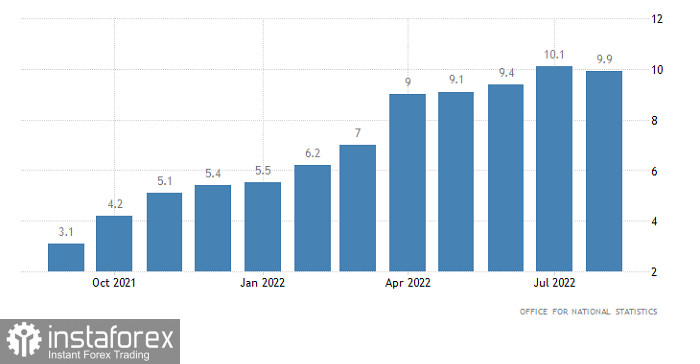

In the UK, inflation slackened to 9.9%, whereas economists had expected a rise to 10.6% from 10.1%. This data should have led to the pound's depreciation. However, the day before that, the currency showed a considerable drop. That is why the market needed a rebound. As a result, the pound sterling jumped despite the data that pointed to a lower pace of monetary policy tightening.

UK Inflation

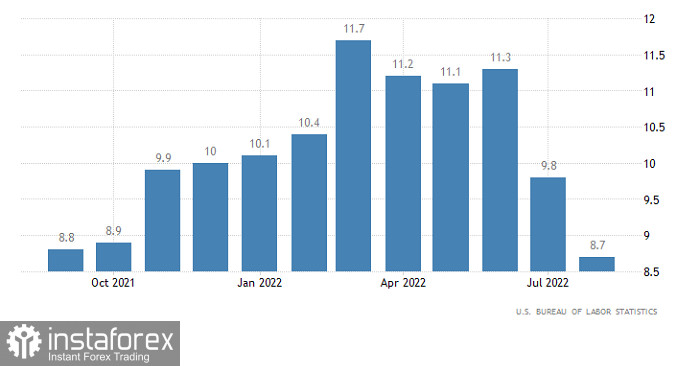

Traders realized what the data meant only at the beginning of the US trade. The pound sterling began moving towards the levels it was trading before the publication. Curiously, this happened just at the moment of the US PPI data release. The growth in producer prices slackened to 8.7% from 9.8%, whereas economists had anticipated a decline to 8.9%. There are signs of a further drop in inflation. It means that the Fed has no reason to raise the benchmark rate by 100 basis points. Nevertheless, the greenback increased.

US Producer Price Index

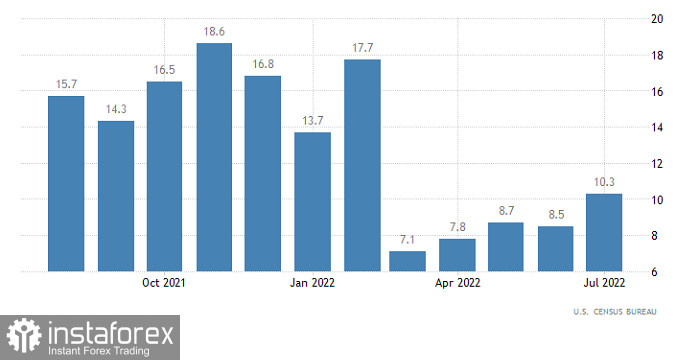

In any case, the market is not ignoring macroeconomic reports. That is why today, the pound sterling may show a rebound amid the US reports. Thus, US retail sales may increase by 9.0% compared to a rise of 10.3%. What is more, industrial production may also show a smaller increase of 3.5% compared to 3.9%. On top of that, there is a great possibility of a full-scale strike of railway workers. That is why the greenback has no reason to grow.

