The GBP/USD currency pair also started the current week on a positive note. The pound sterling, like the euro currency, began to grow at the opening of trading on Monday, so we believe the current growth is exclusively technical. And if so, it is unclear how long it will last. The market has shown that it's time to adjust after falling by 800 points in a few weeks, so again, from a technical point of view, everything is logical now. The pair cannot constantly move in only one direction. Therefore, the growth of the British pound can continue at least until the end of this week, especially since the meeting of the Bank of England was postponed to next week due to the death of the Queen of Great Britain. And next week, there will also be a meeting of the US central bank. And we remember that market participants like to buy the dollar based on a Fed rate hike and do not like to buy the pound based on a Bank of England rate hike. We believe that the global downward trend has not yet been completed, but as long as the price is above the moving average line, selling the pair is stupid. We continue to advise you to act solely on technical analysis. The fundamental background allows us to make certain assumptions that specific signals must confirm. If there are no signals, the "foundation" cannot be worked out separately from the equipment.

Meanwhile, the divergence between BA and Fed rates is unlikely to decrease next week. We believe the US regulator will raise the rate by 0.75%, but even the most minimal option implies an increase of 0.5%. The Bank of England could theoretically raise the rate by 0.75%, but it is likely to raise it again by 0.5%. So, the rate gap will remain unchanged in the best case for the British pound. And rates are one of those factors that have confidently pushed the pound/dollar pair down in the last six months.

Not all Britons are happy that Liz Truss has become Prime Minister.

The new British Prime Minister is already being called "the second Margaret Thatcher," but it should be remembered that Conservatives, not the British people, elected her. Therefore, it is not surprising that after Liz Truss's victory, a tub of criticism has already poured out on her. She was also reminded of the not very successful 12 months of foreign policy, during which the UK spoiled relations with many countries worldwide. She was reproached for the weak economic situation of the country and her inability to solve issues of this scale. Therefore, Truss can now be considered the most successful and suitable Prime Minister of the available options, but time will tell whether she will become the "new Margaret Thatcher." Moreover, Britain loves to drive away its leaders ahead of schedule. And the legacy after Boris Johnson Truss did not get the best.

The British tabloid The Guardian writes that the UK is a sinking ship. The British pound has fallen to 37-year lows, and the economy has suffered significant losses after Brexit and the pandemic. Now it is on the verge of an energy crisis, a crisis of rising living costs, and the verge of a serious recession. Will the current government have enough ability to keep this country afloat? The Guardian calls Truss an "untested prime minister," writes about the small number of allies in the international arena, and also talks about Thatcher's "laurels" that haunt Truss. The tabloid openly declares that the country may "find itself on the sidelines" with the highways, although for now, it is still too early to draw such conclusions. However, another conclusion can be drawn: Truss does not have unprecedented support among the population, which means she will have to win the trust of the British with her decisions and deeds and not with words and promises. The Guardian also notes that the death of Queen Elizabeth II can only worsen the career of the Trails since, at this time, the British do not feel cohesive, and inflation, meanwhile, is conquering 40-year highs and is not going to slow down yet. Britain could be overwhelmed by a wave of bankruptcies due to rising energy prices, and the consequences for the country could be terrible.

