Long-term perspective.

The EUR/USD currency pair was traded illogically again this week. We should start with the fact that we did not see any corrections in the short or long term. Recall that for the last one and a half months, the pair has been slowly but almost without correction growing. Therefore, assuming that after 600 points up, it is necessary to step back down a bit would be logical. In the last nine months, the pair has shown growth of 1600 points and corrected only by 500, which is also very little. No macroeconomic background would unequivocally support the euro currency this week. At the beginning of the week, several speeches by ECB representatives took place, which can be interpreted in any way. Traders interpreted them "in any way," again in favor of the euro currency. The fact that the European economy has not been growing for several quarters does not bother them. The fact that the ECB may slow down the pace of monetary policy tightening next week to a minimum (which will be a harbinger of the end of the entire rate hike cycle) also does not. Therefore, the situation remains the same: whatever happens in the market, the euro still grows. And when it does not grow, it does not fall.

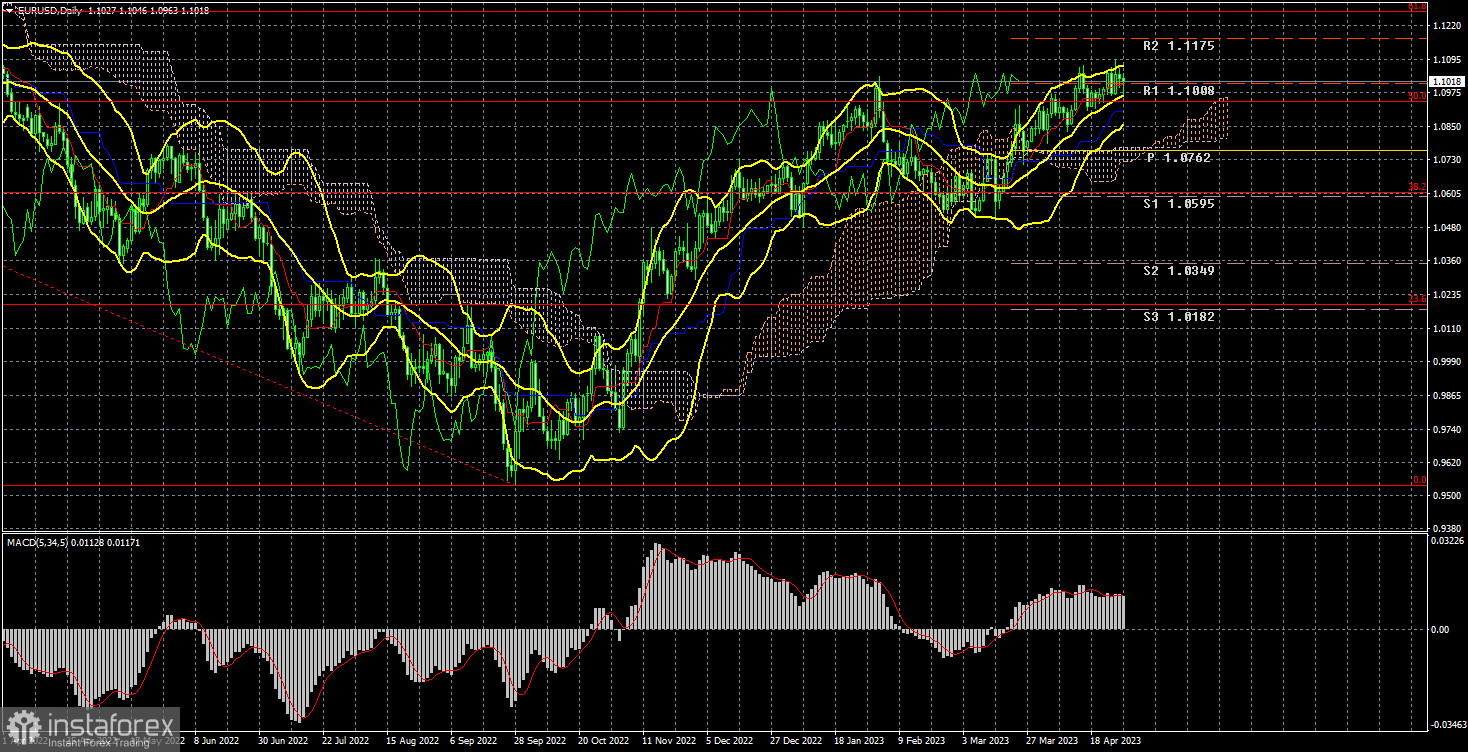

Technically, we still have a consolidation above the important Fibonacci level of 50.0%, which allows us to expect further growth of the euro currency. However, the European currency has mostly stayed the same in the last few weeks. Such a paradox. The euro is both growing and not growing at the same time. The European Union currency is overbought, and there are no new growth factors after 1600 points up. But market participants refuse to fix long positions, so we do not see a correction. In general, the situation remains illogical, and any development of events can be expected. The pair will sooner or later collapse downward, but we remind you that trading should be done based on trade signals and considering the fundamental background. There is no need to try to guess the future movements of the pair.

COT Analysis.

On Friday, a new COT report for April 25th was released. In the last 8–9 months, the data from COT reports have fully corresponded to the market situation. The illustration above clearly shows that the net position of large players (second indicator) began to grow in September 2022. At about the same time, the European currency also began to grow. Currently, the net position of non-commercial traders is bullish and remains very high, as does the position of the European currency, which cannot even adjust downwards properly. We have already drawn traders' attention to the fact that the rather high value of the "net position" allows us to assume a soon ending of the upward trend. The first indicator signals this, where the red and green lines have moved far apart, often preceding the end of the trend. The European currency tried to start a