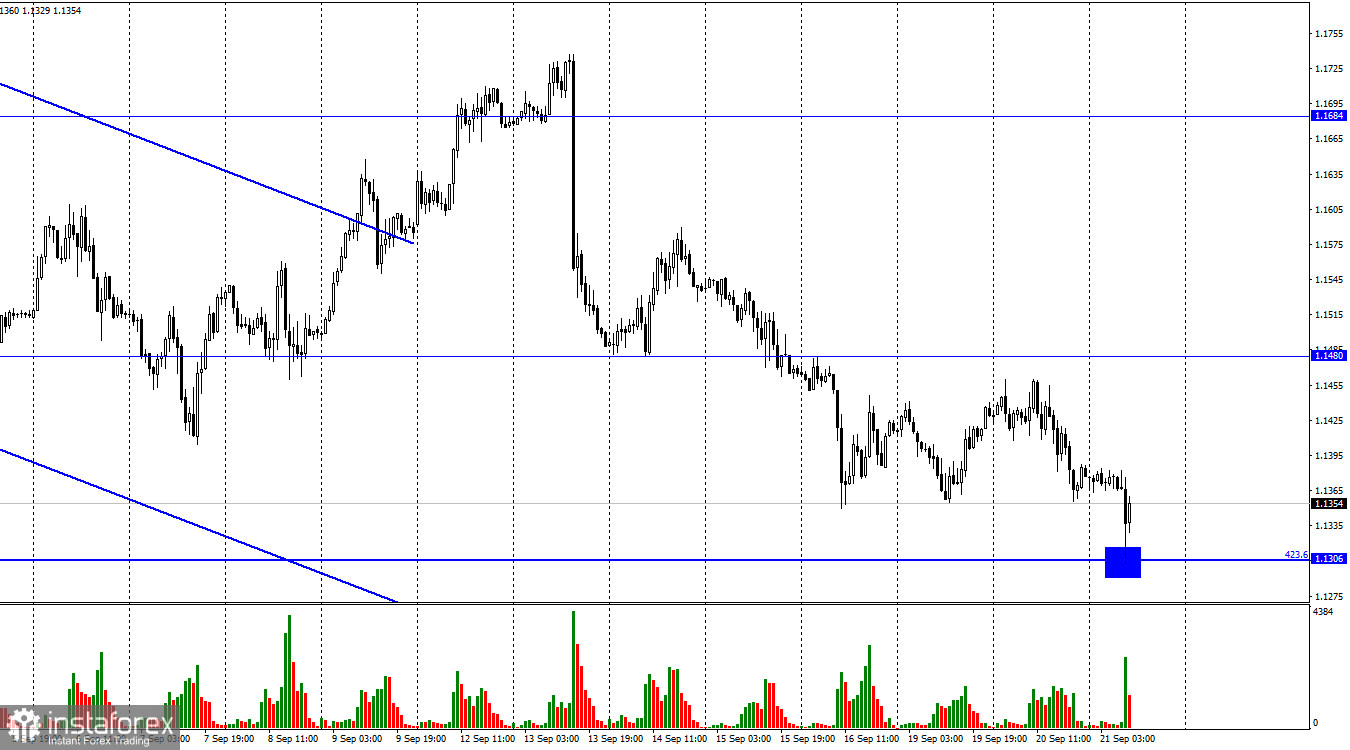

According to the hourly chart, the GBP/USD pair performed a new reversal in favor of the US dollar on Tuesday and resumed the process of falling, and this morning it was already near the corrective level of 423.6%

(1.1306). A rebound from this level could theoretically work in favor of the British pound and some growth towards the level of 1.1480. However, the information background of today clearly does not allow us to count on such a scenario seriously. Recall that partial mobilization has been announced in the Russian Federation today, which means a future escalation of the military conflict in Ukraine. In addition, the Fed will hold a meeting today and tomorrow – a meeting of the Bank of England. The British pound has been falling against the dollar without any geopolitical news lately. This fall may intensify, even despite any decision on the interest rate by the Bank of England.

Thus, the British may collapse even further today, tomorrow, and the day after tomorrow. Second, the activity of traders can go through the roof. Thus, the pair can trade very volatile. Third, in a panic, traders may also close sales, which may lead to a strong growth of the British dollar, but with the current information background, this scenario will look strange. Traders need to prepare for a "storm", and no one can predict what will happen to the pound in a week. I want to note that in the evening, the Fed will also present economic forecasts and make statements on monetary policy. This information can also affect the mood of traders and the FOMC press conference. Wednesday and Thursday can be truly crazy days in the foreign exchange market. Fixing the pair's exchange rate below the level of 1.1306 will increase the probability of a further fall in the direction of the next corrective level of 523.6% (1.0729), but auxiliary ones will be added above this level.

On the 4-hour chart, the pair consolidated below the level of 1.1496, allowing traders to expect a fall up to the Fibo level of 200.0% (1.1111). There are no brewing divergences in any indicator today, but any "bullish" divergence on such a strong trend is a maximum pullback up by 100-150 points. And "bearish" divergences are not formed in the fall.

