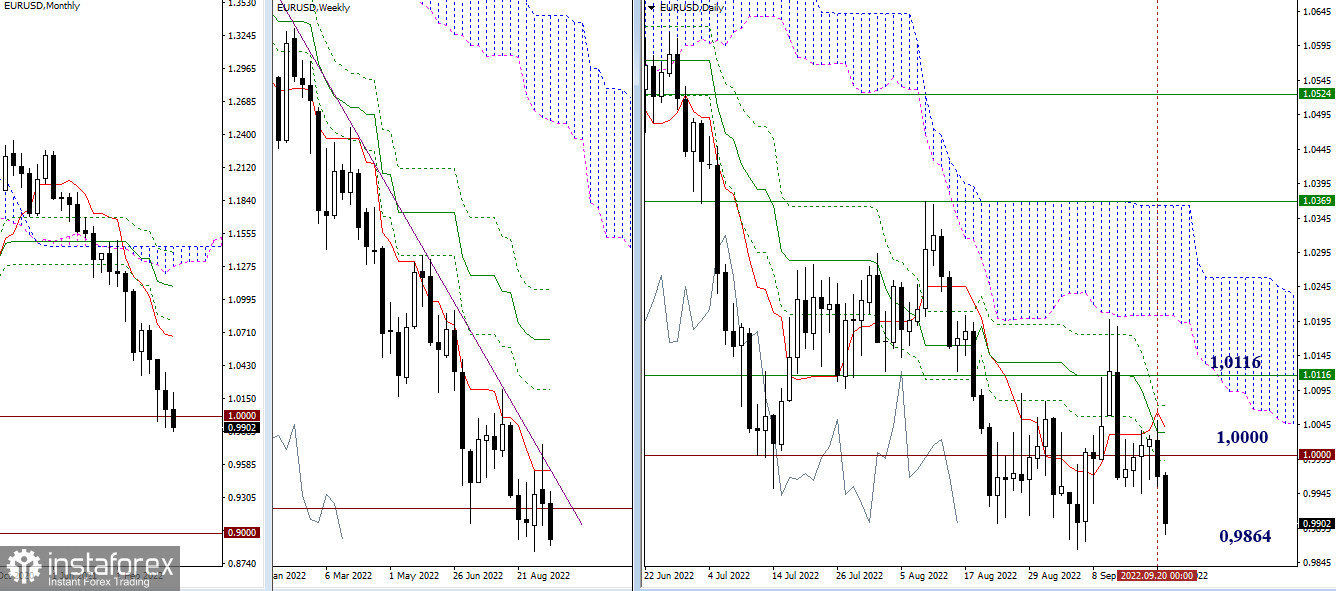

EUR/USD

Higher timeframes

The situation is in favor of sellers as the pair continues to decline. The bearish sentiment will strengthen further if the psychological level of 1.0000 is broken and the quote heads under 0.9864.

