Overview:

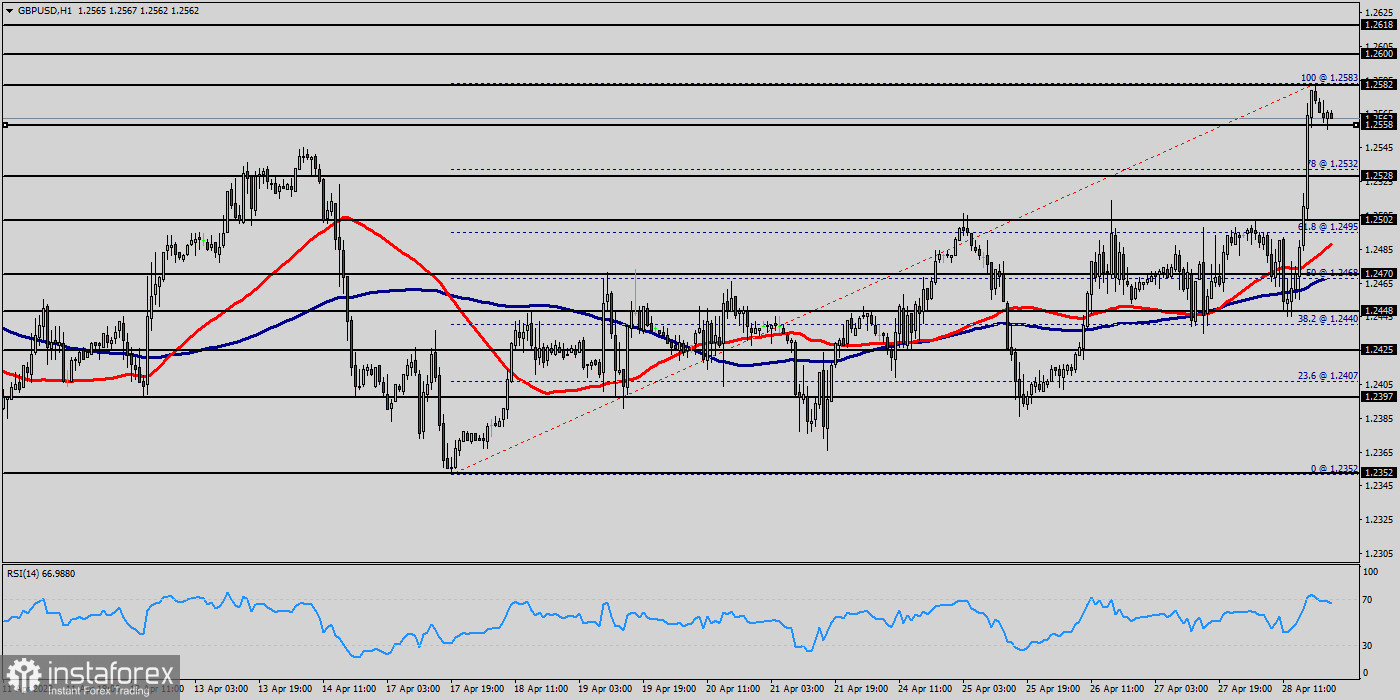

The GBP/USD pair has faced strong support at the level of 1.2502 because resistance became support. So, the strong resistance has been already faced at the level of 1.2582 and the pair is likely to try to approach it in order to test it again.

The level of 1.2502 represents a weekly pivot point for that it is acting as minor support this week. Furthermore, the EUR/USD pair is continuing to trade in a bullish trend from the new support level of 1.2502.

Currently, the price is in a bullish channel. According to the previous events, we expect the EUR/USD pair to move between 1.2502 and 1.2582.

Also, it should be noticed that the double top is set at 1.2582. Additionally, the RSI is still signaling that the trend is upward as it remains strong above the moving average (100).

This suggests the pair will probably go up in coming hours. Accordingly, the market is likely to show signs of a bullish trend.

In other words, buy orders are recommended above 1.2502 with the first target at the level of 1.2582.

Next week :

If the trend is be able to break the double top at the level of 1.2582, then the market will continue rising towards the weekly resistance 1 at 1.2618.

On the other hand, if the GBP/USD pair fails to break through the resistance level of 1.2582 this week, the market will decline further to 1.2502 again so as to retets the weekly pivot point on Friday 29th, 2023.

The pair is expected to drop lower towards at least 1.2502 with a view to test the weekly pivot point. Also, it should be noted that the weekly pivot point will act as minor support today at the price 1.2502.

Indicators :

This would suggest a bearish market because the moving average (100) is still in a positive area and does not show any trend-reversal signs at the moment. EMAs gives more weight to the most recent periods, because moving average is quick moving and works well at showing recent price swings.

On the other hand, Simple Moving Average (EMA) displays a smooth chart which which removes most false signals. Moreover, with using SMAs, you can know whether a pair is trending up or trending down.

Consequently, if you want to obtain a clearer signal of whether the pair is trending up or down if you combine two or more moving averages because simple and exponential are the two major types of moving averages.

Signals:

The trend is still bullish as long as the price of 1.2502 is not broken. Thereupon, it would be wise to buy above the price of at 1.2502 with the primary target at 1.2582. Then, the GBP/USD pair will continue towards the second target at 1.2618. The breakdown of 1.2618 will allow the pair to go further down to the prices of 1.2713.