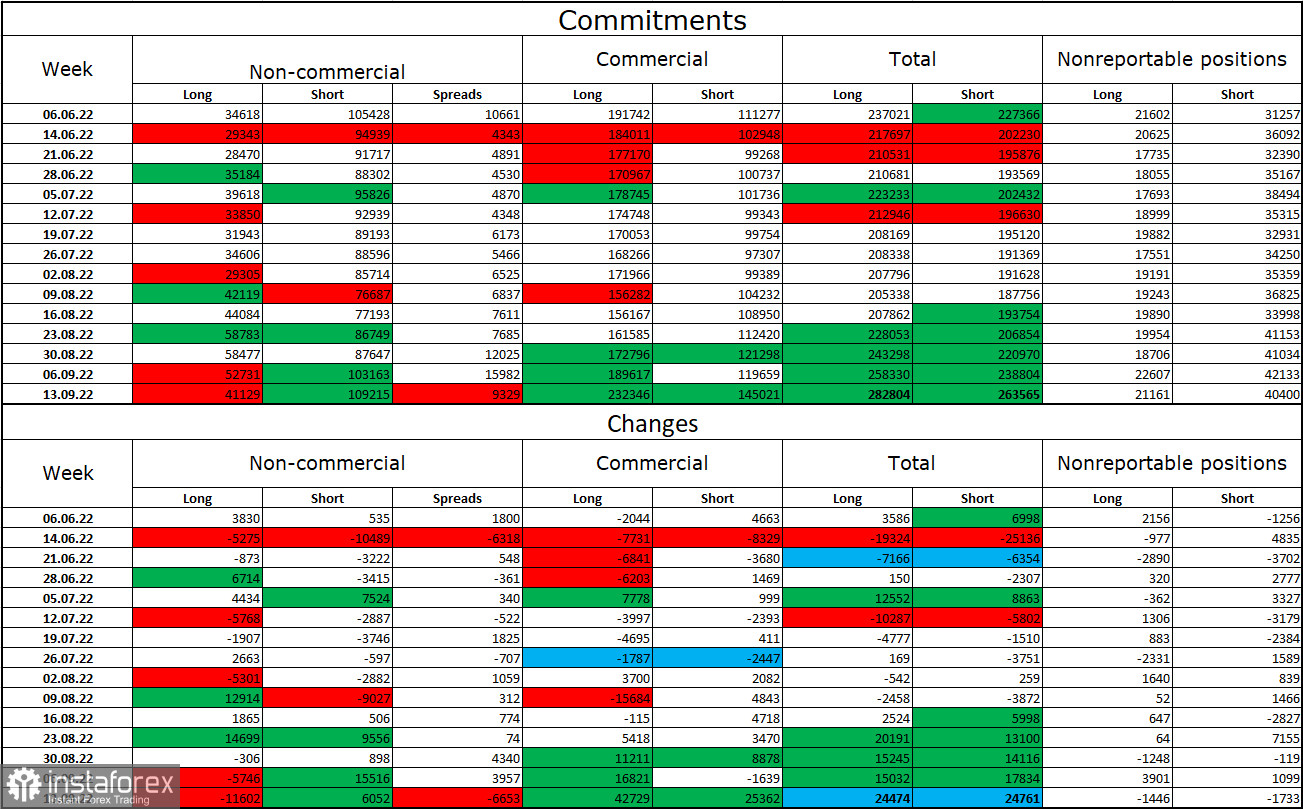

Commitments of Traders (COT) Report:

Over the past week, the mood of the "non-commercial" category of traders has become much more "bearish" than a week earlier. The number of long contracts in the hands of speculators decreased by 11602 units, and the number of short contracts increased by 6052. Thus, the general mood of the major players remains the same – "bearish," and the number of short contracts still exceeds the number of long contracts. After the new report, I am even more skeptical about the possible growth of the British pound. The major players remain mostly in the pound sales, and their mood has gradually changed towards being "bullish" in recent months, but now we are seeing an increase in sales again. And the British pound continues to fall heavily, so changing the mood of traders to "bullish" will take a long time. And when this process begins is not clear at all.

News calendar for the USA and the UK:

US - Fed interest rate decision (18:00 UTC).

US - FOMC statement (18:00 UTC).

US - FOMC economic forecasts (18:00 UTC).

US - FOMC press conference (18:30 UTC).

On Wednesday, the calendar of economic events in the UK is empty in America – the Fed meeting and all the events accompanying it. The influence of the information background on the mood of traders today can be very strong.

GBP/USD forecast and recommendations to traders:

I recommended new British sales at the close under the level of 1.1496 on the 4-hour chart with a target of 1.1306. Now, these transactions can be kept open or closed at will. In the case of closing at 1.1306, sales can be held with a target of 1.1111. I do not recommend buying a pound yet.