The euro is coming through tough times. Just in 24 hours, the currency dropped by almost 200 pips. In fact, the decline began on Tuesday, when the UK government announced its economic support plan, thus causing a slump in the pound sterling to historic lows. Meanwhile, the euro followed the British pound. Thus, the UK government is planning to cut taxes and freeze electricity tariffs. However, spending will remain the same or become bigger thanks to electricity tariffs subsidizing and higher military spending. The thing is that the plan does not provide any information about the source of funding. It means that the UK will increase its national debt. Notably, the national debt has almost reached 100% of GBP. The plan could be compared to the measures imposed by Ronald Reagan. Indeed, the plan of the British government repeats what was done in the United States in the early 80s. The only difference is that at that moment, the US national debt totaled 40% of GDP. By the end of the 80s, it slightly exceeded 50% of GDP. It means that Ronald Reagan had room for maneuver, whereas Liz Truss does not have any. That is why this plan may only aggravate the UK's economic problems and cause a real economic catastrophe that may affect the whole European Union.

At the beginning of the Asian trade, the euro continued losing value amid the result of the Italian general elections. The fact is that the rightwing coalition led by the Brothers of Italy won enough seats to form a government. Since their campaign contradicts the policy of Brussels, political disagreements within the EU could become stronger. This situation may turn into a catastrophe amid the worsening economic crisis. In particular, Ursula Von der Leyen has already said that in case of such an outcome, the European Commission will reduce or stop financial support to Italy presupposed by various EU programs. If the EU exerts pressure on Italy's economy, the country may try to settle this issue, thus launching disintegration in the eurozone.

Against the backdrop, the euro will hardly show a technical rebound after a sharp and deep decline. It simply has no reason for a rise. In Europe, the overall situation is disturbing and depressing. It means that the euro may slide even deeper.

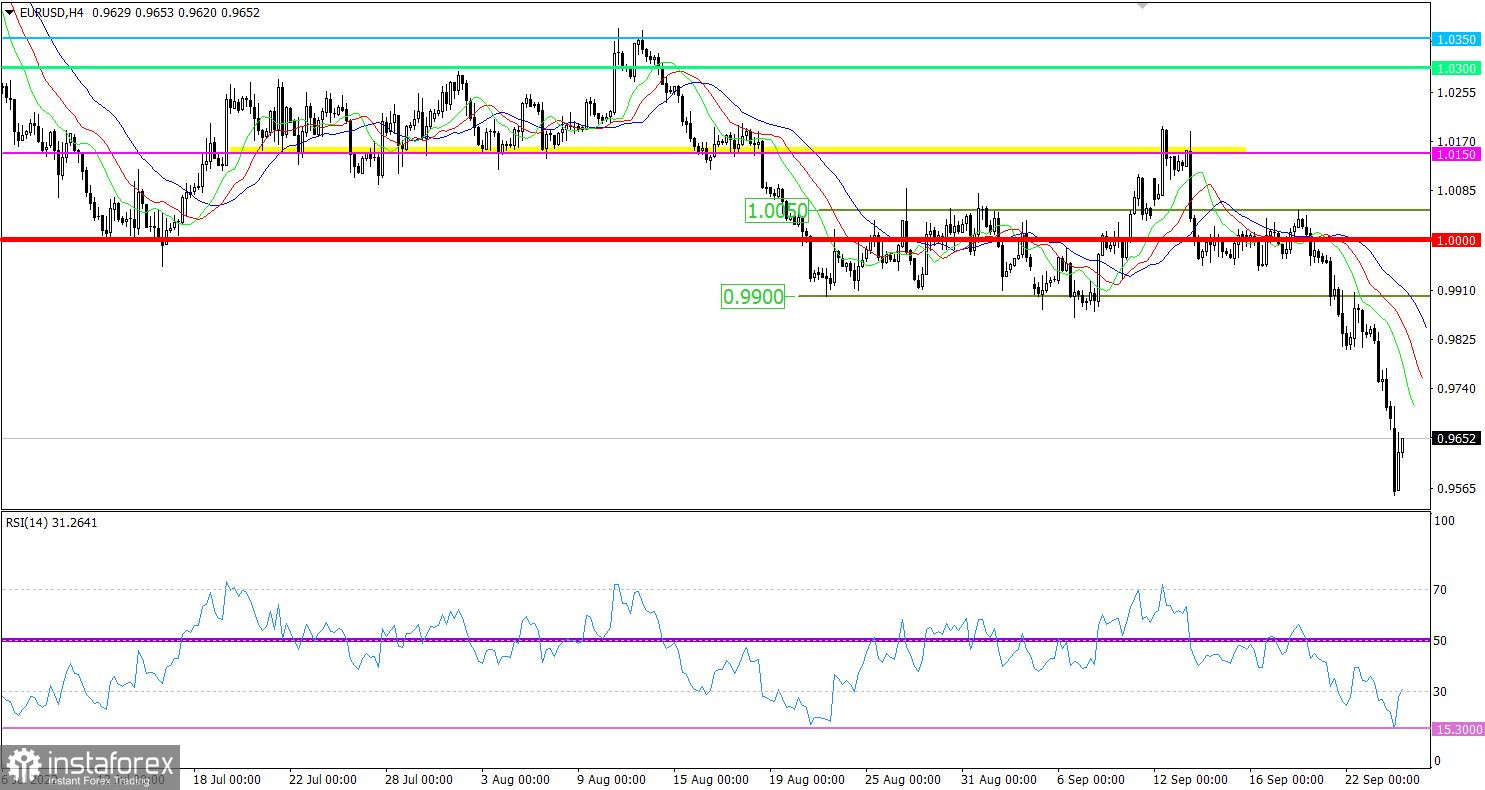

Since Friday, the euro has lost more than 250 pips against the US dollar. As a result, the quote dropped to 0.9553, the level last seen in 2002.

On the 4-hour chart, the RSI technical indicator hit 15.30 for the first time since June 2021. On the daily chart, the indicator downwardly crossed line 30. It means that the indicator is pointing to the fact that the euro is significantly oversold.

On the four-hour and daily charts, the Alligator's MAs are headed downwards, which corresponds to the main trend.

Outlook

At the moment, we see that the pair is forming a technical rebound that may take place thanks to the overheating of short positions. Notably, speculative activity is very high, which may cause an inertial movement. Thus, the pair has every chance to continue falling after a rebound since traders may ignore technical signals.

In terms of the complex indicator analysis, we see that in the short-term period, indicators are providing buy signals amid a technical rebound. The indicators point to a downtrend in the intraday and mid-term periods.