US Retail Sales

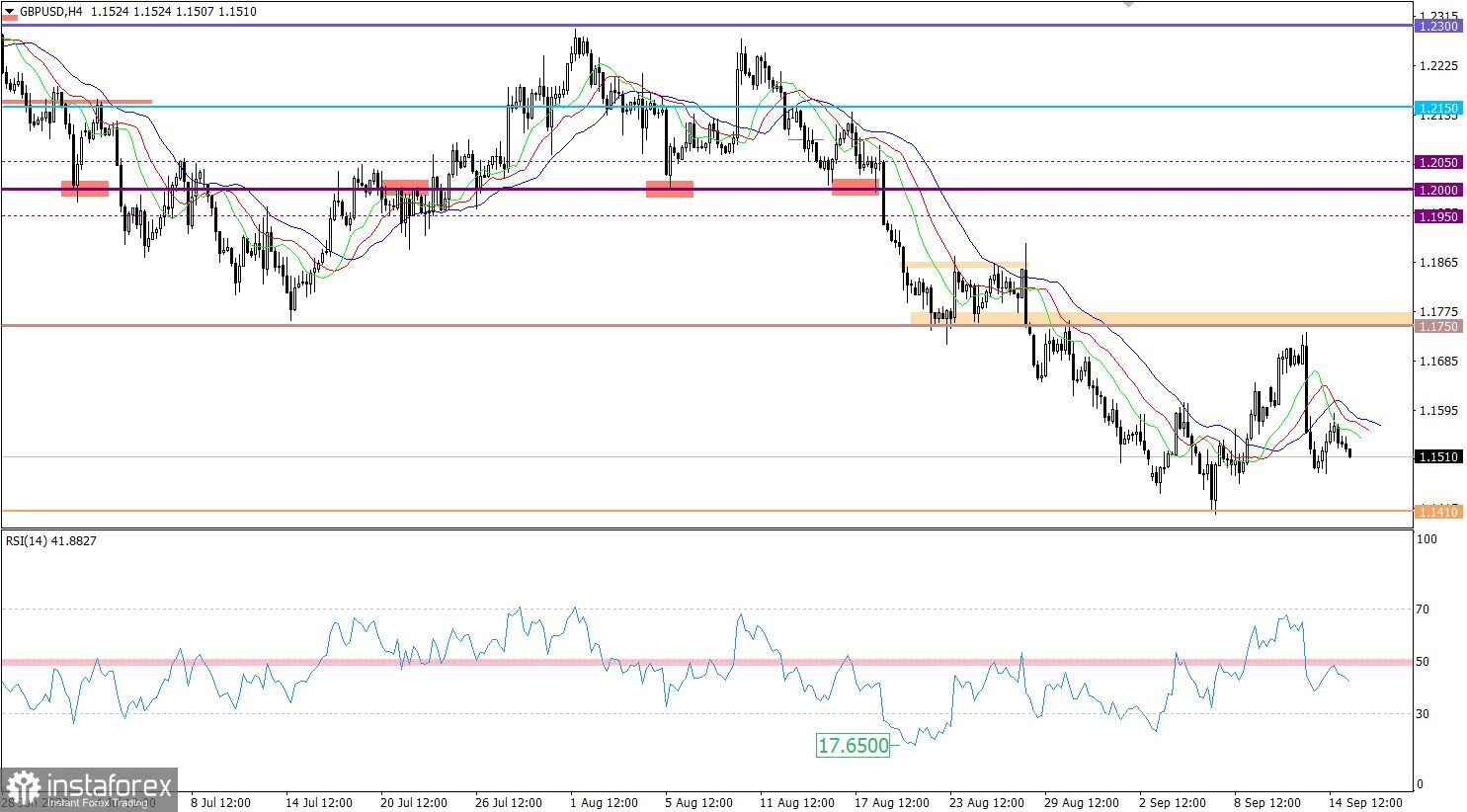

When rebounding from 1.1480, the pound/dollar pair reached the level of 1.1588, where demand for the US dollar resumed mounting. As a result, the quote dropped to the recent support level.

On the four-hour and daily charts, the RSI technical indicator is hovering in the lower area of 30/50. This points to the fact that bearish sentiment prevails among traders.

On the four-hour chart, the Alligator's moving averages are headed downwards, which corresponds to the recent movement. On the daily chart, the indicator is still pointing to the downtrend as moving averages do not intersect each other.

In the daily period, the downtrend is gaining momentum after the recent correction. The main support level is located at 1.1410, the low recorded in 2020.

Outlook

Under the current conditions, the price settlement below 1.1480 on the four-hour chart will form a signal of a further drop. In this case, the pair is highly likely to touch the low logged in 2020.

Traders should take into account that short positions on the pound sterling are overheated. If the price fixes above 1.1480, it may jump to 1.1588-1.1600.

In terms of the complex indicator analysis, we see that technical indicators are providing short signals in the short-term and intraday periods. In the mid-term period, the indicator points to a downtrend.