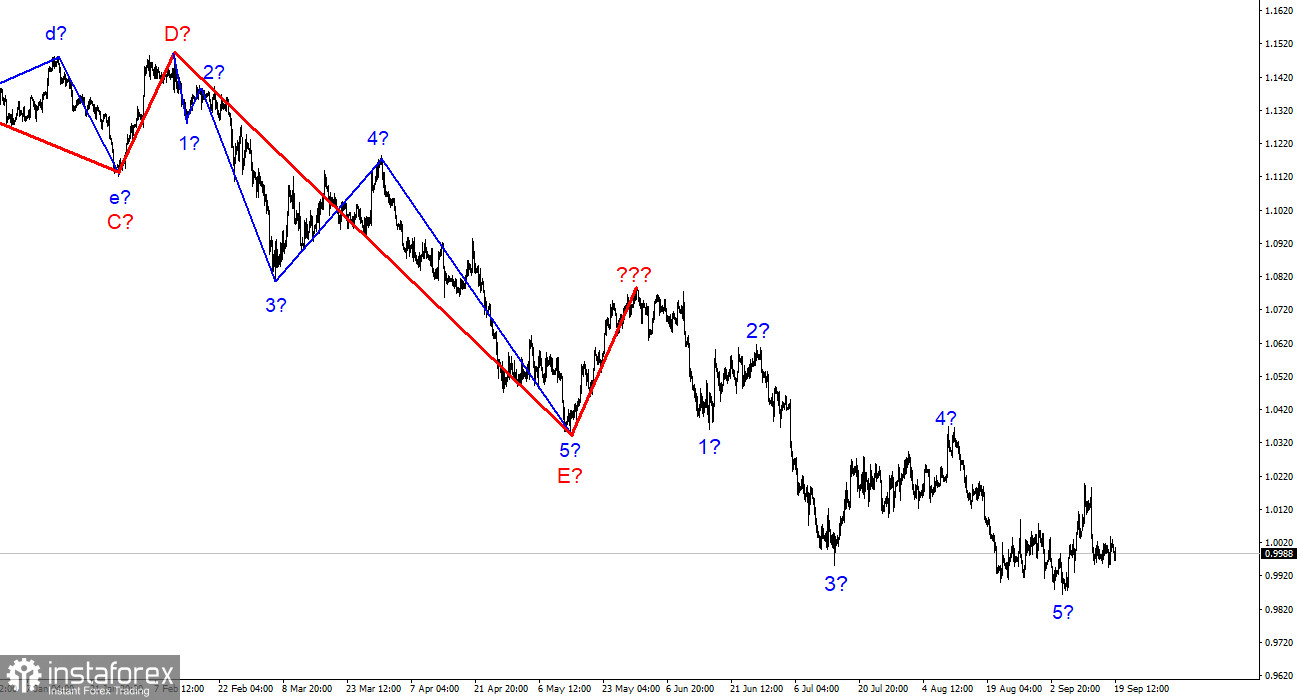

The wave marking of the 4-hour chart for the euro/dollar instrument still does not require adjustments, but it is undoubtedly becoming more complicated. Given the rather strong increase in the quotes of the euro currency, it can be assumed that wave 5 has completed its construction since it is unlikely that the rising wave of the last week is part of wave 5. Thus, the working option ends a long downward trend and begins a new, ascending, minimum corrective, minimum three-wave. Since the European currency still does not show strong growth, I cannot say that there will be no more decline in demand for this currency in the near future. The option of constructing a correction section and further resuming the downward one is not excluded at all. The option of complicating the entire downward section of the trend is not excluded, which in this case, will take an even more extended form. The news background for the markets remains one of the key factors, so if it gets worse, the demand for the euro may start to fall again. And it can get worse, as last Tuesday's US inflation report showed us. Nevertheless, the wave marking indicates that the market is ready to build at least three waves.

The end of 2022 may be unpredictable

The euro/dollar instrument increased by 20 basis points on Friday, and today it decreased by 30. And in general, the instrument has been trading horizontally for the fourth day in a row. This is what I said above – the wave marking is becoming more complicated, and the complication now concerns the last descending and last ascending waves. It seems quite convincing if you try to look at the wave picture with an impartial eye. Nevertheless, there is a feeling that the construction of a downward trend section may not end there. There are several more Fed meetings ahead in 2022 and several ECB meetings at which important decisions on rates will be made. Thus, if all the previous meetings with similar decisions contributed to the reduction of the instrument, then all the remaining meetings can also contribute.

