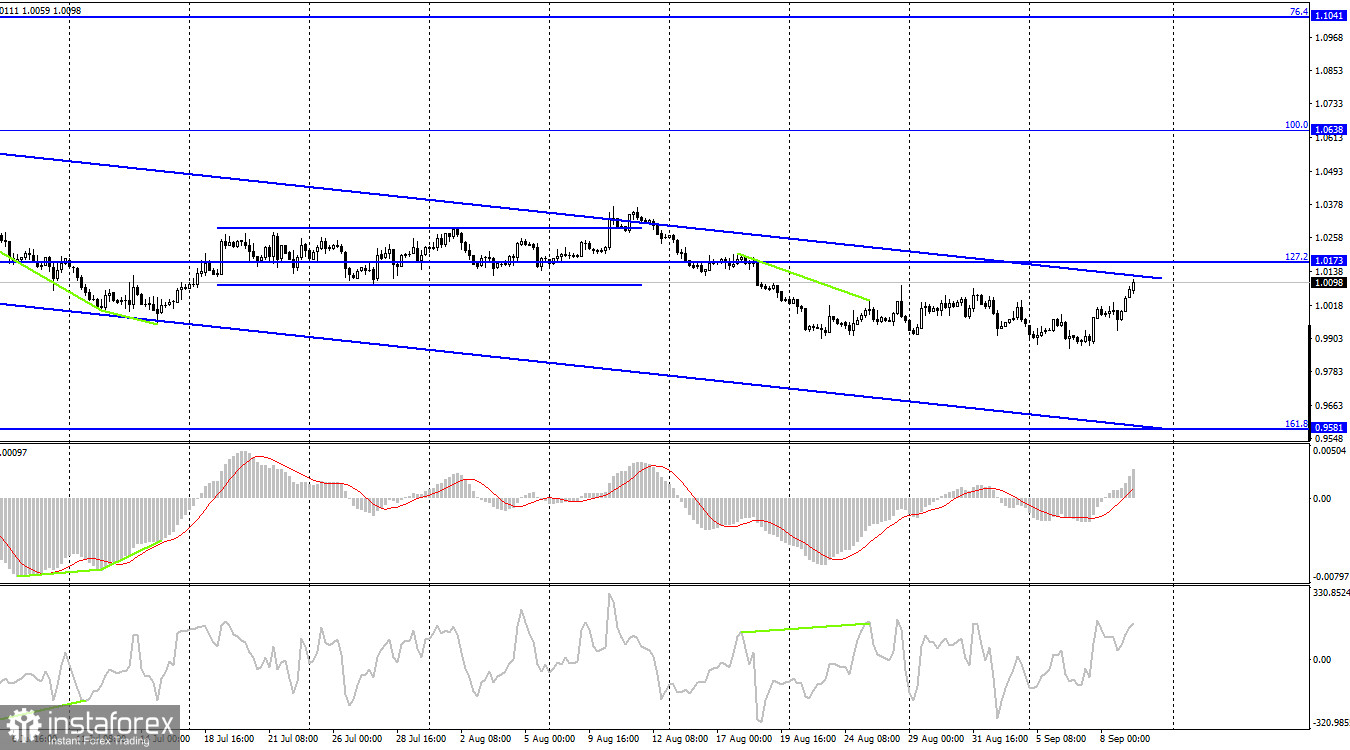

On the four-hour chart, the pair reversed and settled below the 127.2% correctional level of 1.0173. At the moment, it is climbing towards the upper limit of the downtrend channel. This points to the bearish sentiment among traders. If the price bounces off this level, the US dollar will rise. In this case, the euro will decline to the 161.8% correctional level of 0.9581. If the price consolidates above 1.0173, it will have more chances to increase to 1.0638.

