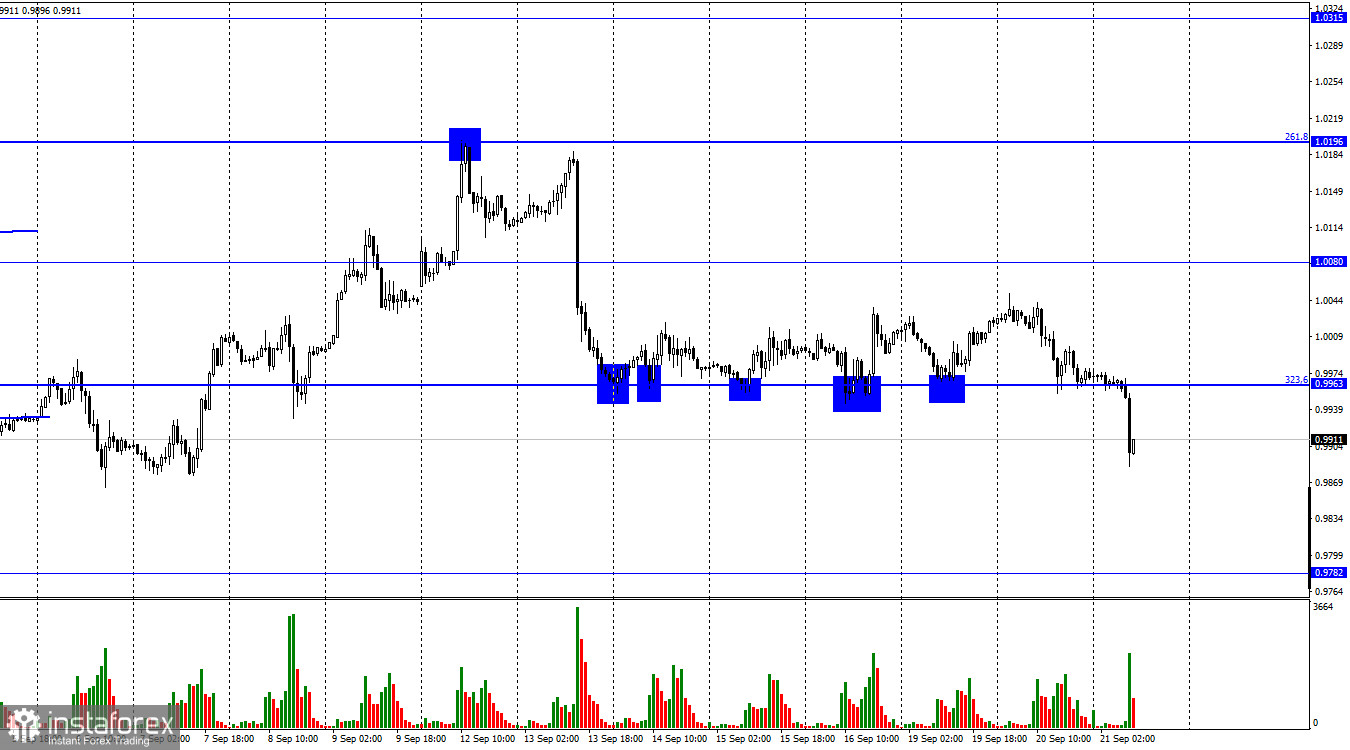

On Tuesday, EUR/USD followed the scenario seen in the previous days. It rebounded from the fibo retracement of 323.6% located at 0.9963 and then went back to 0.9963. Today, however, the price settled below the level of 0.9963 which may validate a further drop towards 0.9782. So, bulls have failed to gain control over the market. A new upward cycle in the US dollar can also be attributed to the Fed's rate decision that will be announced this evening. Meanwhile, the geopolitical conflict in Ukraine is far from being over. Recently, Ukraine has reclaimed some of its occupied territories. Moreover, Russia's President Vladimir Putin has declared a partial mobilization, calling up 300,000 reservists. All this indicates that the conflict in Eastern Europe is set to escalate further.

The planned referendums on joining Russia that are announced in the occupied territories will definitely ignite more violence and military attacks. Against this backdrop, the euro, which has been tumbling together with the pound throughout 2022, will most likely accelerate its decline. As far as I see it, the geopolitical conflict in Ukraine is the main reason behind the depreciation of EUR and GBP. So, there is almost no chance that the downtrend will end any time soon. The information background will stay negative in the coming days. Moreover, today, markets await the results of the Fed meeting. Another rate hike may push the US dollar even higher.