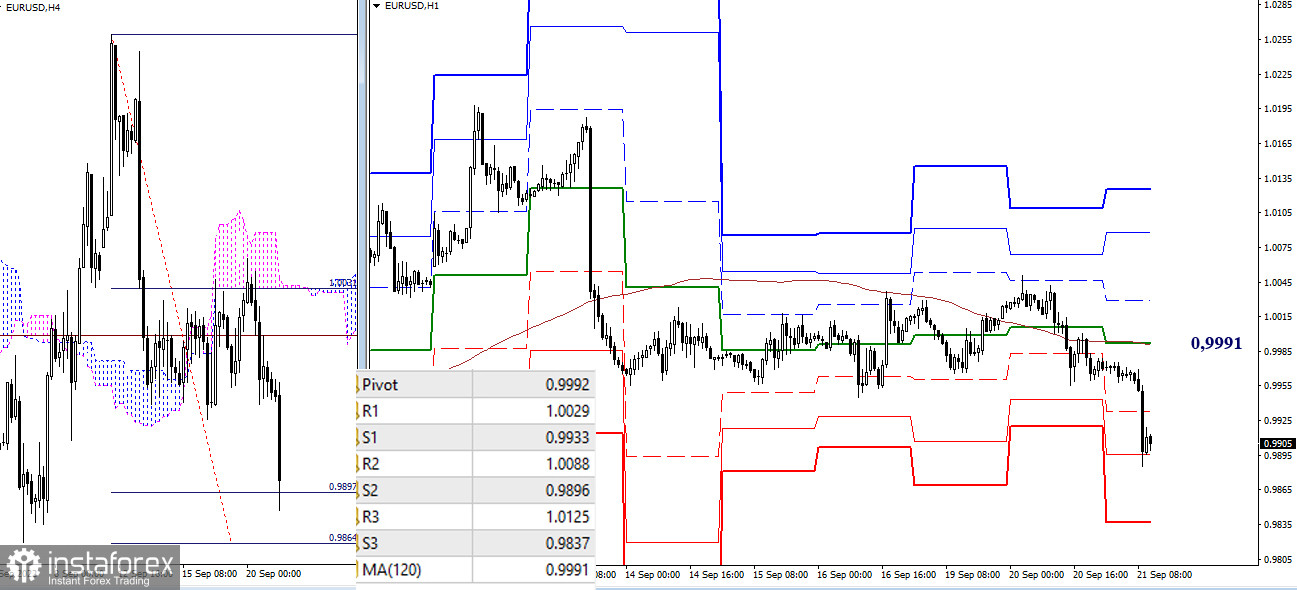

H4 - H1

The pair tested the support of S2 (0.9896) and moved towards the first target for the breakdown of the Ichimoku cloud in H4 (0.9897). It will continue to decline if the quote falls below 0.9864 and under 0.9837, which is the final support of the classic Pivot levels. The key levels today are resistances at the 0.9991 line (weekly long-term trend + central Pivot level of the day).

