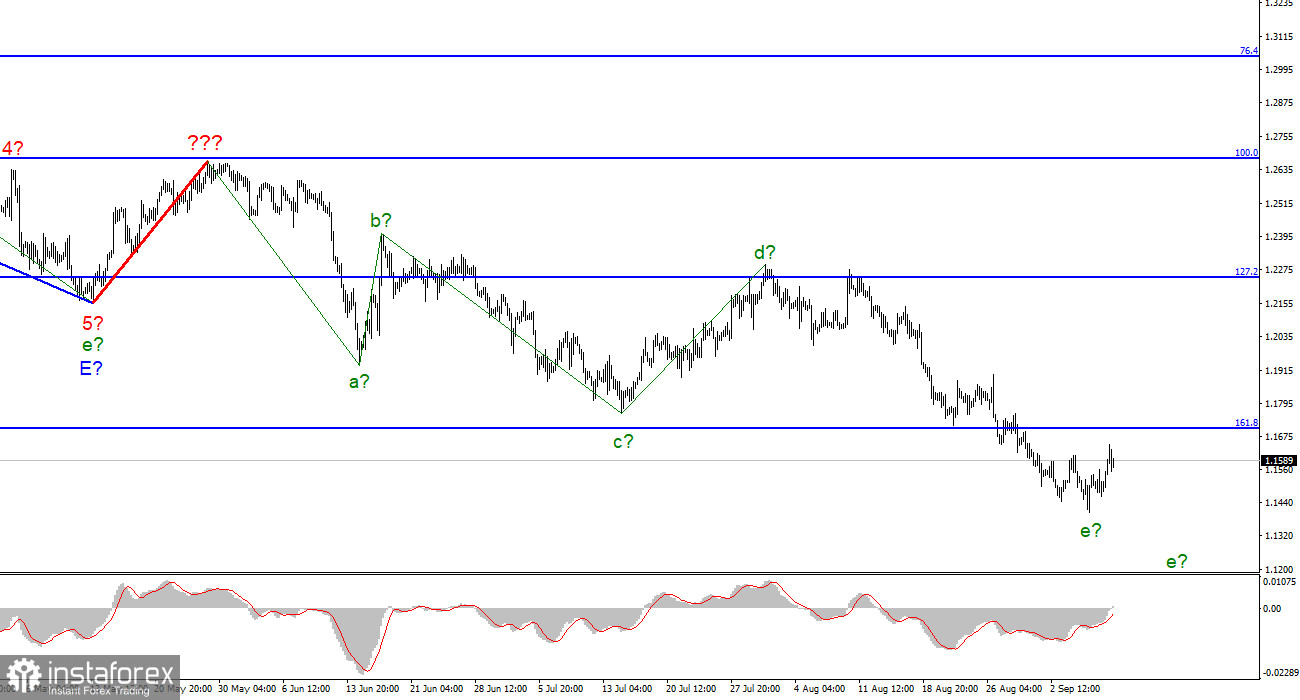

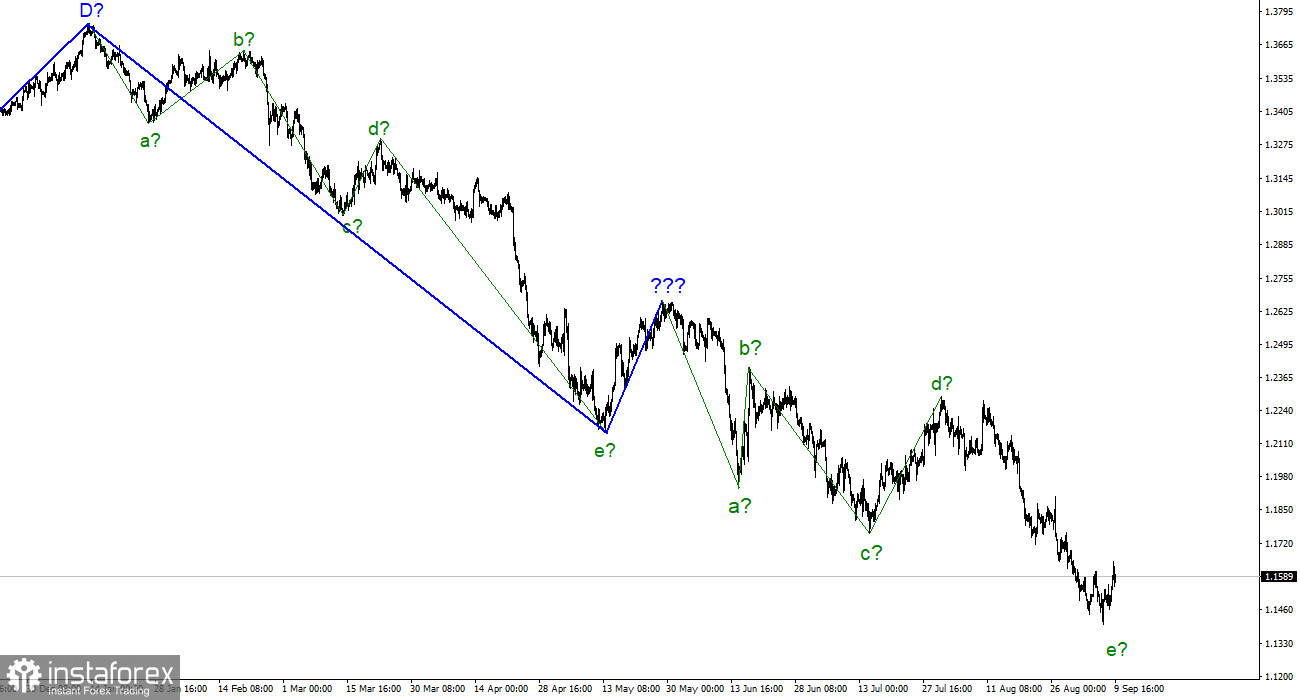

For the pound/dollar instrument, the wave marking looks quite complicated at the moment but still does not require any clarification. The upward wave, which was built between May 13 and May 27, does not fit into the overall wave picture, but it can still be considered corrective as part of the downward trend section. Thus, it can now be concluded that the downward section of the trend continues its construction. At the moment, we have completed waves a, b, c, and d, so we can assume that the instrument is inside wave e. If this is true, then the decline in quotes may continue, and the wave e may take a five–wave form. However, the entire correctional structure, which originated on May 27, may take on a more extended form. Given the news background and the fact that the Fed is not going to stop raising interest rates now, the entire downward trend section may become more complicated. A successful attempt to break through the 1.1708 mark, which corresponds to 161.8% by Fibonacci, indicates that the market is ready for new sales of the British. At the same time, the low of wave e is already much lower than the low of wave c, so wave e can end at any time. The wave markings of the euro and the pound are again very similar.

The Queen of Great Britain has died.

The exchange rate of the pound/dollar instrument increased by 90 basis points on September 9. Thus, the indicator could start building wave 4 in e, and the decline in quotes will resume. The departure of quotes from the reached lows is still too weak to assume the completion of wave e and the entire downward trend segment. There was no news background on Friday, but the movements during the day were quite active. From my point of view, this is not related to any events or factors. The market has been used for trading activity in recent months.