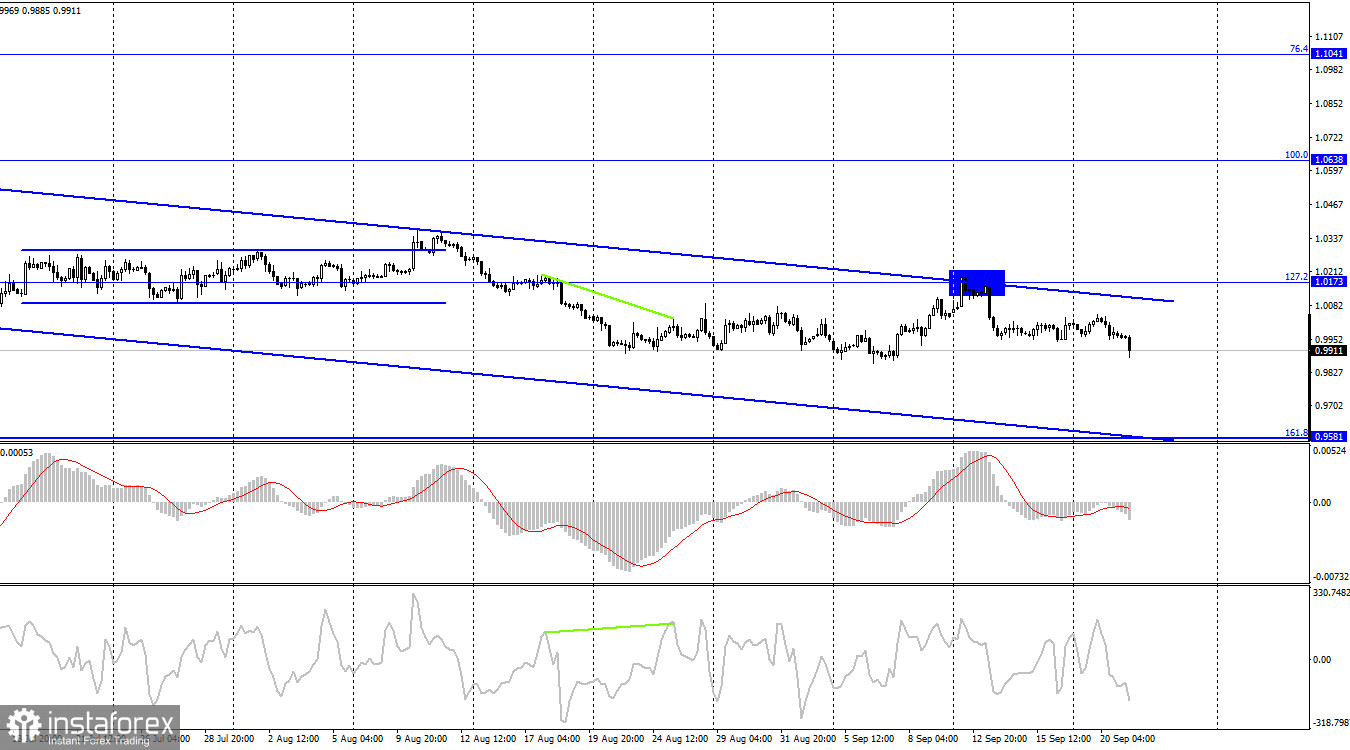

On the 4-hour chart, the pair rebounded from the retracement level of 127.2% located at 1.0173 in favor of the US dollar. The existing downward channel reflects the bearish sentiment of the market. A close above the channel may initiate a change in the trend to bullish. Yet, the recent attempt to do so has failed.

