The euro and the pound continue to actively lose ground against the US dollar as the Federal Reserve is ready to raise interest rates to the highest level since 2008 and predicts further increases. Fed Chairman Jerome Powell has repeatedly spoken about the need to make every effort to curb inflation, which is detrimental to the economy, and most likely today we will hear a number of proofs of this.

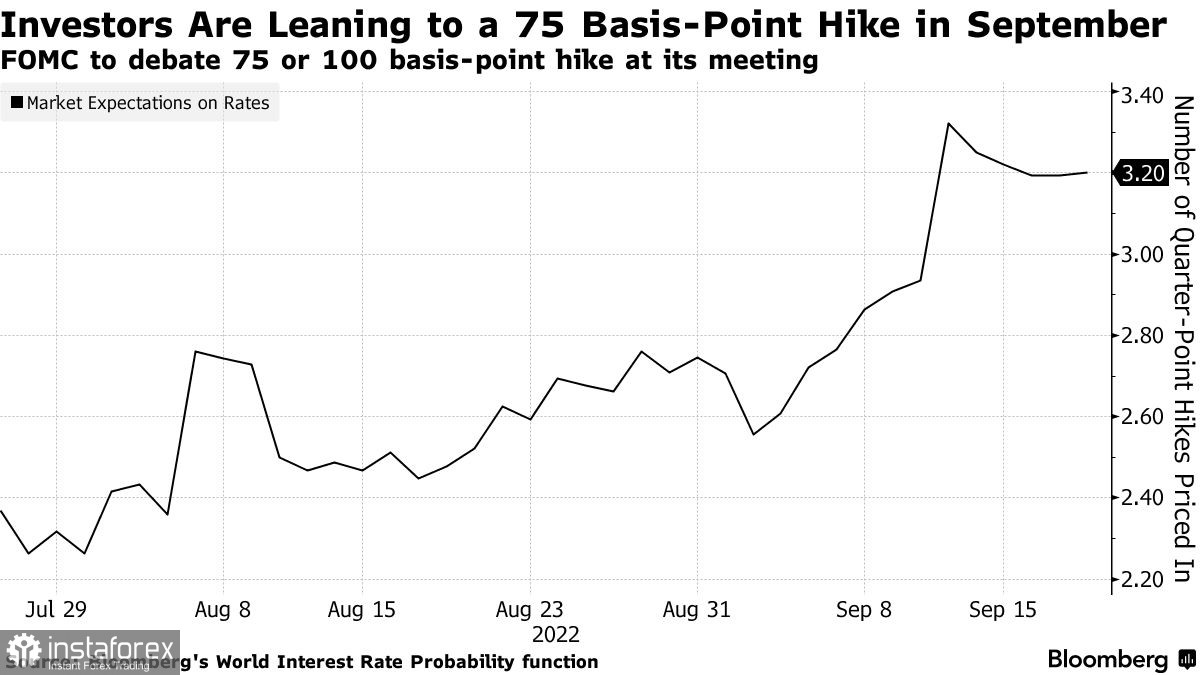

Today, the Federal Open Market Committee is expected to raise rates by 75 basis points for the third time in a row, which will be the most aggressive tightening since Paul Volcker headed the central bank in the early 1980s. Then he made a mistake and began to cut rates quickly, allowing inflation to take root in the economy. Now the Fed very often declares that they will not allow such events. The decision, as well as the Fed's quarterly forecasts, will be announced later today, after which Powell will hold a press conference.

I have repeatedly noted that the planned increase has already been taken into account in the quotes, and the markets will focus more on the forecasts of politicians for further tightening of monetary policy. If Powell's strategy that rates should remain high for a longer time is confirmed, we can expect another round of strengthening of the US dollar against risky assets and a sharp drop in stock indices.

Currently, it is expected that rates will reach a maximum of about 4.5% in March next year, but it is very important how Fed officials react to this today, who have not yet given a clear idea of their plans for interest rates for the future. Initially, it was expected that they would begin to decline in the fall of next year, but everything can change quite quickly.

There is also talk that although rates will be raised by only 0.75%, Fed leaders are likely to discuss the possibility of a 100 basis point increase, especially after prices rose more than expected in August. At the moment, the markets estimate the probability of such an increase at almost 20%.

Most likely, Powell will emphasize the committee's determination to keep rates higher longer than originally planned and will be more frank in recognizing that the economy may slip into recession in the near future, which will be the result of the fight against inflation. He may also refrain from making statements about when the committee plans to slow down the pace of rate hikes — although this will inevitably happen at some point. This will also be a bullish signal for the US dollar.

As noted above, the updated forecasts will include more distant horizons for 2025. Although investors' main attention will be focused on rates for this and next years, forecasts may also show that the FOMC expects to keep rates at a higher level and start reducing them only in 2024 to 3.6% and to 2.9% in 2025.

Most economists expect a unanimous decision on rates this month. If there is disagreement, it most likely comes from the president of the St. Louis Federal Reserve, James Bullard, who this year expressed the need for a softer approach. But the president of the Federal Reserve Bank of Kansas City, Esther George, clearly changed her mind and, on the contrary, expressed disagreement with the dovish direction.

As for the technical picture of EURUSD, so far the bulls are resisting with all their might and do not want to surrender the market, but apparently this is inevitable. At the beginning of the European session, the euro had already fallen heavily. At the moment, the immediate task of buyers is to protect the 0.9900 support. Its breakthrough will push the euro lower at 0.9870. The breakdown of the annual minimum will leave a real prospect of reaching 0.9810 and 0.9760. It is quite difficult to talk about the prospects for the growth of risky assets in the current conditions. To begin with, the bulls need to return to 0.9950, which will allow them to reach the euro's parity against the dollar. In the case of a larger upward trend, it is obvious that sellers will manifest themselves in the area of 1.0040 and 1.0090.

The pound also collapsed to the 13th figure and the pressure on the pair was only maintained. Only after returning to 1.1400, it will be possible to expect that buyers will begin to act more actively. This will create quite a good chance for a larger upward correction, which will provide a direct road to the area of highs: 1.1440 and 1.1480. The farthest target in the current bullish movement will be the 1.1520 area. If the pressure on the pair persists, buyers will have to try very hard to stay above 1.1300. Without doing this, you can see another large sale between 1.1260 and 1.1200.