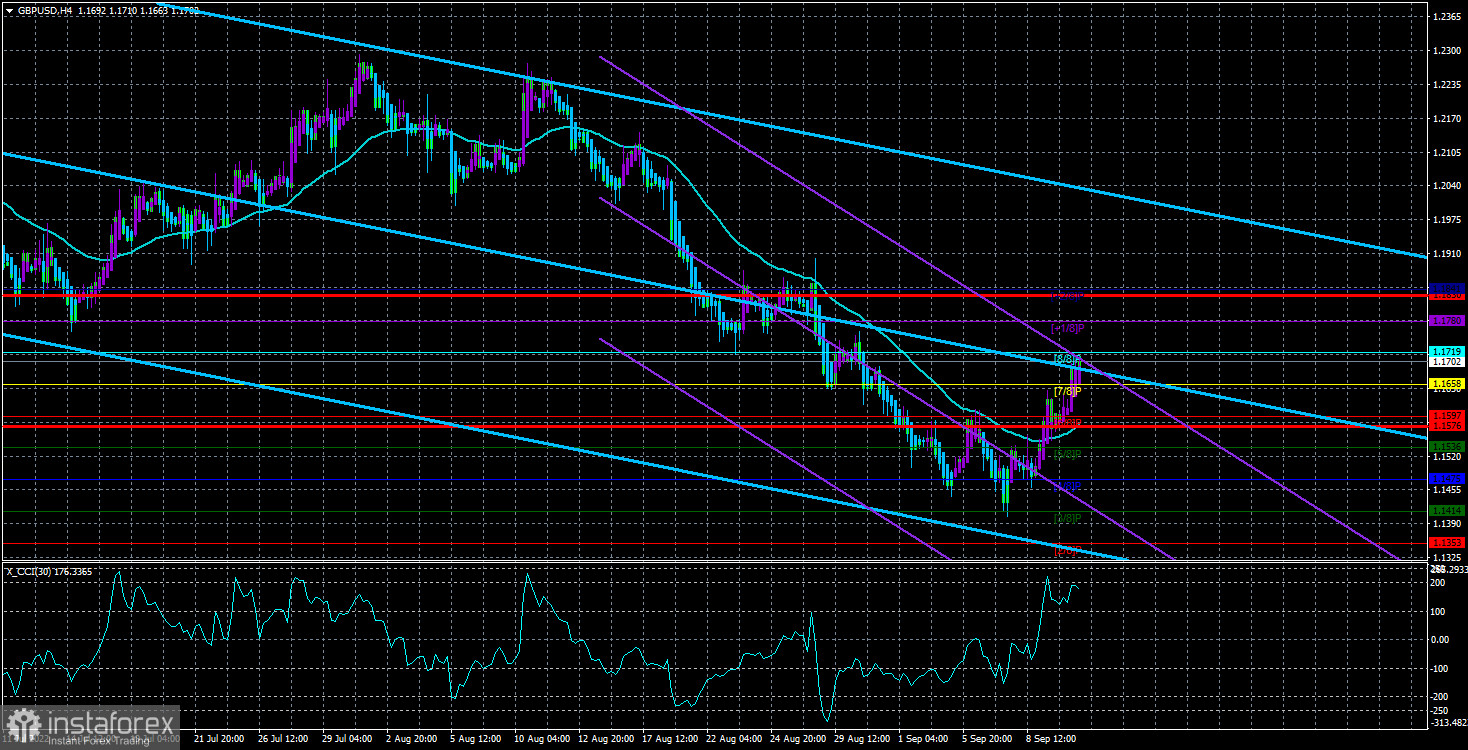

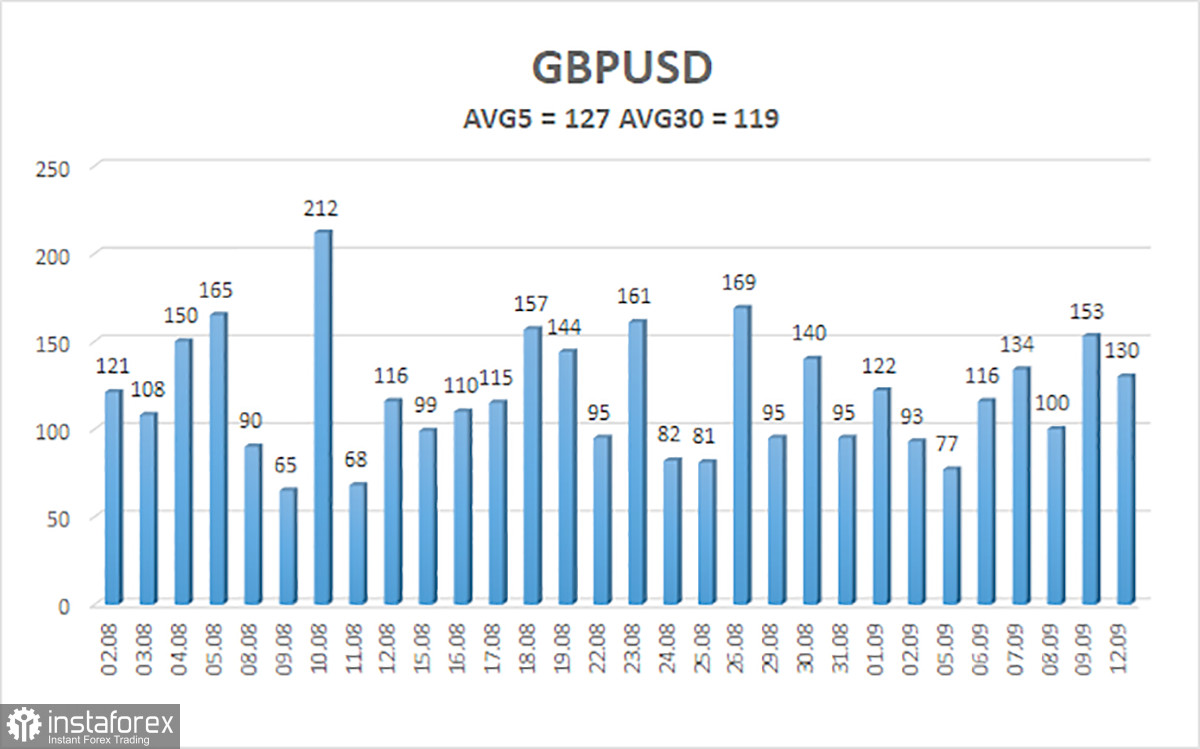

The average volatility of the GBP/USD pair over the last five trading days is 127 points. For the pound/dollar pair, this value is "high." Therefore, on Tuesday, September 13, we expect movement inside the channel, limited by the levels of 1.1576 and 1.1830. The reversal of the Heiken Ashi indicator downwards signals a round of downward correction.

Nearest support levels:

S1 – 1.1658

S2 – 1.1597

S3 – 1.1536

Nearest resistance levels:

R1 – 1.1719

R2 – 1.1780

R3 – 1.1841

Trading Recommendations:

The GBP/USD pair has overcome the moving average on the 4-hour timeframe and is continuing its upward movement. Therefore, at the moment, you should stay in buy orders with targets of 1.1780 and 1.1830, which should be held until the Heiken Ashi indicator turns down. Sell orders should be opened when anchoring below the moving average line with targets of 1.1536 and 1.1475.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. If both are directed in the same direction, then the trend is strong.

Moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.