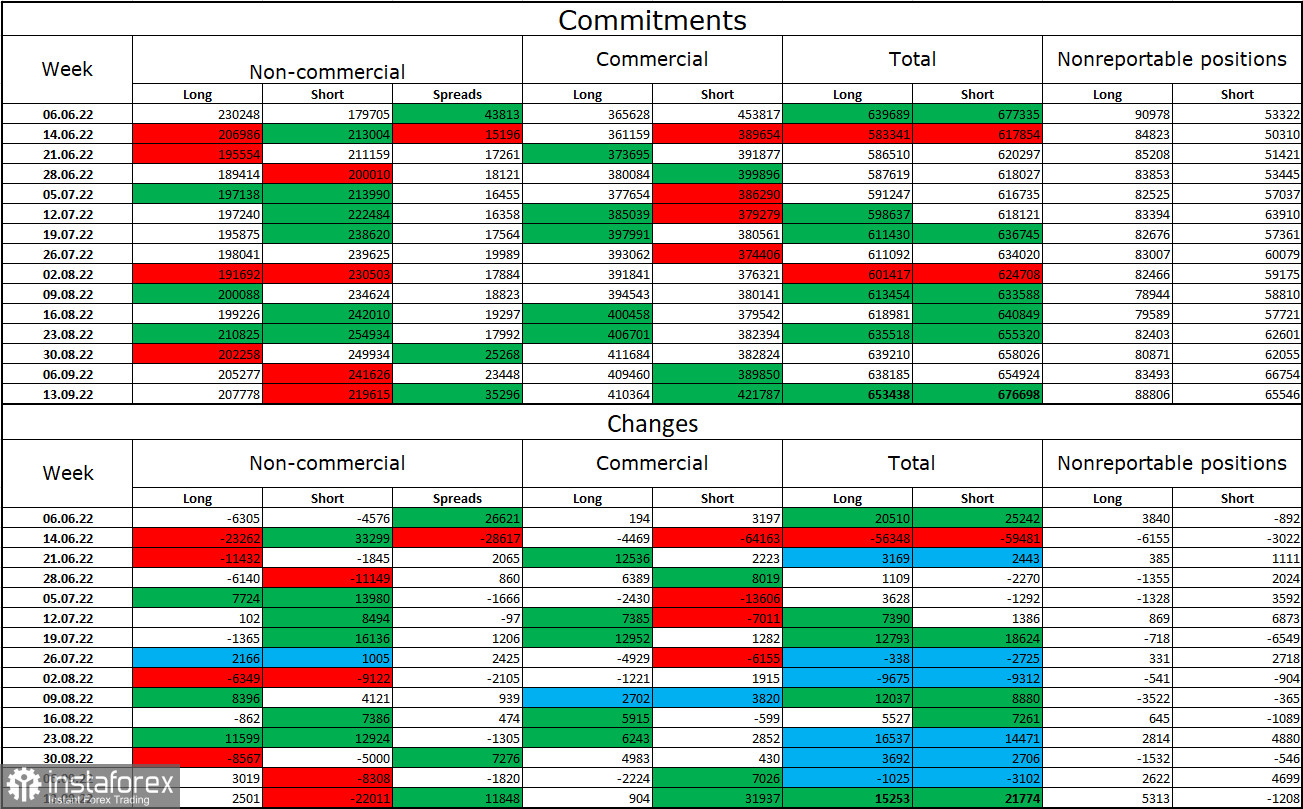

Commitments of Traders (COT) report:

Last week, traders opened 2,501 long contracts and closed 22,011 short contracts. This indicates that large market players became less bearish on the pair. The overall amount of opened long contracts stands at 207,000 while the amount of short contracts is 219,000. Although the gap between these figures is narrowing, the euro is still falling. In recent weeks, there were some chances for the euro to recover. However, bulls are hesitant to buy it. The European currency has failed to show a proper advance over the past months. Therefore, I would advise you to focus on the main descending channel on the 4-hour chart. The pair may start to rise only when the price closes above this channel.

Economic calendar for US and EU:

US - Fed interest rate decision (18-00 UTC).

US - FOMC Statement (18-00 UTC).

US - FOMC Economic Projections (18-00 UTC).

US - FOMC Press Conference (18-30 UTC).

There are no important events in the EU on September 21. Meanwhile, in the US, the Fed will announce the results of the policy meeting. The impact of the information background on the market will be very strong today.

EUR/USD forecast and trading tips:

I would recommend selling the pair when the price rebounds from the level of 1.0173 (1.0196) on the 4-hour chart with the target at 0.9900. You can either keep these positions open or close them. Buying the pair may be possible if the quotes settle firmly above 1.0173 on H4 with the target at 1.0638.