The most important event at the end of this week was the news of the death of Queen Elizabeth II. Her son Charles, who took the name Charles III, ascended the throne. It is unlikely that this unfortunate event affected the mood of the market, so it bought the British at the end of the week. Nevertheless, I can't help but mention this news. In general, this week, the British pound updated its low for almost 40 years, which in itself is a historical fact. The market will be waiting with interest for the meetings of the Fed and the Bank of England, although so far, everything is going to the fact that both central banks will raise their rates again. In the past, the demand for the British continued to decline, even if the British regulator raised its rate. Most likely, it will be the same this time. I don't see any good reasons yet to expect the downtrend to end, but at the same time, I remind you that the wave marking already allows it to end.

General conclusions

The wave pattern of the pound/dollar instrument suggests a continued decline in demand for the pound. I advise now selling the instrument with targets located near the estimated mark of 1.1112, which is equivalent to 200.0% Fibonacci, for each MACD signal "down," but this mark is quite far away, so the instrument may not reach it. Inside the fifth wave, it is necessary to sell more cautiously since the downward section of the trend can end at any moment.

At the higher wave scale, the picture is very similar to the euro/dollar instrument. The same ascending wave that does not fit the current wave pattern, the same five waves down after it. Thus, one thing is unambiguous – the downward section of the trend continues its construction and can turn out to be almost any length.