Early in the American session, the Japanese yen is trading around 137.00 below the strong resistance of 8/8 Murray and below the 21 SMA located at 137.41.

Yesterday in our technical analysis we explained our view that a technical correction could occur in the USD/JPY pair. You can check through our user or here, we mentioned that USD/JPY could face a strong resistance zone at 137.50 due to overbought levels.

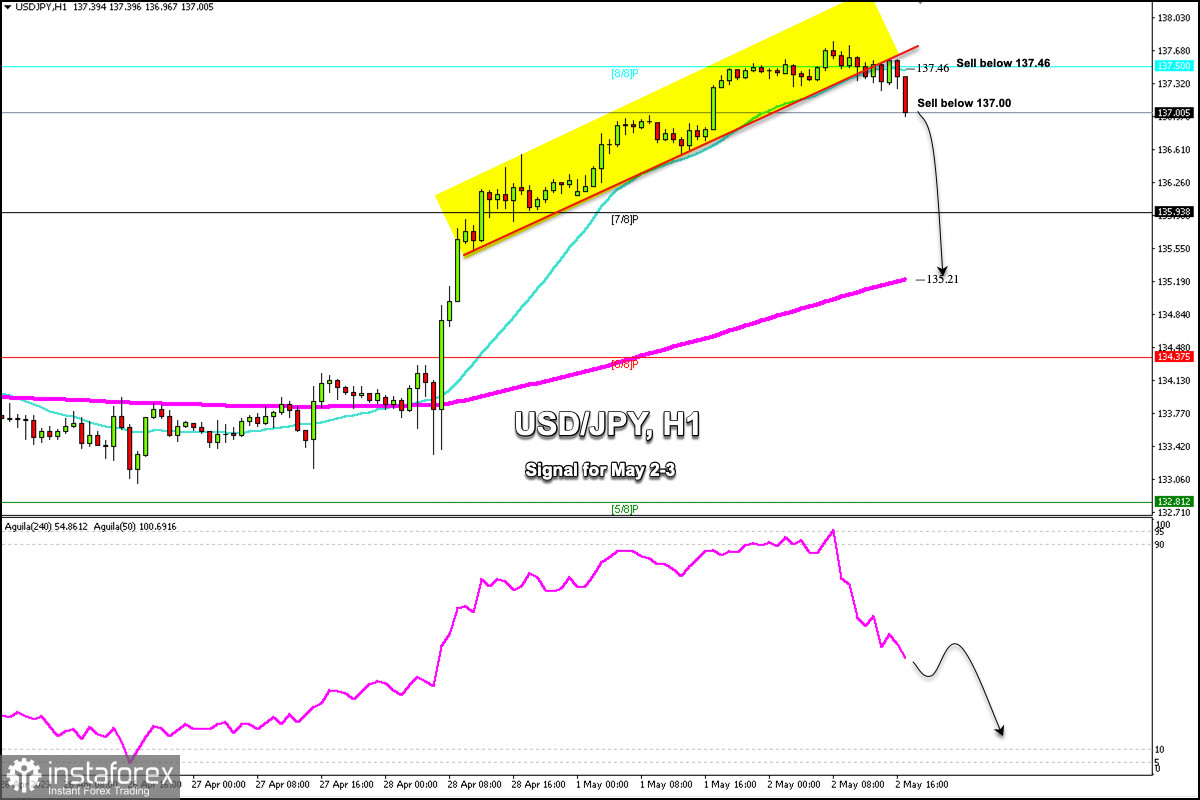

In the 1-hour chart, we can see that the Japanese Yen broke sharply the uptrend channel formed since April 28 and made a pullback, thus confirming the bearish signal for the next few hours.

We expect that in the next few hours, the USD/JPY pair can fall below 137.45 (21 SMA) and can reach 7/8 Murray located at 135.93 and could fall to the 200 EMA located at 137.21.

Yesterday, the Eagle indicator reached 95 points in the 1-hour chart. This represents extremely overbought levels. Since then, the indicator has been giving a negative signal. USD/JPY is likely to continue its decline in the next few hours until 135.93 (7/8 Murray) and even 135.21.

Our trading plan for the next few hours is to sell at the current price level of 137.00 or in case of a pullback below 137.46, with targets at 135.21 (200 EMA) and finally at 6/8 Murray at 134.37.