decline, but we have seen only a trivial downward pullback so far. During the last reporting week, the number of buy contracts for the "non-commercial" group increased by 1.1 thousand, and the number of shorts decreased by 3.9 thousand. Accordingly, the net position grew again by 5 thousand contracts. The number of buy contracts is higher than that of sell contracts for non-commercial traders by 169 thousand, which is very high. The gap is almost threefold. A correction is still brewing, so even without COT reports, it is clear that the pair should start a new decline. But so far, we only see movement to the north.

Fundamental event analysis.

Several speeches by ECB representatives took place in the European Union this week, stating that the rate will continue to rise and inflation will decrease. All the most important data was released only on Friday. In Germany, the GDP report for the first quarter showed a 0% increase. In the European Union, GDP for the first quarter showed a 0.1% increase. Inflation in Germany in April fell to 7.2%, while the unemployment rate remained unchanged at 5.6%. As we can see, the data is quite mediocre. Yet, the European currency managed to rise even on the last trading day of the week, despite no significant and resonant statistics in the United States. There were only data on the expenditure and income of the American population and the Personal Consumption Expenditures Index. The values of all three indicators turned out to be maximally neutral, but the US dollar was confidently falling again during the American trading session. However, the day before, the dollar strengthened when US GDP in the first quarter was twice lower than forecast.

Trading plan for the week of May 1–5:

- In the 24-hour timeframe, the pair consolidated back above the Ichimoku indicator lines, but we cannot conclude that the upward trend will continue for a long time. The pair's decline is likely, but there are no current sell signals. Therefore, formally, it is possible to trade on the rise now, but it should be understood that the European currency may start a collapse at any moment. The market situation could be clearer.

- As for selling the euro/dollar pair, it can be considered in the 24-hour timeframe by the price consolidating below the critical line. We expect the correction to be 50% of the entire upward trend, i.e., in the area of the 1.0300 level. The ECB will not raise the rate forever, so market participants maintain high demand for the euro currency.

Explanations for the illustrations:

Support and resistance price levels, Fibonacci levels - levels that are targets when opening purchases or sales. Take Profit levels can be placed near them.

Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5).

Indicator 1 on COT charts - the size of the net position for each category of traders.

Indicator 2 on COT charts - the size of the net position for the "Non-commercial" group.