***

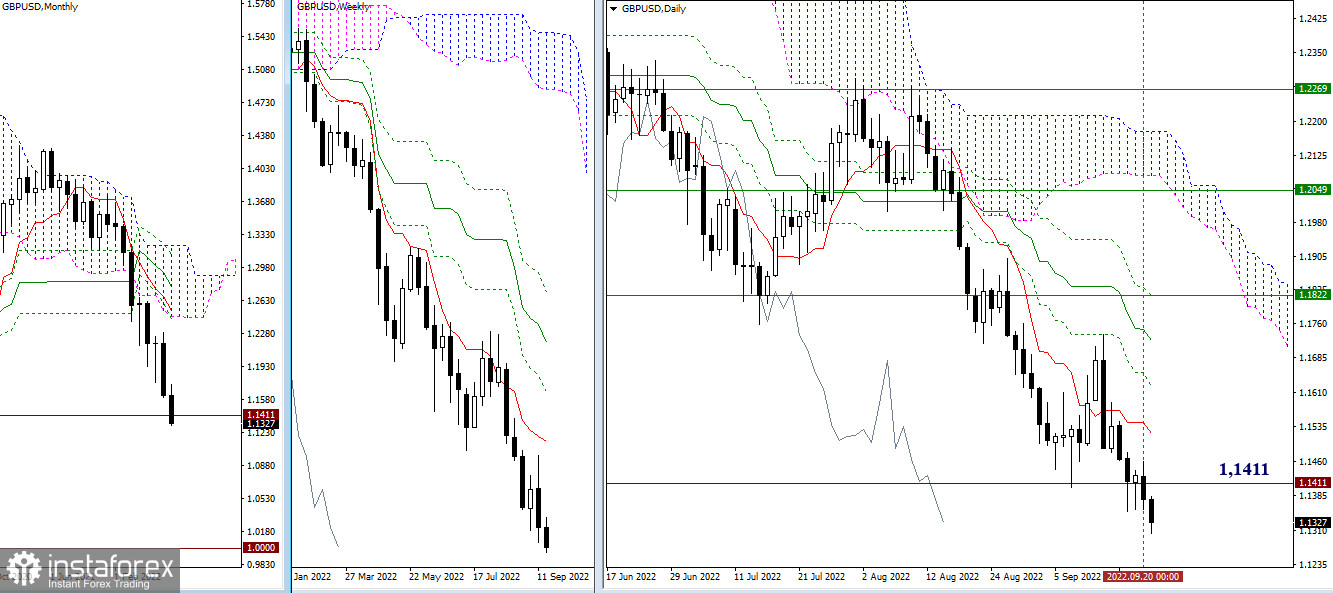

GBP/USD

Higher timeframes

The pair closed below 1.1411 (2020 lows) yesterday. Most likely, the decline will continue, which will make the psychological support area of 1.0000 as a new benchmark.

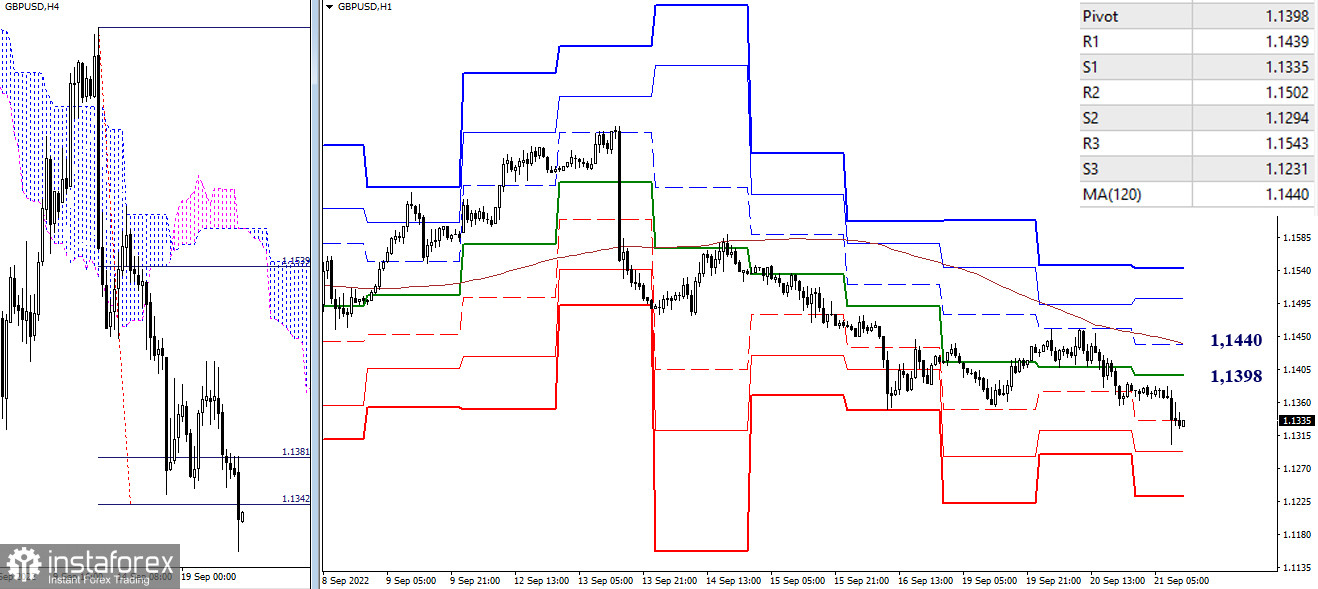

H4 - H1

Bearish players, having completed the next upward correction, are trying to go beyond the target level for the breakdown of the H4 cloud (1.1342). Key levels for a further decline are the support of the classic Pivot levels (1.1294 - 1.1231), while resistances are 1.1398 (central Pivot level) and 1.1440 (weekly long-term trend). The breakdown and consolidation above these levels are capable of changing the current trend.

***

The following are used in the analysis above:

Higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)