The probability of quotes leaving this channel through its lower border is growing daily. As recently as the day before yesterday, the cryptocurrency tested this level for strength for the fifth time. This time, the upward pullback was not strong, by and large, it did not exist at all, and the price continued to remain near the $18,500 level. Thus, we continue to expect this level to be overcome and the cryptocurrency's further fall. It should be noted that the downtrend on the 24-hour TF is still being maintained. Therefore, our expectations of a fall cannot be considered based only on a complex "foundation".

The Fed meeting will be held in the evening, and its results are already known to the market. There is only one intrigue – what Jerome Powell will say at the press conference. As you can see, economic forecasts and the threat of recession for the American economy, in general, do not bother traders at all since the US currency is steadily growing. Therefore, there is no doubt that the rate will rise by 0.75-1.00% today. Jerome Powell can be expected to maintain the "hawkish" rhetoric since, after the first month, the decline in inflation has already slowed down, which means that the measures that the Fed has already taken are not enough for hopes of a quick return to 2%. Therefore, the Fed feels obliged to raise the rate further. And together with the Fed, the ECB, and the Bank of England, they will raise the rate. That is, for bitcoin, the fundamental background is deteriorating and will continue to deteriorate until the end of 2022. During this time, traders have the right to expect a further fall in the first cryptocurrency in the world.

A lot will also depend on Jerome Powell's rhetoric. If, for example, the market hears promises to raise the rate to 4.5% or doubts about the ability of inflation to continue slowing down at a rapid pace, all this can assure the markets that the period of stabilization of rates will come very soon. Consequently, risky assets will be in lower demand in the coming months, and safe assets will be in increased demand. Bitcoin and all cryptocurrencies, in general, do not belong to the safe ones. If the price is fixed above the trend line and the side channel, it will be possible to count on a certain growth. Of course, it is impossible to exclude this option completely.

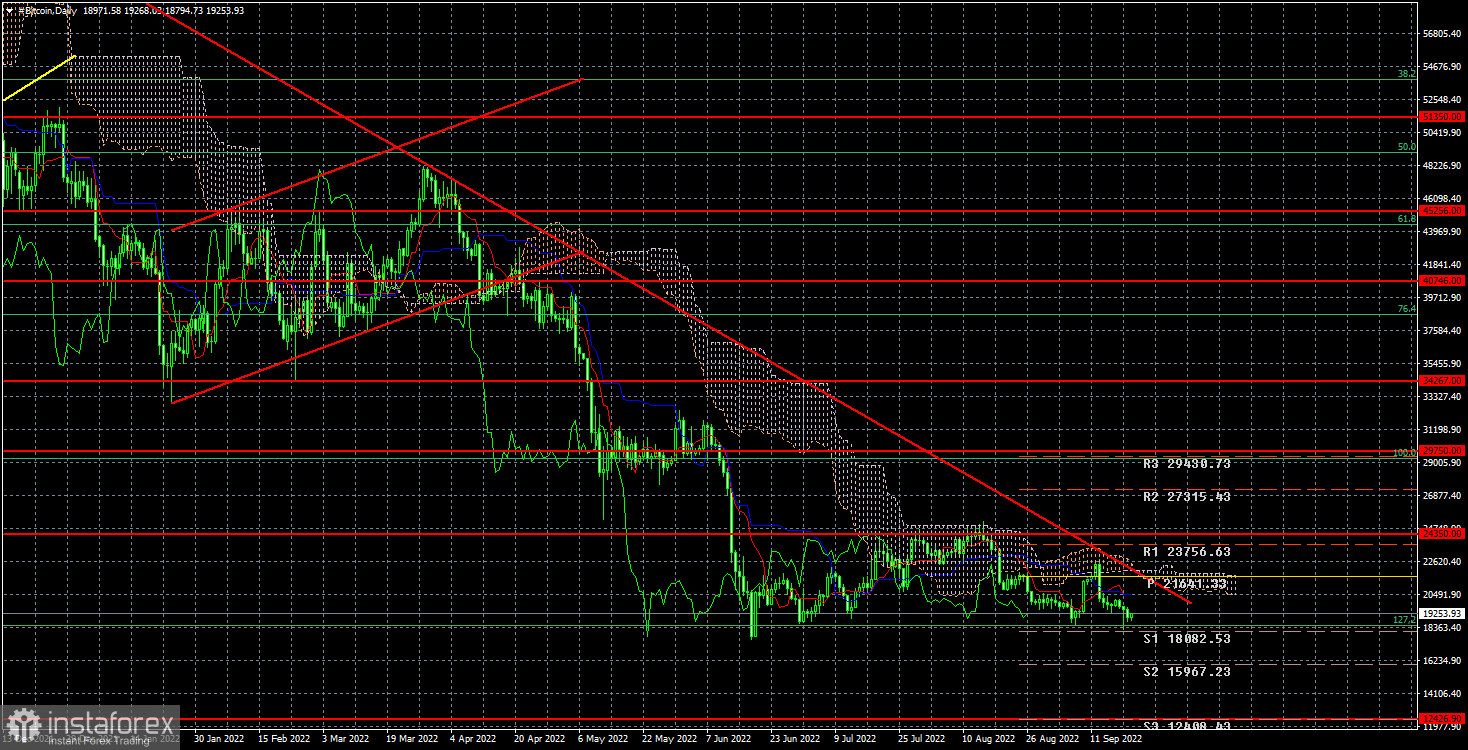

In the 24-hour timeframe, the quotes of "bitcoin" could not overcome the level of $ 24,350, but they also could not yet overcome the level of $18,500 (127.2% Fibonacci). Thus, we have a side channel, and it is unknown how much time Bitcoin will spend on it. We recommend not rushing to open positions. It is much better to wait for the price to exit this channel, and only then open the corresponding transactions. Overcoming the $18,500 level will take you all the way to the $12,426 level. You can also use rebound signals (from the trend line or the upper or lower border of the channel).