This week, there is no point in discussing anything other than the Fed meeting. This is a key event this week and for the whole month. Moreover, the market is waiting for a new rate increase by 75 basis points. Some analysts allow increases of 100 basis points. There are rumors that the Fed may raise the rate by 75 points at the two remaining meetings this year. Superficially, it seems that everything is clear and understandable. Still, Jerome Powell said earlier that the FOMC would monitor changes in the consumer price index and monetary policy following these changes. Thus, the situation with rates, the mood of the Fed, and the market's reaction to all these events can change rapidly. And the wave marking predicts the imminent completion of the downward trend section.

General conclusions

Based on the analysis, I conclude that the construction of the downward trend section is not completed with a probability of 100%. Sales should be abandoned for a while since, at this time, we have five waves down, and the tool can now build a corrective set of waves. I would not advise you to rush with purchases either since the news background may cause a new drop in demand for the European currency. The FOMC meeting will be held this week.

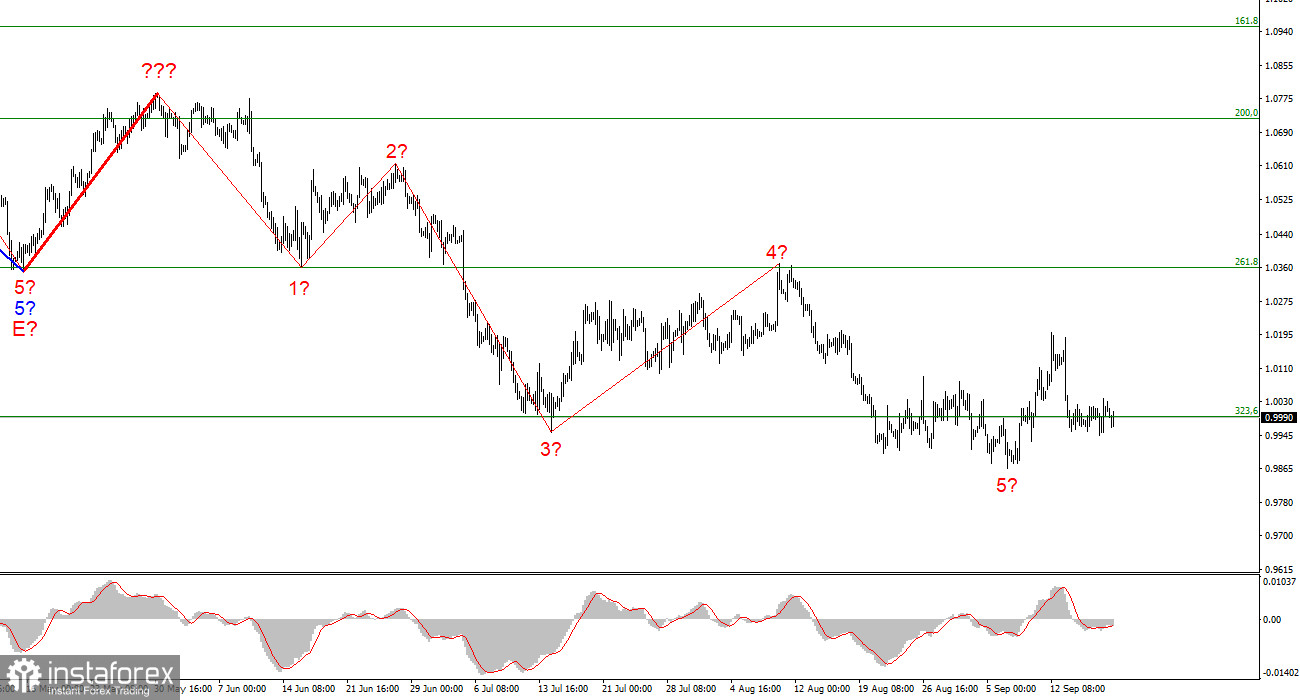

At the higher wave scale, the wave marking of the descending trend segment becomes noticeably more complicated and lengthens. It can take on almost any length, so I think it's best to isolate the three and five-wave standard structures from the overall picture and work on them. One of these five waves can be completed right now.