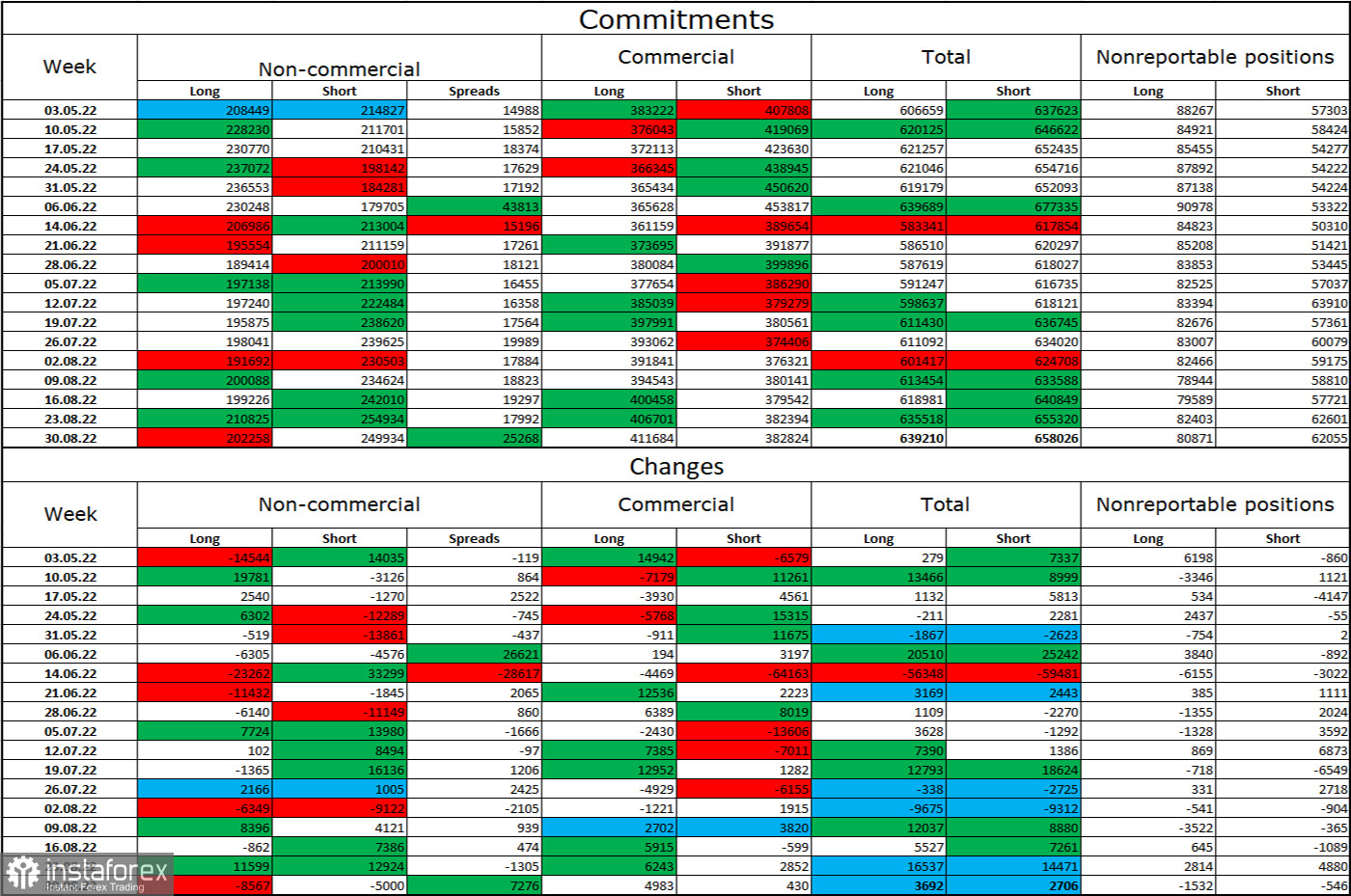

COT report

Last week, speculators closed 8,567 long contracts and 5,000 short contracts. This means that the bearish mood of the major players intensified again. The total number of long contracts stands at 202 thousand, whereas the number of short contracts is 249 thousand. The difference between these figures is still quite small. In the last few weeks, the euro received more reasons to grow. However, the recent COT report showed that the bullish sentiment was becoming weaker. Judging by the COT report, the euro will continue losing value.

Macroeconomic data from the US and the eurozone:

On September 9, the macroeconomic calendar of both the eurozone and the US is absolutely empty. Today, information flow will have zero influence on traders.

Outlook for EUR/USD and trading recommendations:

Traders may go short if the price bounces off 1.0173 or the upper limit of the channel on the 4-hour chart. The target is located at 0.9900. Buy orders could be initiated if the price consolidates above the downward channel on the four-hour chart. The target is at 1.0638.